Mahindra Manulife Mutual Fund

The New Star of the Mutual Fund Industry : Mahindra Mutual Fund

- Total Funds 24

- Average annual returns 9.12%

About Mahindra Manulife Mutual Fund

Mahindra Manulife Mutual Fund is a collaboration between Mahindra and Mahindra Financial Services Ltd. and Manulife Investment Management. It aims to provide a comprehensive range of investing options across asset classes and platforms.

It Offers 21 schemes, including 11 Equity, 6 Debt and 4 Hybrids, the fund caters to diverse investor preferences. Mahindra Manulife AMC holds the 25th position among other top AMCs, it reflects a commitment to delivering competitive investment solutions through global and Indian financial expertise. Mahindra Manulife Large & Mid Cap Fund, the flagship scheme, has exhibited an impressive average annualized return of 24.13% since its inception.

More-

Launched in

04-Feb-2016

-

AMC Age

10 Years

-

Website

https://www.mahindramanulife.com -

Email Address

mfinvestors@mahindra.com

Top Performing Mahindra Manulife Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 42.10 | 4 years | 0.24% | 4.19% | 6.05% | 14.2% | 4.57% | 31.56% | 13.16% | 3.4% | - | - | Invest | |

| 930.83 | 1 years | -1.18% | -1.35% | 2.32% | 11.87% | -0.68% | 19.66% | - | - | - | - | Invest | |

| 1305.64 | 2 years | 0.72% | -3.96% | -1.12% | 5.69% | -2.94% | 9.02% | 9.83% | - | - | - | Invest | |

| 6132.78 | 8 years | 0.25% | -4.9% | -4.16% | -0.24% | -4.02% | 7.74% | 6.67% | 20.29% | 19.06% | - | Invest | |

| 755.51 | 6 years | 0.32% | -4.37% | -1.27% | 1.89% | -3.72% | 7.18% | 8.45% | 14.42% | 12.39% | - | Invest | |

| 2108.49 | 6 years | 0.25% | -3.83% | -2.26% | 0.54% | -3.29% | 7.17% | 10.57% | 16.28% | 15.06% | - | Invest | |

| 566.91 | 9 years | 0.29% | -1.39% | -0.27% | 3.02% | -1.05% | 6.79% | 6.43% | 10.13% | 8.87% | - | Invest | |

| 599.35 | 8 years | 0.15% | 0.2% | 1.05% | 2.43% | 0.21% | 6.57% | 6.82% | 6.79% | 5.55% | - | Invest | |

| 218.94 | 6 years | 0.15% | 0.28% | 1.23% | 2.62% | 0.28% | 6.52% | 6.87% | 6.9% | 5.74% | - | Invest | |

| 1215.68 | 9 years | 0.12% | 0.44% | 1.43% | 2.92% | 0.45% | 6.34% | 6.83% | 6.93% | 5.85% | - | Invest | |

| 2776.86 | 6 years | 0.53% | -4.35% | -3.41% | 0.34% | -3.35% | 6.28% | 4.15% | 17.1% | 16.37% | - | Invest | |

| 973.16 | 9 years | 0.2% | -5.5% | -3.52% | -0.46% | -4.53% | 6.22% | 6.5% | 14% | 14.39% | - | Invest | |

| 4294.84 | 8 years | 0.82% | -4.68% | -2.82% | 2.02% | -3.67% | 6.13% | 9.32% | 23.71% | 21.74% | - | Invest | |

| 2227.85 | 5 years | 1.11% | -3.62% | -2.11% | 2.94% | -2.71% | 5.92% | 8.81% | 18.77% | 18.15% | - | Invest | |

| 1596.73 | 4 years | 0.15% | -5.52% | -3.64% | -0.5% | -4.57% | 5.72% | 6.4% | 15.98% | - | - | Invest | |

| 928.21 | 4 years | 0.34% | -3.24% | -2.5% | 0.44% | -2.52% | 5.45% | 5.71% | 12.87% | - | - | Invest | |

| 741.05 | 1 years | 0.86% | -5.78% | -5.25% | -1.15% | -4.86% | 5.42% | - | - | - | - | Invest | |

