Aditya Birla Sunlife Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 97

- Average annual returns 13.46%

About Aditya Birla Sunlife Mutual Fund

Birla Sun Life Asset Management Company Ltd. (BSLAMC) oversees the investments of Aditya Birla Sun Life Mutual Fund. The Aditya Birla Group has formed a collaboration with Sun Life Financial Services Inc. of Canada. This agreement brings together Aditya Birla Group's experience of the Indian market and Sun Life's worldwide capabilities. This AMC was started on 5th August 1994 by Mr A. Balasubramaniam.

Aditya Birla Sun Life Mutual Fund offers a portfolio of 114 fund schemes, including 41 Equity, 44 Debt, and 13 hybrid funds. It currently holds the 6th rank among Asset Management Companies. Aditya Birla Sun Life Frontline Equity Fund, the flagship scheme, has exhibited an impressive average annualized return of 19.35% since its inception.

More-

Launched in

23-Dec-1994

-

AMC Age

31 Years

-

Website

https://mutualfund.adityabirlacapital.com -

Email Address

care.mutualfunds@adityabirlacapital.com

Top Performing Aditya Birla Sunlife Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1724.36 | 4 years | 13.29% | -14.03% | 68.48% | 123.29% | 17.47% | 168.3% | 89.06% | 56.34% | - | - | Invest | |

| 1022.83 | 14 years | 5.01% | 3.02% | 26.84% | 57.45% | 13.19% | 81.71% | 58.14% | 40.1% | 26.76% | - | Invest | |

| 1781.05 | 13 years | 5.83% | 3.09% | 27.05% | 57.47% | 19.03% | 80.43% | 57.47% | 39.37% | 26.19% | 16.94% | Invest | |

| 855.80 | 1 years | -1.04% | 7.71% | 2.05% | 4.81% | 4.79% | 50.51% | - | - | - | - | Invest | |

| 5713.52 | 6 years | 1.01% | 10.73% | 10.48% | 18.94% | 8.54% | 34.11% | 8.16% | 32.5% | 26.37% | - | Invest | |

| 303.29 | 18 years | 0.57% | -0.05% | 7.09% | 11.58% | 4.07% | 28.11% | 22.2% | 16.71% | 11.94% | 12.19% | Invest | |

| 6111.84 | 3 years | 0.42% | 1.56% | 6.95% | 13% | 2.47% | 26.55% | 17.61% | 19.52% | - | - | Invest | |

| 1490.82 | 4 years | -1.16% | 6.56% | 0.99% | 5.02% | -1.23% | 26.18% | 12.18% | - | - | - | Invest | |

| 3640.65 | 12 years | -0.73% | 4.23% | 1.83% | 8.15% | 0.63% | 25.22% | 13.24% | 18.99% | 12.79% | 16.64% | Invest | |

| 459.38 | 4 years | 1.12% | -2.47% | 3.68% | 11% | 0.35% | 25.03% | 23.51% | 31.65% | - | - | Invest | |

| 2133.98 | 1 years | 0.19% | 5.36% | 5.58% | 9.46% | 2.26% | 24.08% | - | - | - | - | Invest | |

| 331.71 | 19 years | 0.03% | -1.67% | 5.68% | 12.47% | 0.94% | 23.87% | 15.34% | 20.25% | 14.5% | 14.23% | Invest | |

| 1075.29 | 19 years | -0.06% | 9.86% | 2.37% | 2.84% | 2.8% | 22.32% | 8.26% | 23.41% | 19.12% | 16.56% | Invest | |

| 1050.65 | 11 years | 0.24% | 8.12% | 3.21% | 6.7% | 1.7% | 22.29% | 12.44% | 22.07% | 15.21% | 14.63% | Invest | |

| 419.29 | 6 years | -1.45% | 3.44% | -0.35% | 1.37% | -1.61% | 21.27% | 10.9% | 16.96% | 10.17% | - | Invest | |

| 918.86 | 5 years | -1.43% | 0.96% | -1.28% | 5.06% | -2.79% | 21% | 12.69% | 21.44% | 15.96% | - | Invest | |

| 26.96 | 3 years | 0.19% | -1.77% | 5.29% | 12.17% | 0.96% | 20.78% | 14.35% | 20.61% | - | - | Invest | |

