What is SIP (Systematic Investment Plan)?

Systematic Investment Plan (SIP) is one of the options for Investing in Mutual Funds. It helps you invest in a disciplined way. You can invest a set amount of money regularly in a particular fund using the SIP facility. You can select which mutual funds to invest in and set the intervals for SIP payments. The intervals can be monthly, weekly, quarterly, semi-annually, or annually. SIP has many benefits like lowering risk by diversifying investments. It can give higher returns than traditional options and the best thing is easy to invest online.

There are two ways to start SIP.

First, you can set a specific financial goal amount. Now, you can use an SIP plan calculator to figure out how much you need to invest and begin investing. Another option is to choose a set SIP amount and use a basic SIP calculator to estimate your investment's potential value. Based on this estimation, you can select suitable funds and commence your investments.

SIP is one of the best investment options that by nature deals with the market's ups & downs. It enables you to benefit from rupee cost averaging, meaning you acquire more units when prices are low and fewer units when prices are high. Over time, using this strategy can help you get lower prices and make more money on your investments. These are the funds to invest in SIP that will generate your desired corpus..

Best SIP Plans to Invest in 2024?

Investors can invest only Rs.500 every month. This makes investing in Top SIP plans much more convenient. Most of the funds offer good returns when invested for a longer duration. Invest top funds of your choice.

Best SIP Plans for 3 years

| HDFC Balanced Advantage Fund |

| ICICI Balanced Advantage Fund |

| SBI Multi Asset Allocation Fund |

Best SIP Plans for 5 years

| Kotak Emerging Equity Scheme - Growth |

| HDFC Focused 30 Gr |

| Axis Midcap Fund - Regular Plan-Growth |

Best SIP Plans for 10 years

| Franklin India Smaller Companies Gr |

| Nippon India Small Cap Gr Gr |

| HSBC Small Cap Fund Reg Growth |

What are the Benefits of Investing in SIP?

1. Rupees Cost Averaging Boosts your investment

Online SIP offers a unique advantage called rupee cost averaging. Here’s how it works. Investing a consistent amount over time helps you take advantage of market fluctuations. This means you can buy more units when the market is down and fewer units when it’s up. As a result, your average cost per unit decreases.

2. Compounding- Making money work for you

Regular SIP investments over the long term tap into the power of compounding. This means your money grows from the initial investment and the earnings it has made. This compounding effect can significantly grow your wealth

3. Discipline

SIP helps you stay disciplined with your investments. It automates the process, ensuring you don’t miss your saving goals.

4. Regular Saving

It encourages you to save and invest regularly. It’s like setting aside a portion of your income every month, which adds up over time.

5. Risk Reduction

It reduces the impact of market ups and downs. You buy more when prices are low and less when they are high, which averages out your costs.

6. Flexibility

You can choose the amount you want to invest and the frequency that suits your budget and goals.

7. No Market Timing Worries

With SIP, you don’t have to worry about trying to predict the best time to enter or exit the market. You keep investing, irrespective of market conditions. So let’s look closer at the SIP process of how it will work to compound your money.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

How Does SIP work?

SIP (Systematic Investment Plan) is a simple and flexible way to invest your money. SIP focuses on consistent investment. It’s a method for investing in Mutual Funds Schemes. With SIP, you decide how much money you want to invest, and it can be a small amount- don’t need to invest a lump sum amount. You choose whether you want to put in money every month or every quarter, depending on your financial goals, and when you invest in a mutual fund, they give some units in return. The number of units you receive depends on the mutual fund’s price is called the Net asset value (NAV).

As time goes by, the value of these units can go up, and that’s how your money grows. You can keep adding money to your SIP regularly, and it keeps buying more units, which can lead to even more growth. You can save and invest easily without stressing about stocks or complex investments. An example is easy to understand let’s dive into one-

Suppose you invest Rs.1000 every month in a mutual fund through a SIP for 5 years. The mutual fund generates an average annual return of 12%. At the end of the 5 years, your total investment would be Rs.60000 (Rs.1000 per month for 5 years).

With the 12 % average annual return, the final value of your investment could be approximately Rs.82,486. This reflects how your money can grow over time, not just from the original amount you put in but also from the extra money you make as time passes. This is what we call the power of compounding.

Invest Online in SIPs, without worrying about any paper work, with just a few documents and few clicks you can Start your SIP Journey.

How to invest in SIPs?

Investing in SIP (Systematic Investment Plan) is a straightforward process. Here are the steps to invest in SIP:

1. Collect your document

For SIP, before you may invest, you must ensure that you have all of the required documentation like-

- PAN

- Aadhar Card

- Bank Cheque

- E-sign

2. Provide KYC Details

Complete your KYC (Know Your Customer) process by submitting the necessary documents. This usually includes proof of identity, address, and PAN.

3. Bank Mandate

Link your bank account for automatic debits for your SIP investments at regular intervals, such as monthly, quarterly, or yearly by providing the mandate amount. This ensures that your SIP contribution is deducted from your bank account on the chosen date each month.at regular intervals, such as monthly, quarterly, or yearly by providing the mandate amount.