| 86.00 | 7 years | -0.03% | -0.34% | -0.08% | 0.7% | -0.38% | 5% | 6.14% | 6.39% | 4.62% | - | Invest | |

| 4223.69 | 3 years | 0.07% | -7.91% | -10.15% | -4.74% | -7.25% | 0.43% | 3.42% | 21.84% | - | - | Invest | |

| 380.46 | 6 months | -0.34% | -3.04% | 0.6% | 6.36% | -2% | - | - | - | - | - | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Feb-2026 | Jan-2026 | Dec-2025 | Nov-2025 | Oct-2025 | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 |

|---|

| Fund Name | 2026-Q1 | 2025-Q4 | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 |

|---|

| Fund Name | 2026 | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 42.10 | Very High |

1.79%

|

21.87%

|

17.55%

|

12.18%

|

-

|

-

|

7.57%

|

Invest | |

| 930.83 | Very High |

4.12%

|

22.46%

|

-

|

-

|

-

|

-

|

16.74%

|

Invest | |

| 1305.64 | Very High |

3.39%

|

16.01%

|

7.69%

|

-

|

-

|

-

|

11.37%

|

Invest | |

| 6132.78 | Very High |

1.52%

|

11.7%

|

6.46%

|

13.7%

|

16.1%

|

-

|

18.38%

|

Invest | |

| 755.51 | Very High |

2.85%

|

11.62%

|

7.3%

|

11.87%

|

12.35%

|

-

|

14.36%

|

Invest | |

| 2108.49 | Very High |

1.49%

|

9.72%

|

8.01%

|

13.19%

|

14.23%

|

-

|

16.24%

|

Invest | |

| 566.91 | Moderate |

1.3%

|

8.03%

|

6.31%

|

8.29%

|

8.56%

|

-

|

9.32%

|

Invest | |

| 599.35 | Moderate |

0.87%

|

4.93%

|

6.14%

|

6.46%

|

6.18%

|

-

|

5.89%

|

Invest | |

| 218.94 | Low to Moderate |

0.93%

|

5.02%

|

6.13%

|

6.49%

|

6.31%

|

-

|

6.02%

|

Invest | |

| 1215.68 | Moderate |

0.98%

|

5%

|

5.99%

|

6.4%

|

6.33%

|

-

|

5.88%

|

Invest | |

| 2776.86 | Very High |

1.54%

|

10.2%

|

4.13%

|

10.75%

|

13.42%

|

-

|

16.71%

|

Invest | |

| 973.16 | Very High |

1.57%

|

10.31%

|

6.44%

|

10.85%

|

12.59%

|

-

|

13.84%

|

Invest | |

| 4294.84 | Very High |

1.84%

|

11.86%

|

6.08%

|

15.33%

|

18.62%

|

-

|

20.7%

|

Invest | |

| 2227.85 | Very High |

1.98%

|

10.02%

|

5.62%

|

13.38%

|

16.05%

|

-

|

16.58%

|

Invest | |

| 1596.73 | Very High |

1.59%

|

10.43%

|

6.42%

|

11.66%

|

-

|

-

|

13.36%

|

Invest | |

| 928.21 | Very High |

1.16%

|

7.48%

|

5.16%

|

9.5%

|

-

|

-

|

10.6%

|

Invest | |

| 741.05 | Very High |

0.86%

|

11.93%

|

-

|

-

|

-

|

-

|

4.77%

|

Invest | |

| 86.00 | Moderate |

0.55%

|

2.98%

|

5.19%

|

6.03%

|

5.65%

|

-

|

5.19%

|

Invest | |

| 4223.69 | Very High |

-0.2%

|

9.78%

|

3.28%

|

13.43%

|

-

|

-

|

14.84%

|

Invest | |

| 380.46 | Average |

3.94%

|

-

|

-

|

-

|

-

|

-

|

16.66%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Very High |

17.27%

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

13.97%

|

0.69%

|

0.99%

|

0.91%

|