| 24700.43 | 27 years | -1.01% | 2.58% | -0.19% | 3.83% | -1.66% | 18.88% | 11.58% | 19.1% | 14.33% | 16.29% | Invest | |

| 408.21 | 4 years | -0.91% | 4.61% | -0.86% | 2.25% | -1.8% | 18.82% | 9.46% | 24.05% | - | - | Invest | |

| 234.11 | 4 years | 0.1% | 6.29% | 3.16% | 3.69% | 1.01% | 18.55% | 8.64% | 22.77% | - | - | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Feb-2026 | Jan-2026 | Dec-2025 | Nov-2025 | Oct-2025 | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 |

|---|

| Fund Name | 2026-Q1 | 2025-Q4 | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 |

|---|

| Fund Name | 2026 | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 1724.36 | Very High |

40.77%

|

225.83%

|

112.21%

|

76.82%

|

-

|

-

|

58.35%

|

Invest | |

| 1022.83 | High |

-

|

-

|

-

|

-

|

-

|

-

|

-

|

Invest | |

| 1781.05 | High |

18.53%

|

89.74%

|

65.11%

|

51.05%

|

35.8%

|

22.43%

|

17.02%

|

Invest | |

| 855.80 | Very High |

1.99%

|

8.55%

|

-

|

-

|

-

|

-

|

17.14%

|

Invest | |

| 5713.52 | Very High |

10.22%

|

27.44%

|

12.82%

|

21.45%

|

26.26%

|

-

|

28.08%

|

Invest | |

| 303.29 | Very High |

6.07%

|

32.56%

|

27.65%

|

23.29%

|

16.5%

|

13.44%

|

11.44%

|

Invest | |

| 6111.84 | Very High |

4.86%

|

22.17%

|

17.69%

|

18.37%

|

-

|

-

|

18.4%

|

Invest | |

| 1490.82 | Very High |

0.51%

|

16.52%

|

9.79%

|

-

|

-

|

-

|

11.31%

|

Invest | |

| 3640.65 | Very High |

3%

|

12.62%

|

12.96%

|

14.54%

|

14.81%

|

13.81%

|

14.22%

|

Invest | |

| 459.38 | Very High |

1.97%

|

29.59%

|

24.17%

|

26.05%

|

-

|

-

|

24.95%

|

Invest | |

| 2133.98 | Very High |

4.68%

|

16.54%

|

-

|

-

|

-

|

-

|

9.43%

|

Invest | |

| 331.71 | High |

3.42%

|

19.01%

|

15.56%

|

17.81%

|

16.24%

|

14.45%

|

11.71%

|

Invest | |

| 1075.29 | Very High |

2.82%

|

9.14%

|

4.92%

|

12.71%

|

17.99%

|

17.01%

|

13.48%

|

Invest | |

| 1050.65 | Very High |

2.65%

|

12.88%

|

7.92%

|

14.65%

|

15.29%

|

14.08%

|

13.66%

|

Invest | |

| 419.29 | Very High |

0.62%

|

8.51%

|

8.27%

|

12.56%

|

12.54%

|

-

|

12.8%

|

Invest | |

| 918.86 | Very High |

0.42%

|

12.21%

|

10.94%

|

16.37%

|

16.03%

|

-

|

16.23%

|

Invest | |

| 26.96 | High |

3.02%

|

17.45%

|

13.47%

|

17.01%

|

-

|

-

|

17.45%

|

Invest | |

| 24700.43 | Very High |

0.49%

|

8%

|

8.54%

|

13.78%

|

14.33%

|

14.6%

|

18.07%

|

Invest | |

| 408.21 | Very High |

0.26%

|

6.16%

|

5.84%

|

13.83%

|

-

|

-

|

17.52%

|

Invest | |

| 234.11 | Very High |

0.97%

|

5.91%

|

2.58%

|

12.4%

|

-

|

-

|

14.2%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Very High |

13.96%

|

-

|

-

|

-

|

Invest | |

| High |

11.41%

|

-

|

-

|

-

|

Invest | |

| High |

10.92%

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

19.35%

|

-

|

0.92%

|

1.17%

|

Invest | |

| Very High |

13.92%

|

18.94%

|

-

|

1.18%

|

Invest | |

| Very High |

-

|

