Sundaram Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 30

- Average annual returns 10.63%

About Sundaram Mutual Fund

Sundaram mutual fund is a fully owned subsidiary of one of India's oldest and most respected companies, Sundaram Finance Limited (SFL), which was founded on August 26, 1996, by Mr. Harsha Viji. Since its launch, it has established itself among the top mutual fund companies in India. Presently, this AMC manages a total of 43 funds, comprising 25 equity funds, 12 debt funds, and 6 hybrid funds. This holds the 19th position among other top Asset Management Companies (AMCs) in the country. The flagship plan, the Sundaram Mid Cap Fund, has delivered a remarkable average annualized return of 24.29% since its inception.

More-

Launched in

24-Aug-1996

-

AMC Age

29 Years

-

Website

https://www.sundarammutual.com -

Email Address

dhirent@sundarammutual.com

Top Performing Sundaram Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 3090.46 | 2 years | -0.27% | 2.17% | 3.4% | 11.84% | 2.25% | 21.32% | 16.38% | - | - | - | Invest | |

| 1660.65 | 17 years | -0.07% | -0.7% | 2.92% | 10.6% | -0.29% | 20.86% | 13.07% | 19.75% | 14.56% | 17.62% | Invest | |

| 947.40 | 20 years | 0.81% | 4.76% | 0.33% | 4.38% | 1.07% | 20.47% | 12.63% | 23.25% | 20.22% | 16.48% | Invest | |

| 13292.89 | 23 years | 0.11% | 1.37% | -0.91% | 3.91% | -1.07% | 17.77% | 15.13% | 25.04% | 20.06% | 16.89% | Invest | |

| 156.48 | 18 years | -0.67% | -3.27% | 0.3% | 9.66% | -1.71% | 14.75% | 14.8% | 17.73% | 12% | 13.06% | Invest | |

| 6986.67 | 18 years | 0.25% | 1% | -0.77% | 3.96% | -1.25% | 13.93% | 11.2% | 17.35% | 14.68% | 15.78% | Invest | |

| 3400.63 | 21 years | 0.36% | -0.46% | -3.48% | 1.79% | -1.77% | 13.44% | 7.5% | 20% | 20.13% | 15.79% | Invest | |

| 4808.86 | 7 years | -0.56% | -2.57% | -2.92% | 1.57% | -4.02% | 12.61% | 12.52% | 18.42% | 16.97% | - | Invest | |

| 2907.68 | - | -0.3% | 0.04% | -2.57% | 1.06% | -2.7% | 12.29% | 9.77% | 17.74% | 15.81% | 16.99% | Invest | |

| 1401.54 | 29 years | -0.03% | 0.08% | -1.31% | 1.45% | -2.18% | 11.12% | 10.39% | 15.64% | 13.78% | 16.03% | Invest | |

| 1401.54 | 29 years | -0.03% | 0.08% | -1.31% | 1.45% | -2.18% | 11.12% | 10.39% | 15.64% | 13.78% | 16.03% | Invest | |

| 2128.18 | 3 years | -0.04% | 0.08% | -1.3% | 1.46% | -2.17% | 11.02% | 10.08% | 15.06% | - | - | Invest | |

| 1476.88 | 26 years | -0.27% | -0.13% | -1.17% | 1.29% | -2.33% | 10.18% | 8.62% | 13.5% | 12.5% | 13.6% | Invest | |

| 35.85 | 8 years | -0.91% | -2.48% | -4.41% | -2% | -3.5% | 10.04% | 5.57% | 18.62% | 23.08% | - | Invest | |

| 7846.01 | 26 years | -0.39% | -0.19% | -1.21% | 2.32% | -1.44% | 9.26% | 8.78% | 13.1% | 11.19% | 13.79% | Invest | |

| 3363.64 | 5 years | -0.24% | -0.18% | -0.65% | 2.54% | -1.84% | 7.53% | 6.9% | 12.58% | 11.2% | - | Invest | |

| 1206.72 | 23 years | -0.26% | -0.02% | -0.34% | 2% | -0.66% | 7.25% | 8.66% | 11.32% | 9.98% | 9.85% | Invest | |