Invest | |

| Very High |

11.79%

|

-

|

0.97%

|

0.72%

|

Invest | |

| Very High |

10.07%

|

3.42%

|

1.15%

|

1.07%

|

Invest | |

| Moderate |

5.82%

|

-

|

1.09%

|

0.82%

|

Invest | |

| Moderate |

0.63%

|

-

|

-

|

-

|

Invest | |

| Low to Moderate |

0.54%

|

-

|

-

|

-

|

Invest | |

| Moderate |

0.48%

|

-

|

-

|

-

|

Invest | |

| Very High |

13.32%

|

-

|

0.99%

|

0.76%

|

Invest | |

| Very High |

12.44%

|

-

|

0.88%

|

0.77%

|

Invest | |

| Very High |

14.84%

|

0.89%

|

0.95%

|

1.14%

|

Invest | |

| Very High |

12.49%

|

2.52%

|

0.92%

|

0.99%

|

Invest | |

| Very High |

14.38%

|

1.07%

|

0.9%

|

0.91%

|

Invest | |

| Very High |

8.06%

|

0.61%

|

1.13%

|

0.77%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

2.02%

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

4.86%

|

0.85%

|

1.05%

|

Invest | |

| Average |

-

|

-

|

-

|

-

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹1000

|

₹5000

|

1.37%

|

Amit Garg

|

20-Oct 2021

|

Invest | |

|

₹500

|

₹1000

|

2.05%

|

Rahul Pal

|

13-Mar 2024

|

Invest | |

|

₹500

|

₹1000

|

2.13%

|

Krishna Sanghavi

|

11-Sep 2023

|

Invest | |

|

₹500

|

₹1000

|

1.82%

|

Fatema Pacha

|

11-May 2017

|

Invest | |

|

₹500

|

₹1000

|

2.35%

|

Abhinav Khandelwal

|

18-Mar 2019

|

Invest | |

|

₹500

|

₹1000

|

2.07%

|

Rahul Pal

|

22-Jul 2019

|

Invest | |

|

₹500

|

₹1000

|

2.37%

|

Rahul Pal

|

01-Feb 2017

|

Invest | |

|

₹500

|

₹1000

|

1.09%

|

Rahul Pal

|

15-Feb 2017

|

Invest | |

|

₹500

|

₹1000

|

0.69%

|

Rahul Pal

|

17-Oct 2019

|

Invest | |

|

₹500

|

₹1000

|

0.26%

|

Rahul Pal

|

05-Jul 2016

|

Invest | |

|

₹500

|

₹1000

|

1.94%

|

Abhinav Khandelwal

|

31-Dec 2019

|

Invest | |

|

₹500

|

₹500

|

2.18%

|

Fatema Pacha

|

18-Oct 2016

|

Invest | |

|

₹500

|

₹1000

|

1.88%

|

Abhinav Khandelwal

|

30-Jan 2018

|

Invest | |

|

₹500

|

₹1000

|

2.02%

|

Krishna Sanghavi

|

17-Nov 2020

|

Invest | |

|

₹500

|

₹1000

|

2.08%

|

Fatema Pacha

|

23-Aug 2021

|

Invest | |

|

₹500

|

₹1000

|

2.22%

|

Rahul Pal

|

30-Dec 2021

|

Invest | |

|

₹500

|

₹1000

|

2.26%

|

Manish Lodha

|

26-Jun 2024

|

Invest | |

|

₹500

|

₹1000

|

1.57%

|

Rahul Pal

|

20-Aug 2018

|

Invest | |

|

₹500

|

₹1000

|

1.85%

|

Abhinav Khandelwal

|

12-Dec 2022

|

Invest | |

|

₹500

|

₹1000

|

-

|

|

21-Jul 2025

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

10.6186

(03-02-2026)

|

10.7264

(02-02-2026)

|

-1%

|

10.8732

|

7.7427

|

Invest | |

|

13.5957

(03-02-2026)

|

13.2851

(02-02-2026)

|

2.34%

|

13.939

|

10.6805

|

Invest | |

|

15.3659

(03-02-2026)

|

14.9870

(02-02-2026)