6.08%

|

0.92%

|

1.94%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

15.35%

|

1.9%

|

0.97%

|

0.91%

|

Invest | |

| Very High |

22.45%

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| High |

7.06%

|

-

|

-

|

-

|

Invest | |

| Very High |

15.1%

|

-

|

0.91%

|

0.8%

|

Invest | |

| Very High |

13.2%

|

-

|

0.99%

|

0.74%

|

Invest | |

| Very High |

11.61%

|

-

|

0.98%

|

0.7%

|

Invest | |

| Very High |

13.56%

|

2.46%

|

0.99%

|

1.08%

|

Invest | |

| High |

5.34%

|

-

|

-

|

-

|

Invest | |

| Very High |

12.55%

|

-

|

0.98%

|

0.85%

|

Invest | |

| Very High |

14.71%

|

-

|

-

|

-

|

Invest | |

| Very High |

20.94%

|

-

|

-

|

-

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹100

|

₹100

|

1.02%

|

Pranav Gupta

|

02-Feb 2022

|

Invest | |

|

₹100

|

₹100

|

0.54%

|

Sachin Wankhede

|

13-May 2011

|

Invest | |

|

₹100

|

₹100

|

0.52%

|

Pranav Gupta

|

20-Mar 2012

|

Invest | |

|

₹500

|

₹500

|

1.08%

|

Haresh Mehta

|

02-Sep 2024

|

Invest | |

|

₹100

|

₹500

|

1.84%

|

Dhaval Gala

|

31-Dec 2019

|

Invest | |

|

₹1000

|

₹1000

|

2.54%

|

Dhaval Joshi

|

31-Oct 2007

|

Invest | |

|

₹100

|

₹500

|

1.77%

|

Dhaval Shah

|

31-Jan 2023

|

Invest | |

|

₹100

|

₹500

|

2.1%

|

Dhaval Gala

|

17-Nov 2021

|

Invest | |

|

₹100

|

₹1000

|

1.95%

|

Dhaval Gala

|

14-Dec 2013

|

Invest | |

|

₹100

|

₹100

|

0.92%

|

Dhaval Joshi

|

01-Nov 2021

|

Invest | |

|

₹500

|

₹500

|

2.01%

|

Harish Krishnan

|

28-Jun 2024

|

Invest | |

|

₹100

|

₹1000

|

1.2%

|

Vinod Bhat

|

17-Aug 2006

|

Invest | |

|

₹100

|

₹1000

|

2.26%

|

Mahesh Patil

|

17-Mar 2006

|

Invest | |

|

₹100

|

₹1000

|

2.27%

|

Harish Krishnan

|

03-Feb 2015

|

Invest | |

|

₹1000

|

₹1000

|

2.41%

|

Dhaval Shah

|

11-Mar 2019

|

Invest | |

|

₹100

|

₹500

|

2.4%

|

Chanchal Khandelwal

|

23-Oct 2020

|

Invest | |

|

₹100

|

₹100

|

0.95%

|

Vinod Bhat

|

14-Oct 2022

|

Invest | |

|

₹1000

|

₹100

|

1.68%

|

Harish Krishnan

|

27-Aug 1998

|

Invest | |

|

₹100

|

₹100

|

0.97%

|

Pranav Gupta

|

01-Apr 2021

|

Invest | |

|

₹100

|

₹100

|

0.91%

|

Pranav Gupta

|

18-Feb 2022

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

39.2309

(26-02-2026)

|

40.3722

(25-02-2026)

|

-2.83%

|

56.2622

|

14.1034

|

Invest | |

|

138.1323

(26-02-2026)

|

139.2633

(25-02-2026)

|

-0.81%

|

-

|

-

|

Invest | |

|

45.6376

(26-02-2026)

|

46.0823

(25-02-2026)

|

-0.97%

|

50.5631

|

24.9664

|

Invest | |

|

11.6291

(26-02-2026)

|

11.4606

(25-02-2026)

|

1.47%

|

12.9116

|

7.3259

|

Invest | |

|

38.08

(26-02-2026)

|

37.86

(25-02-2026)

|

0.58%

|

37.86

|

27.27

|

Invest | |

|

48.1843

(26-02-2026)

|

48.6633

(25-02-2026)

|

-0.98%

|

49.4201

|

33.1486

|

Invest | |

|

16.8659

(26-02-2026)

|

16.8951

(25-02-2026)

|

-0.17%

|

17.2985

|

13.1047

|

Invest | |

|

15.33

(26-02-2026)