| 376.88 | 21 years | 0.34% | 0.5% | 0.83% | 2.59% | 0.42% | 7.18% | 7.54% | 7.39% | 5.69% | 6.56% | Invest | |

| 768.20 | 21 years | 0.3% | 0.41% | 0.66% | 2.4% | 0.33% | 7.06% | 7.44% | 7.12% | 5.98% | 7.3% | Invest | |

| 189.66 | 22 years | 0.3% | 0.53% | 0.98% | 2.61% | 0.5% | 6.98% | 7.42% | 7.29% | 6.01% | 5.8% | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Feb-2026 | Jan-2026 | Dec-2025 | Nov-2025 | Oct-2025 | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 |

|---|

| Fund Name | 2026-Q1 | 2025-Q4 | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 |

|---|

| Fund Name | 2026 | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 3090.46 | High |

4.28%

|

20.29%

|

16.36%

|

-

|

-

|

-

|

16.37%

|

Invest | |

| 1660.65 | Very High |

4.33%

|

15.97%

|

12.63%

|

14.99%

|

16.57%

|

15.66%

|

14.4%

|

Invest | |

| 947.40 | Very High |

2.81%

|

13.3%

|

7.74%

|

15.09%

|

18.04%

|

17.09%

|

12.05%

|

Invest | |

| 13292.89 | Very High |

0.78%

|

11.29%

|

9.26%

|

17.03%

|

19.33%

|

17.05%

|

19.97%

|

Invest | |

| 156.48 | Average |

1.54%

|

21.31%

|

18.24%

|

17.5%

|

14.94%

|

12.79%

|

9.67%

|

Invest | |

| 6986.67 | Very High |

0.62%

|

8.95%

|

6.47%

|

11.76%

|

13.28%

|

14.64%

|

13.57%

|

Invest | |

| 3400.63 | Very High |

-1.74%

|

4.78%

|

4.07%

|

10.64%

|

15.03%

|

16.2%

|

15.68%

|

Invest | |

| 4808.86 | Very High |

-2.09%

|

3.99%

|

7.79%

|

12.65%

|

14.7%

|

-

|

18.22%

|

Invest | |

| 2907.68 | Very High |

-1.29%

|

4.69%

|

4.99%

|

11.11%

|

13.45%

|

15.12%

|

15.3%

|

Invest | |

| 1401.54 | Very High |

-0.27%

|

6.27%

|

5.87%

|

10.6%

|

12.48%

|

13.98%

|

14.94%

|

Invest | |

| 1401.54 | Very High |

-0.27%

|

6.27%

|

5.87%

|

10.6%

|

12.48%

|

13.98%

|

14.94%

|

Invest | |

| 2128.18 | Very High |

-0.29%

|

6.34%

|

6.16%

|

10.32%

|

-

|

-

|

11.24%

|

Invest | |

| 1476.88 | Average |

-0.18%

|

5.75%

|

5.21%

|

9.06%

|

11.03%

|

12.05%

|

13.42%

|

Invest | |

| 35.85 | Very High |

-3.5%

|

1.15%

|

1.86%

|

8.14%

|

14.61%

|

-

|

18.43%

|

Invest | |

| 7846.01 | High |

-0.23%

|

4.4%

|

4.84%

|

9.09%

|

10.36%

|

11.73%

|

12.18%

|

Invest | |

| 3363.64 | Very High |

0.34%

|

5.41%

|

3.96%

|

8.02%

|

9.97%

|

-

|

10.55%

|

Invest | |

| 1206.72 | Moderate |

0.23%

|

4.42%

|

5.73%

|

8.43%

|

9.42%

|

10.08%

|

8.6%

|

Invest | |

| 376.88 | Moderate |

1.12%

|

5.25%

|

6.83%

|

7.16%

|

6.67%

|

6.37%

|

7.16%

|

Invest | |

| 768.20 | Moderate |

0.98%

|

4.96%

|

6.71%

|

7.04%

|

6.6%

|

6.77%

|

7.15%

|

Invest | |

| 189.66 | Low to Moderate |

1.2%

|

5.33%

|

6.76%

|

7.06%

|

6.69%

|

5.83%

|

6.75%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

14.56%

|

4.69%

|

0.95%

|