|

2.53%

|

15.6053

|

12.5572

|

Invest | |

|

35.7032

(03-02-2026)

|

34.6914

(02-02-2026)

|

2.92%

|

36.7065

|

29.5092

|

Invest | |

|

23.6834

(03-02-2026)

|

23.1156

(02-02-2026)

|

2.46%

|

24.1713

|

20.3568

|

Invest | |

|

27.5895

(03-02-2026)

|

27.0649

(02-02-2026)

|

1.94%

|

28.1421

|

23.939

|

Invest | |

|

21.2022

(03-02-2026)

|

20.9892

(02-02-2026)

|

1.01%

|

21.3009

|

19.1537

|

Invest | |

|

1687.9080

(03-02-2026)

|

1686.8544

(02-02-2026)

|

0.06%

|

1687.91

|

1584.36

|

Invest | |

|

1421.7104

(03-02-2026)

|

1420.9022

(02-02-2026)

|

0.06%

|

1421.71

|

1335.49

|

Invest | |

|

1757.7087

(03-02-2026)

|

1757.1470

(02-02-2026)

|

0.03%

|

1757.71

|

1653.5

|

Invest | |

|

27.1829

(03-02-2026)

|

26.5311

(02-02-2026)

|

2.46%

|

27.8952

|

22.8386

|

Invest | |

|

28.7562

(03-02-2026)

|

27.9799

(02-02-2026)

|

2.77%

|

29.6095

|

24.6164

|

Invest | |

|

33.5595

(03-02-2026)

|

32.6987

(02-02-2026)

|

2.63%

|

34.6062

|

27.9243

|

Invest | |

|

27.2557

(03-02-2026)

|

26.6114

(02-02-2026)

|

2.42%

|

27.6096

|

23.5493

|

Invest | |

|

16.3328

(03-02-2026)

|

15.8988

(02-02-2026)

|

2.73%

|

16.827

|

14.0077

|

Invest | |

|

14.5879

(03-02-2026)

|

14.3556

(02-02-2026)

|

1.62%

|

14.874

|

13.0295

|

Invest | |

|

9.8139

(03-02-2026)

|

9.5041

(02-02-2026)

|

3.26%

|

10.1043

|

8.0445

|

Invest | |

|

14.4954

(03-02-2026)

|

14.4837

(02-02-2026)

|

0.08%

|

14.555

|

13.7495

|

Invest | |

|

18.6076

(03-02-2026)

|

17.9829

(02-02-2026)

|

3.47%

|

20.1197

|

15.7947

|

Invest | |

|

10.7682

(03-02-2026)

|

10.4470

(02-02-2026)

|

3.07%

|

10.8543

|

9.5594

|

Invest |

Mahindra Manulife Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top Mahindra Manulife Mutual Fund

Mahindra Manulife Small Cap Fund - Regular Plan - Growth

3Y Returns 21.84%

VS

Mahindra Manulife Small Cap Fund - Regular Plan - Growth

3Y Returns 21.84%

VS

Quant Small Cap Fund Regular Growth

3Y Returns 17.83%

Quant Small Cap Fund Regular Growth

3Y Returns 17.83%

Mahindra Manulife Flexi Cap Fund - Regular Plan -Growth

3Y Returns 15.98%

VS

Mahindra Manulife Flexi Cap Fund - Regular Plan -Growth

3Y Returns 15.98%

VS

Quant Flexi Cap Fund-Growth

3Y Returns 15.94%

Quant Flexi Cap Fund-Growth

3Y Returns 15.94%

Mahindra Manulife Mid Cap Fund - Regular Plan - Growth

3Y Returns 23.71%

VS

Mahindra Manulife Mid Cap Fund - Regular Plan - Growth

3Y Returns 23.71%

VS

Motilal Oswal Midcap Fund-Regular Plan-Growth Option

3Y Returns 22.04%

Motilal Oswal Midcap Fund-Regular Plan-Growth Option

3Y Returns 22.04%

Mahindra Manulife Dynamic Bond Fund - Regular Plan - Growth

3Y Returns 6.39%

VS

Mahindra Manulife Dynamic Bond Fund - Regular Plan - Growth

3Y Returns 6.39%

VS

UTI Dynamic Bond Fund - Regular Plan - Growth Option

3Y Returns 6.67%

UTI Dynamic Bond Fund - Regular Plan - Growth Option

3Y Returns 6.67%

Investment Strategy

Portfolio management would involve active allocation between sectors and stocks based on the stages of business cycles in the economy as business growth for various sectors has a lead or large economy.