4. Choose a Mutual Fund Plan

Decide which mutual fund you want to invest in. Consider factors like your financial goals, risk tolerance, and investment horizon.

5. Select SIP Duration

Decide how long you want to continue the SIP. These SIPs can be for a few months or extend for several years. It depends on your financial goals and investment plan.

6. Ready to Invest

Once your profile is completed, your SIP will begin, and the specified amount will be automatically debited from your bank account at the selected frequency for any calculation regarding the Systematic Investment Plan, you can use the SIP calculator.

What is a SIP calculator and How to use it?

A SIP calculator is a helpful online tool. It shows how your investment in mutual funds can grow as you keep investing regularly. It tells how much your money might become in the future, based on how it can grow over a certain number of years.

Managing SIPs on our own can be a bit challenging, as you invest money every month. The tricky part is that the time you hold onto each payment can be different, so the profit on each one varies. That’s where the SIP calculator helps. It does the hard work for you, making it easy and precise.

Let’s make it more easy with a simple example-

Imagine you want to invest Rs.500 every month in a mutual fund, and the fund will grow at an average rate of 8% per year. You plan to invest for 15 years.

1. Input Data: Provide the SIP calculator with these details

Monthly investment: Rs.500

Expected annual return: 10%

Investment duration: 15 years

2. Calculator: The SIP calculator uses a formula that considers the regular monthly contribution of Rs.500 and the expected annual growth rate of 10% to project the potential growth of the invested amount over the investment duration of 15 years.

3. Result: The SIP calculator provides an estimate of the total investment made over the years, along with the potential maturity amount and the expected returns at the end of the investment period.

The SIP calculator shows that if you invest Rs.500 for 15 years at a 10% growth rate, the maturity amount could be around Rs.208,962.

Now comes the main questions regarding FD and SIP. What if Fixed Deposit (FD) is considered lower risk compared to SIP, but SIP has the potential for higher returns? While FDs are generally low-risk, SIPs may offer greater profits. let's seek clarification.

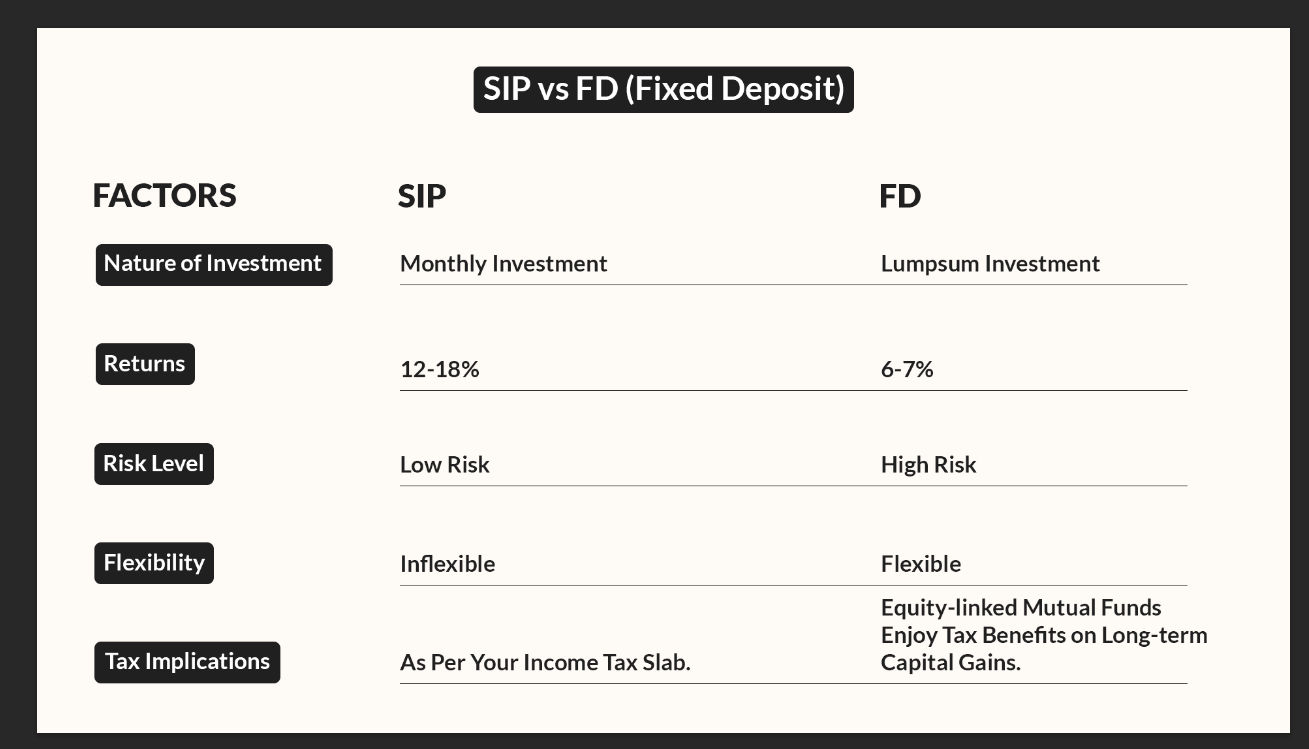

Comparison of SIP with FD?