1.12%

|

Invest | |

| Very High |

14.05%

|

0.84%

|

0.88%

|

0.95%

|

Invest | |

| Very High |

13.35%

|

1.33%

|

0.93%

|

1.18%

|

Invest | |

| Average |

15.74%

|

-

|

-

|

-

|

Invest | |

| Very High |

12.94%

|

-

|

0.96%

|

0.85%

|

Invest | |

| Very High |

14.09%

|

0.26%

|

0.78%

|

0.83%

|

Invest | |

| Very High |

12.7%

|

3.91%

|

1.02%

|

1.02%

|

Invest | |

| Very High |

12.58%

|

-

|

0.93%

|

0.88%

|

Invest | |

| Very High |

11.66%

|

0.13%

|

0.86%

|

0.92%

|

Invest | |

| Very High |

11.66%

|

0.13%

|

0.86%

|

0.92%

|

Invest | |

| Very High |

8.4%

|

-

|

0.87%

|

0.85%

|

Invest | |

| Average |

11.71%

|

-

|

0.85%

|

0.8%

|

Invest | |

| Very High |

15.89%

|

1.63%

|

0.74%

|

0.76%

|

Invest | |

| High |

8.82%

|

-

|

1.12%

|

0.75%

|

Invest | |

| Very High |

11.94%

|

-

|

0.89%

|

0.72%

|

Invest | |

| Moderate |

5.34%

|

0.58%

|

1.13%

|

1.08%

|

Invest | |

| Moderate |

1.18%

|

-

|

-

|

-

|

Invest | |

| Moderate |

0.92%

|

-

|

-

|

-

|

Invest | |

| Low to Moderate |

3.92%

|

-

|

-

|

-

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹100

|

₹100

|

1.76%

|

Dwijendra Srivastava

|

25-Jan 2024

|

Invest | |

|

₹100

|

₹100

|

2.14%

|

Rohit Seksaria

|

10-Jun 2008

|

Invest | |

|

₹100

|

₹100

|

2.4%

|

Ratish Varier

|

29-Sep 2005

|

Invest | |

|

₹100

|

₹100

|

1.77%

|

Bharath S.

|

19-Jul 2002

|

Invest | |

|

₹100

|

₹100

|

2.31%

|

Pathanjali Srinivasan

|

22-Aug 2007

|

Invest | |

|

₹100

|

₹100

|

1.85%

|

Ravi Gopalakrishnan

|

27-Feb 2007

|

Invest | |

|

₹100

|

₹100

|

1.97%

|

Ravi Gopalakrishnan

|

15-Feb 2005

|

Invest | |

|

₹100

|

₹100

|

1.94%

|

Ravi Gopalakrishnan

|

01-Sep 2018

|

Invest | |

|

₹100

|

₹100

|

2.01%

|

Ratish Varier

|

01-Jan 2013

|

Invest | |

|

₹500

|

₹500

|

2.23%

|

Sudhir Kedia

|

31-Mar 1996

|

Invest | |

|

₹500

|

₹500

|

2.23%

|

Sudhir Kedia

|

31-Mar 1996

|

Invest | |

|

₹100

|

₹100

|

2%

|

Ravi Gopalakrishnan

|

06-Sep 2022

|

Invest | |

|

₹250

|

₹100

|

2.2%

|

Sudhir Kedia

|

22-Nov 1999

|

Invest | |

|

₹250

|

₹5000

|

1.42%

|

Dwijendra Srivastava

|

03-Oct 2017

|

Invest | |

|

₹100

|

₹100

|

1.86%

|

Ravi Gopalakrishnan

|

14-Jan 2000

|

Invest | |

|

₹100

|

₹100

|

1.93%

|

Ravi Gopalakrishnan

|

01-Oct 2020

|

Invest | |

|

₹100

|

₹100

|

2.19%

|

Dwijendra Srivastava

|

23-May 2002

|

Invest | |

|

₹250

|

₹5000

|

0.41%

|

Dwijendra Srivastava

|

30-Dec 2004

|

Invest | |

|

₹250

|

₹5000

|

0.51%

|

Dwijendra Srivastava

|

30-Dec 2004

|

Invest | |

|

₹250

|

₹5000

|

1.14%

|

Dwijendra Srivastava

|

09-May 2003

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

13.6140

(13-02-2026)