Head of Equity & Debt Team (CIO)

Mr. Krishna Sanghavi (CIO)

Mr. Krishna Sanghavi, a CMA from the Institute of Cost and Works Accountants of India with an MMS in Finance, boasts over 27 years of experience. With 14 years in Mutual Funds and 8 years in Life Insurance, he held leadership roles, including 'Head of Equities' at Canara Robeco, Kotak Mahindra, and Aviva. In these positions, he expertly managed and supervised Equity Portfolios.

Mr. Rahul Pal (CIO)

Mr Rahul Pal, a Chartered Accountant, joined Mahindra Manulife Investment Management Private Limited after serving as 'CIO – Fixed Income' at Taurus Asset Management Company Limited. He previously worked as a fund Manager – Fixed Income' at Sundaram Asset Management Company Limited, where he managed and supervised fixed-income portfolios.

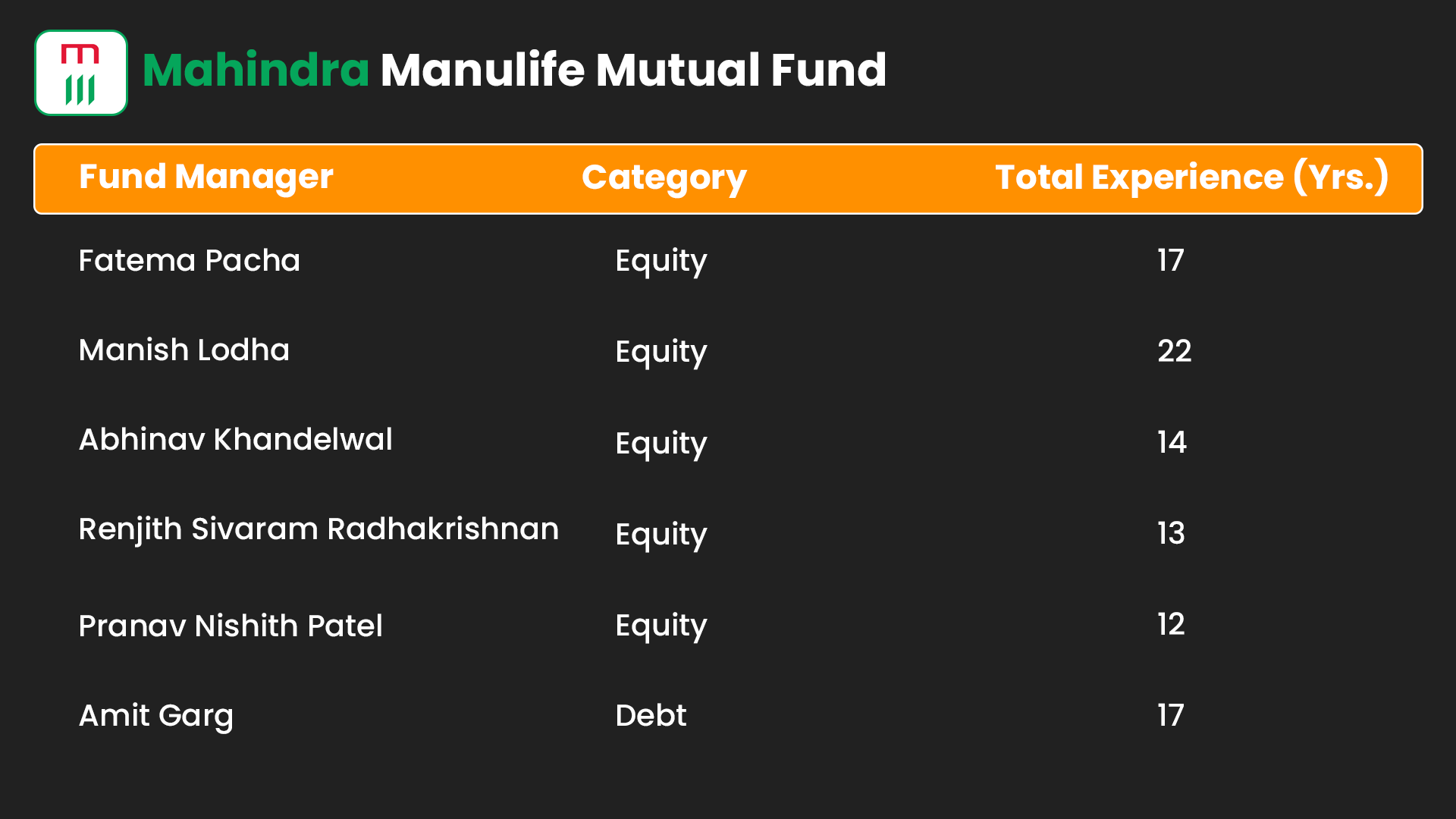

Key Fund Management Team

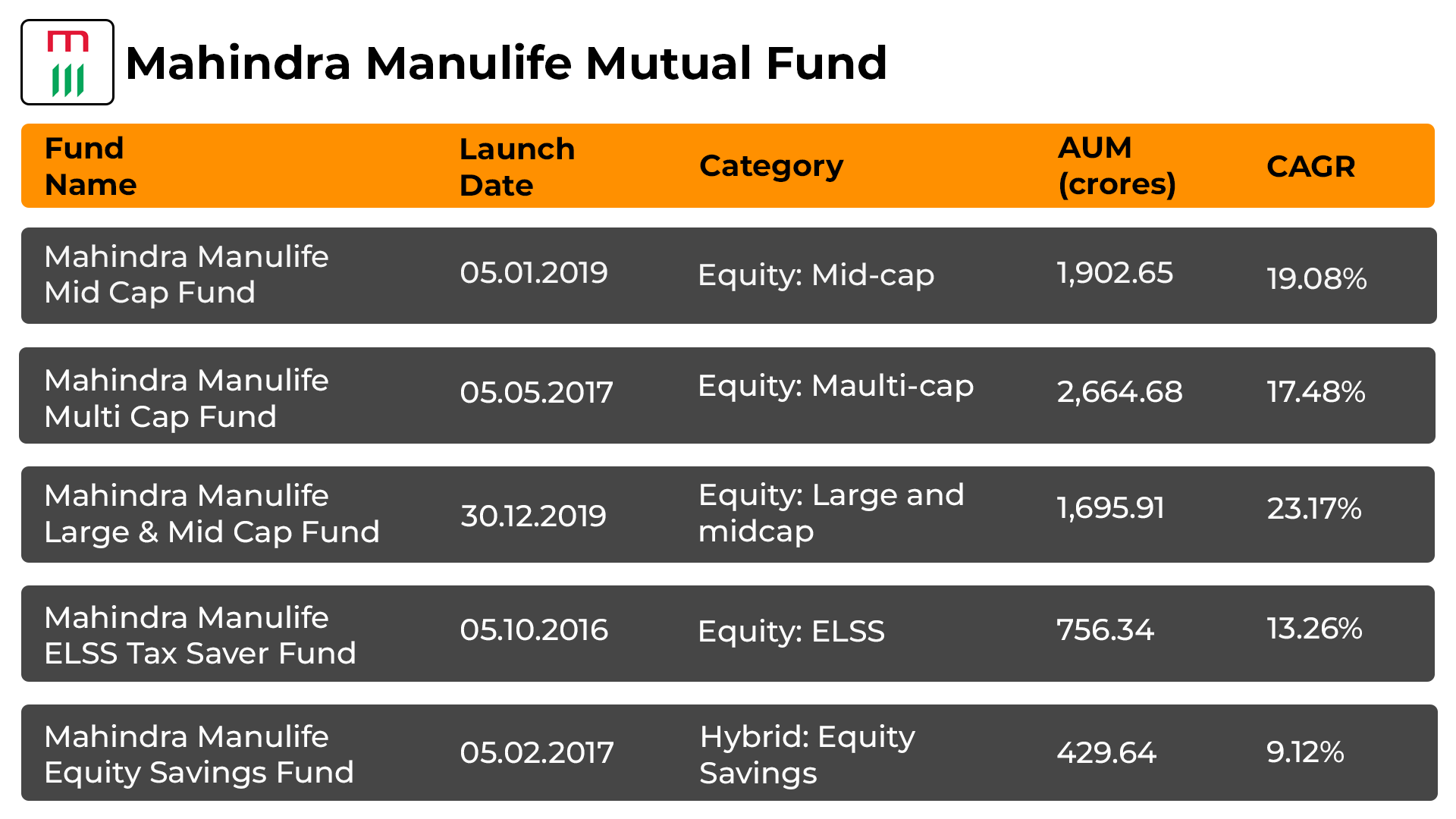

Top 5 Mahindra Manulife Mutual Funds

History of Mahindra Manulife Mutual

Mahindra Manulife Mutual Fund operates according to a trust deed dated September 29, 2015. The trust includes Mahindra & Mahindra Financial Services Limited as the Sponsor and Mahindra Trustee Company Private Limited as the Trustee. The Trust Deed has been properly registered under the Indian Registration Act of 1908. Mahindra Finance's history reflects a consistent upward path, highlighting a strong commitment to empowering customers.