|

15.28

(25-02-2026)

|

0.33%

|

15.68

|

11.41

|

Invest | |

|

64.95

(26-02-2026)

|

64.99

(25-02-2026)

|

-0.06%

|

65.47

|

51.57

|

Invest | |

|

18.3926

(26-02-2026)

|

18.5644

(25-02-2026)

|

-0.93%

|

19.3335

|

11.978

|

Invest | |

|

10.43

(26-02-2026)

|

10.41

(25-02-2026)

|

0.19%

|

10.41

|

8.2

|

Invest | |

|

74.9496

(26-02-2026)

|

75.1191

(25-02-2026)

|

-0.23%

|

80.0813

|

59.5902

|

Invest | |

|

97.89

(26-02-2026)

|

97.7

(25-02-2026)

|

0.19%

|

97.94

|

77.08

|

Invest | |

|

34.23

(26-02-2026)

|

34.07

(25-02-2026)

|

0.47%

|

34.16

|

26.85

|

Invest | |

|

20.511

(26-02-2026)

|

20.476

(25-02-2026)

|

0.17%

|

20.967

|

16.537

|

Invest | |

|

26.25

(26-02-2026)

|

26.16

(25-02-2026)

|

0.34%

|

27.03

|

20.92

|

Invest | |

|

17.4486

(26-02-2026)

|

17.4663

(25-02-2026)

|

-0.1%

|

18.6438

|

14.1693

|

Invest | |

|

1868.52

(26-02-2026)

|

1864.35

(25-02-2026)

|

0.22%

|

1906.05

|

1533.03

|

Invest | |

|

24.2148

(26-02-2026)

|

24.0751

(25-02-2026)

|

0.58%

|

24.7721

|

19.5368

|

Invest | |

|

17.059

(26-02-2026)

|

17.0041

(25-02-2026)

|

0.32%

|

17.0754

|

13.8025

|

Invest |

Aditya Birla Sunlife Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top Aditya Birla Sunlife Mutual Fund

Aditya Birla Sun Life Savings Fund-Retail Growth

3Y Returns 7.4%

VS

Aditya Birla Sun Life Savings Fund-Retail Growth

3Y Returns 7.4%

VS

Nippon India Ultra Short Duration Fund- Growth Option

3Y Returns 6.87%

Nippon India Ultra Short Duration Fund- Growth Option

3Y Returns 6.87%

Aditya Birla Sun Life Low Duration Fund - Growth Plan

3Y Returns 6.86%

VS

Aditya Birla Sun Life Low Duration Fund - Growth Plan

3Y Returns 6.86%

VS

UTI Low Duration Fund - Regular Plan - Growth Option

3Y Returns 7.4%

UTI Low Duration Fund - Regular Plan - Growth Option

3Y Returns 7.4%

Aditya Birla Sun Life Dividend Yield Fund - Growth - Regular Plan

3Y Returns 19.8%

VS

Aditya Birla Sun Life Dividend Yield Fund - Growth - Regular Plan

3Y Returns 19.8%

VS

ICICI Prudential Dividend Yield Equity Fund Growth Option

3Y Returns 23.44%

ICICI Prudential Dividend Yield Equity Fund Growth Option

3Y Returns 23.44%

Aditya Birla Sun Life Banking and Financial Services Fund - Regular Plan - Growth

3Y Returns 18.99%

VS

Aditya Birla Sun Life Banking and Financial Services Fund - Regular Plan - Growth

3Y Returns 18.99%

VS

Sundaram Financial Services Opportunities Fund Regular Plan - Growth

3Y Returns 21.18%

Sundaram Financial Services Opportunities Fund Regular Plan - Growth

3Y Returns 21.18%

Investing Strategy

Aditya Birla uses Pro Investing, allowing investors to divide their money among three funds using a single form. Aditya Birla Sun Life Flexi Cap Fund, Aditya Birla Sun Life Frontline Equity Fund, and Aditya Birla Sun Life Balanced Advantage Fund are the three well-known mutual fund schemes from Aditya Birla Sun Life that are combined into Pro Investing. The goal is to minimize risks in negative market conditions while maximizing gains during favourable market periods.