|

13.7752

(12-02-2026)

|

-1.17%

|

13.9758

|

10.9363

|

Invest | |

|

110.6632

(13-02-2026)

|

112.0226

(12-02-2026)

|

-1.21%

|

112.974

|

89.1216

|

Invest | |

|

98.3302

(13-02-2026)

|

99.4171

(12-02-2026)

|

-1.09%

|

99.5777

|

77.2942

|

Invest | |

|

1424.0666

(13-02-2026)

|

1445.7087

(12-02-2026)

|

-1.5%

|

1453.24

|

1139.78

|

Invest | |

|

39.3788

(12-02-2026)

|

39.9406

(11-02-2026)

|

-1.41%

|

41.0837

|

28.7732

|

Invest | |

|

87.3403

(13-02-2026)

|

88.4741

(12-02-2026)

|

-1.28%

|

89.0795

|

72.3649

|

Invest | |

|

256.1417

(13-02-2026)

|

260.5039

(12-02-2026)

|

-1.67%

|

268.451

|

207.082

|

Invest | |

|

34.9733

(13-02-2026)

|

35.5637

(12-02-2026)

|

-1.66%

|

36.6581

|

29.5257

|

Invest | |

|

381.2295

(13-02-2026)

|

387.3505

(12-02-2026)

|

-1.58%

|

398.331

|

323.207

|

Invest | |

|

517.5182

(13-02-2026)

|

523.3832

(12-02-2026)

|

-1.12%

|

532.496

|

442.605

|

Invest | |

|

517.5182

(13-02-2026)

|

523.3832

(12-02-2026)

|

-1.12%

|

532.496

|

442.605

|

Invest | |

|

14.9826

(13-02-2026)

|

15.1527

(12-02-2026)

|

-1.12%

|

15.4153

|

12.7908

|

Invest | |

|

223.0758

(13-02-2026)

|

225.8737

(12-02-2026)

|

-1.24%

|

230.086

|

192.489

|

Invest | |

|

25.8721

(13-02-2026)

|

26.4552

(12-02-2026)

|

-2.2%

|

27.7726

|

21.5957

|

Invest | |

|

163.1459

(13-02-2026)

|

164.5748

(12-02-2026)

|

-0.87%

|

166.889

|

143.736

|

Invest | |

|

21.4732

(13-02-2026)

|

21.6783

(12-02-2026)

|

-0.95%

|

22.0249

|

18.9998

|

Invest | |

|

71.6617

(13-02-2026)

|

72.0007

(12-02-2026)

|

-0.47%

|

72.383

|

65.7612

|

Invest | |

|

44.5005

(13-02-2026)

|

44.4488

(12-02-2026)

|

0.12%

|

44.5005

|

41.5358

|

Invest | |

|

41.4507

(13-02-2026)

|

41.4098

(12-02-2026)

|

0.1%

|

41.4507

|

38.7337

|

Invest | |

|

45.7713

(13-02-2026)

|

45.7430

(12-02-2026)

|

0.06%

|

45.7713

|

42.8122

|

Invest |

Sundaram Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top Sundaram Mutual Fund