Nature of investment

In an FD, you deposit a lump sum amount with a bank or financial institution for a fixed period at a predetermined interest rate. It's a one-time investment.

SIP, on the other hand, is a method of investing in mutual funds where you regularly invest a fixed amount at predefined intervals (like monthly). It allows for periodic investments over time.

Returns

Fixed Deposits offer returns in the range of 6.5% to 7.5% per annum, provide stability. SIPs can yield returns of 10% to 15% per year and have the potential for higher growth.

SIP returns are linked to the performance of the mutual fund. They can vary based on market conditions and the fund's performance. SIPs have the potential for higher returns, especially over the long term, but they are not guaranteed.

Risk Level

FDs are considered low-risk investments as the principal amount and interest earned are usually guaranteed. However, the returns may be lower compared to other investment options.

SIPs involve market-linked risk because they invest in mutual funds, which are subject to market fluctuations. While they offer the potential for higher returns, there is also a risk of loss, especially in the short term.

Flexibility

FDs are relatively inflexible. Once the money is invested, it is locked in for the specified tenure, and withdrawing before maturity may attract penalties.

SIPs offer flexibility. You can start, stop, increase, or decrease your SIP amount based on your financial goals. Additionally, you can redeem your mutual fund units partially or fully at any time, although it's advisable to stay invested for the long term.

Tax Implications

Returns from FDs are generally taxable as per your income tax slab.

SIPs in equity-linked mutual funds enjoy tax benefits on long-term capital gains (if held for more than one year) and the dividend income is tax-free. Debt-linked mutual funds may have different tax implications.

Systematic Investment Plans (SIPs) can be your toolkit for sowing the seeds of financial success. Whether you're dreaming of a peaceful retirement, securing your child's education, or planning that dream vacation, SIPs offer a flexible and disciplined approach to achieving these financial goals.

How to invest in SIP for different financial goals?

Retirement

Planning for retirement is a significant financial goals, and selecting the right investment options is crucial to secure your post-working years. A lot of people begin planning for retirement when they are in their 20s and 30s. This gives them enough time to save and invest. The best option is a SIP, where you can save monthly without burdening yourself. When you are in your 40s and 50s, it's a good idea to think about high-return funds. These funds can handle short-term market volatility because you have a long time to invest. mutual fund companies have created separate categories & funds made especially for retirement planning

Best SIP Plans for Retirement

- HDFC Retirement Savings Equity Reg

- ICICI Prudential Retirement Pure Equity Gr

- Nippon India Retirement Wealth Creation Sch Gr Gr

- HDFC Retirement Savings Hybrid Equity Reg

- ICICI Prudential Retirement Hybrid Ag Gr

Child Education

Education has become too costly. SIP strategies for child education are the solution. This disciplined and systematic investment method helps build a corpus over time, ensuring that you have the necessary funds when your child is ready for higher education. By starting early and consistently contributing to an SIP, you harness the power of compounding, allowing your investments to grow and potentially cover educational expenses. It's a smart and efficient way to financially prepare for your child's academic future.

Best SIP Plans for Child Education

- SBI Magnum Children Benefit Inv Reg Gr

- Tata Young Citizen Reg Gr

- HDFC Children Gift Fund Investment

- ICICI Prudential Child Care Gift Cum

- UTI CCF Investment Reg Gr

Vacation

By setting up a SIP specifically for vacations, you can regularly invest a fixed amount in mutual funds. Over time, this disciplined approach can accumulate a fund that allows you to enjoy well-deserved getaways without straining your budget.

How to Invest in SIP at Different Ages?

SIPs in the 20s

If you're starting a new career in finance, it's best to begin with a small amount of money. You should think about investing in funds that are less risky and of good quality. It's a good idea to increase the amount you invest each year. The best categories and funds to consider are-

- large-cap funds

- large & mid-cap funds

- Multi-cap funds

- Aggressive hybrid funds

- Multi-asset allocation funds

- Dynamic asset allocation funds.

SIPs in the 40s

If you have a steady income and family responsibilities, prioritize your retirement and your child's education. For higher returns generating funds, consider pure equity funds. Among the best categories are-

- Small-cap

- Mid-cap

- Focused equity funds

SIPs in the 50s

Are you approaching retirement with a decent income but limited savings due to family expenses? When you plan for retirement, you can balance potential returns by considering mutual funds with moderate risk. Some examples include- Mid-cap funds

- Flexi-cap

- Multi-cap

- Large & mid-cap

- Mid-cap funds

Retirement Planning Fund

Retirement Planning Fund

Best Tax Saving Funds

Best Tax Saving Funds

Child Future Planning Funds

Child Future Planning Funds

Smart Saving Account

Smart Saving Account

Top Performing Funds

Top Performing Funds

New Fund Offer (NFO)

New Fund Offer (NFO)

_(1).webp)

5413

5413  8 Min. Read

8 Min. Read

.webp)

_(1).webp)

.webp)