- MMFSL has a substantial fund management team.

- Operates in 1172 offices, covering 26 states and 3 union territories.

- Offers a diverse portfolio with 50 Mahindra Manulife MF schemes.

- Actively managed portfolio strategy for long-term capital appreciation

- Emphasis on strong governance practices.

- Known for conducting best-in-class fundamental research.

- Utilizes digital platforms for enhanced accessibility and services.

How to Select the Best Mahindra Manulife Mutual Fund?

Getting started with investments is like taking the first step on a journey, and it's crucial to make that step wisely. Here are some key aspects to consider in simple terms:

- Defining Objectives: Make reasonable financial decisions. Identify them and create a plan for needs.

- Risk Tolerance: Determine level of risk comfort, keeping in mind that increased risk can result in higher returns.

- Diversification: Spread your investments across several industries to reduce risk and maximize returns.

- Self-education: To gain a better understanding of finances. Analyse previous performance and fund operations.

- Regular Monitoring: Consistently check your investments and make adjustments as market conditions shift.

- Seeking Advice: Because market swings may influence mutual funds, consult with professionals.

The SIP Calculator can also help you set realistic goals for mutual funds.

How to Invest in Mahindra Manulife Fund Schemes via MySIPonline?

Investing in Top Mahindra Manulife Mutual Funds is made easy with mysiponline. Here's a simple step-by-step guide:

- Visit mysiponline.com and select mutual fund plans based on goals.

- Register for free, complete your profile, and select preferred funds.

- Complete your KYC procedure, for the next procedure.

- Choose and add money to the cart according to your risk tolerance.

- Make your payment and wait for confirmation of your investment.

- Keep track of your investments with mysiponline.com.

Investing in mutual funds using Online SIP is simple. It's a straight process with rapid KYC and user-friendly features.

What is the Taxation on Mahindra Manulife Mutual Fund?

The taxation of Mahindra Manulife mutual funds depends on which category they fall under equity or debt.

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase

- Long-term Capital Gains (LTCG): Gains exceeding Rs. 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Can I invest for a very short-term duration in Mahindra Manulife Mutual Fund?

What are the different Mahindra mutual funds available?

What is the advantage of investing in amc Funds?

Are all SIPs in Mahindra Funds online tax-free?

How to analyse the performance of Mahindra Manulife Mutual Fund?

Why do I need a financial adviser?

Explore Other AMC’s

Top Blogs of Mahindra Manulife Mutual Fund

Blogs

You can select three funds for compare.

You can select three funds for compare.