Sundaram Large and Midcap Fund Regular Plan - Growth

3Y Returns 17.35%

VS

Sundaram Large and Midcap Fund Regular Plan - Growth

3Y Returns 17.35%

VS

Quant Large and Mid Cap Fund-Growth

3Y Returns 14.82%

Quant Large and Mid Cap Fund-Growth

3Y Returns 14.82%

Sundaram Arbitrage Fund Regular Growth

3Y Returns 6.66%

VS

Sundaram Arbitrage Fund Regular Growth

3Y Returns 6.66%

VS

SBI Arbitrage Opportunities Fund - Regular Plan - Gr

3Y Returns 7.11%

SBI Arbitrage Opportunities Fund - Regular Plan - Gr

3Y Returns 7.11%

SUNDARAM MEDIUM DURATION FUND Regular Plan - Growth

3Y Returns 5.74%

VS

SUNDARAM MEDIUM DURATION FUND Regular Plan - Growth

3Y Returns 5.74%

VS

Aditya Birla Sun Life Medium Term Plan - Growth - Regular Plan

3Y Returns 10.07%

Aditya Birla Sun Life Medium Term Plan - Growth - Regular Plan

3Y Returns 10.07%

Sundaram Overnight Fund Regular Plan - Growth

3Y Returns 6.25%

VS

Sundaram Overnight Fund Regular Plan - Growth

3Y Returns 6.25%

VS

UTI - Overnight Fund - Regular Plan - Growth Option

3Y Returns 6.31%

UTI - Overnight Fund - Regular Plan - Growth Option

3Y Returns 6.31%

Investing Strategy

Sundaram Finance's investment strategy centers on the pillars of Growth, Quality, and Profitability while upholding principles of safeguarding shareholder value. This approach involves identifying companies aligned with Sundaram's dedication to long-term growth, high-quality standards, and profitability.

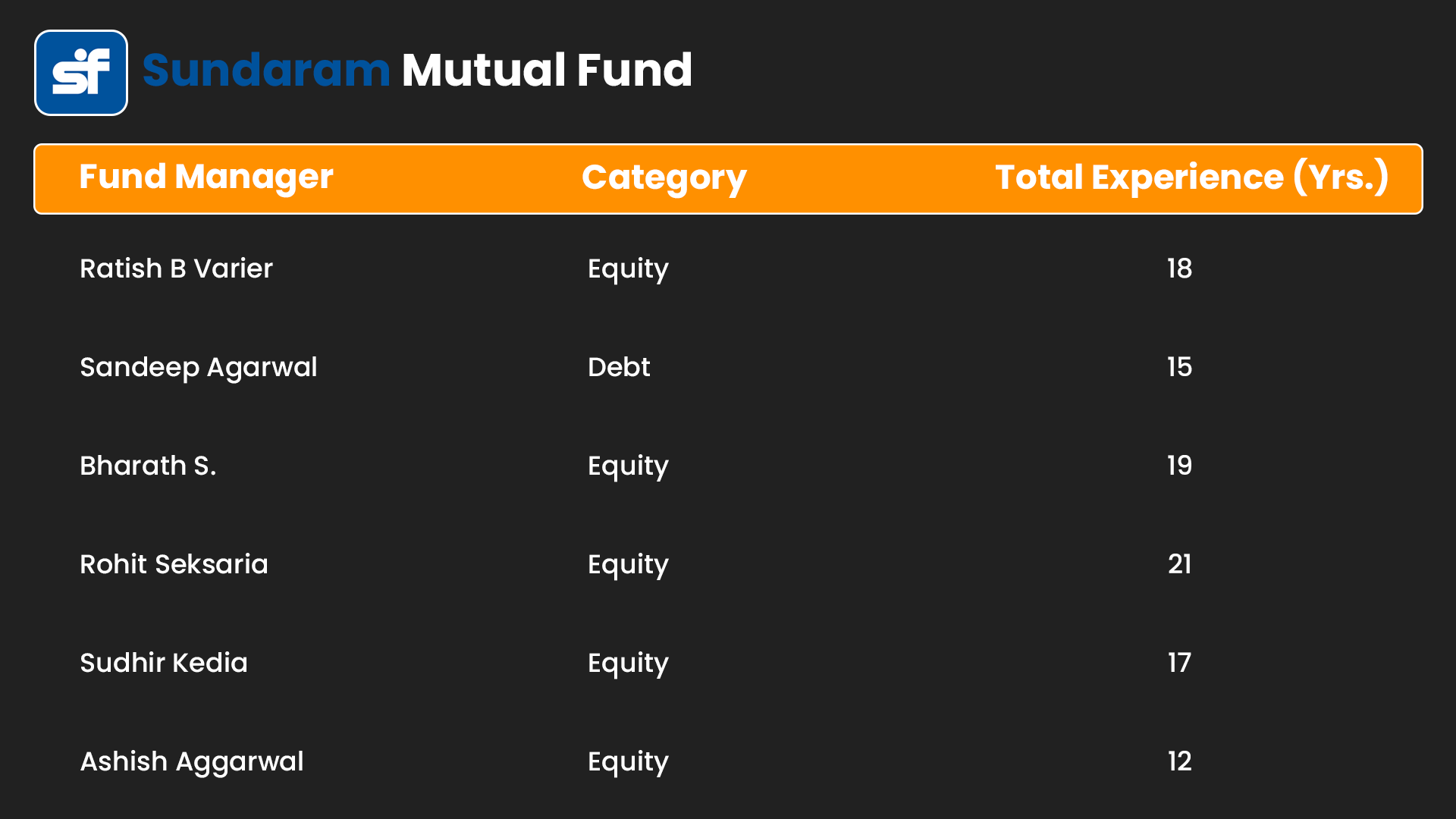

Key Fund Managers

Mr. Ravi Gopalakrishnan (CIO)

Ravi Gopalakrishnan, with over three decades of experience in research and asset management, joined Sundaram Asset Management Company in January 2022. Ravi adopts a strong bottom-up approach to investing and has a track record of successful performance across firms and business cycles

List of all Fund Manager Team

Top 5 Sundaram Mutual funds

History of Sundaram Mutual Fund?

Sundaram Mutual Fund was sponsored by Sundaram Finance and Newton Group in 1996. However, Newton Group exited from this partnership in 2002.

BNP Paribas Asset Management (BNPP AM) became a partner in 2006. In 2010, as part of a global purchase, BNP Paribas Asset Management's parent company bought the Fortis Group's banking and financial services operations. As a result, Sundaram Finance acquired BNP Paribas' entire investment, gaining complete control of the firm.

Sundaram Finance is now the mutual fund's only sponsor, with a 100% ownership in both the Asset Management and Trustee companies. Mr. T V Sundaram Iyengar began the organization as a bus service in 1911, and it has since grown to wholly control and operate the mutual fund industry.

- Sundaram has a 21-member investment team.

- Sundaram MF offers a 133 diversified schemes.

- This AMC has 94 global branches, 305 distributors.

- The Fund house shows strong governance practices.

How to Select the Best Sundaram Mutual Fund?

To choose the best Sundaram Mutual Fund schemes follow these points:

- Establish definite investing objectives that align with your budget.

- Before making investing choices assess the level of risk tolerance.

- Spread your money over a variety of industries and asset types.

- Learn about the performance of funds and investing strategies.

- Regularly review investments and make necessary adjustments.

To summarize, remember these points and also use the SIP Calculator that will help you determine the annual return of your future investment.

How to Invest in Sundaram Mutual Fund with mysiponline?

To Begin your Sundaram mutual fund investment journey with ease through mysiponline, a platform known for its simplicity and convenience:

- Visit mysiponline.com, pick SUNDARAM AMC funds

- Sign up for free account complete profile details to invest

- verify your KYC with PAN, Aadhar card, Signature, Bank proof

- Add desired funds to your cart based on the risk appetite

- Proceed to make payment and wait for the confirmation.

- Monitor investments easily with mysiponline.com account.

To conclude, start your mutual fund investing journey with Online SIP, which guarantees simplicity, convenience, and effective investment tracking.

Taxation of Sundaram Mutual fund?

The taxation of Sundaram Mutual Funds depends on which category they fall under equity or debt:

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding Rs. 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Explore Other AMC’s

Top Blogs of Sundaram Mutual Fund

Blogs

You can select three funds for compare.

You can select three funds for compare.