Head of Equity and Debt Team (CIO)

Mr. Mahesh Patil (CIO)

Mr Mahesh Patil leads as the Chief Investment Officer (CIO) at Aditya Birla Sun Life AMC Limited. He joined the organization in October 2005 and has received prestigious awards, such as the India CIO of the Year, and Equity by Asia Asset Management in 2016 and 2018. He was also honoured with the Chairman’s Individual Award from The Aditya Birla group in 2015 for his accomplished leadership.

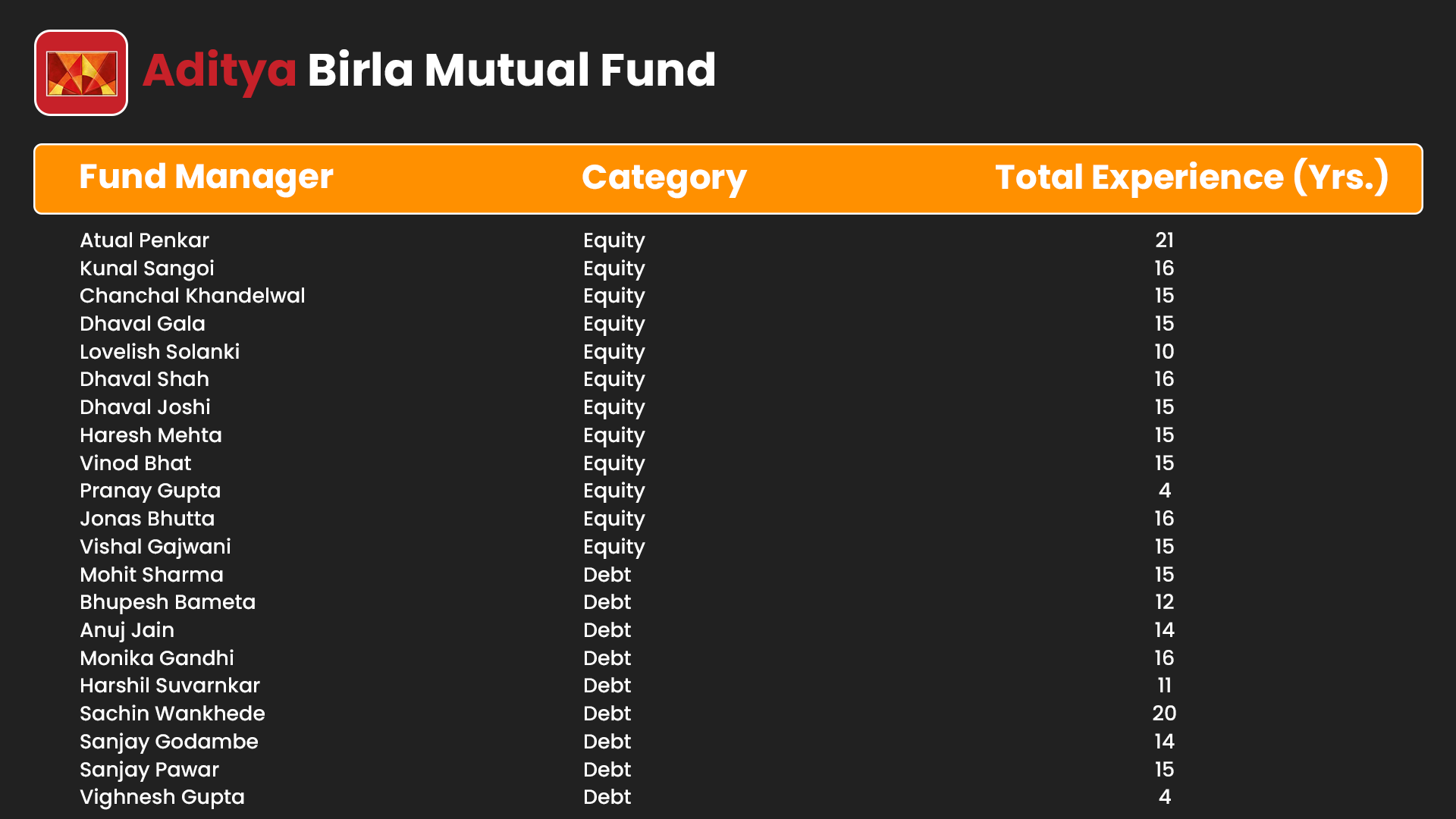

Key Fund Management Team

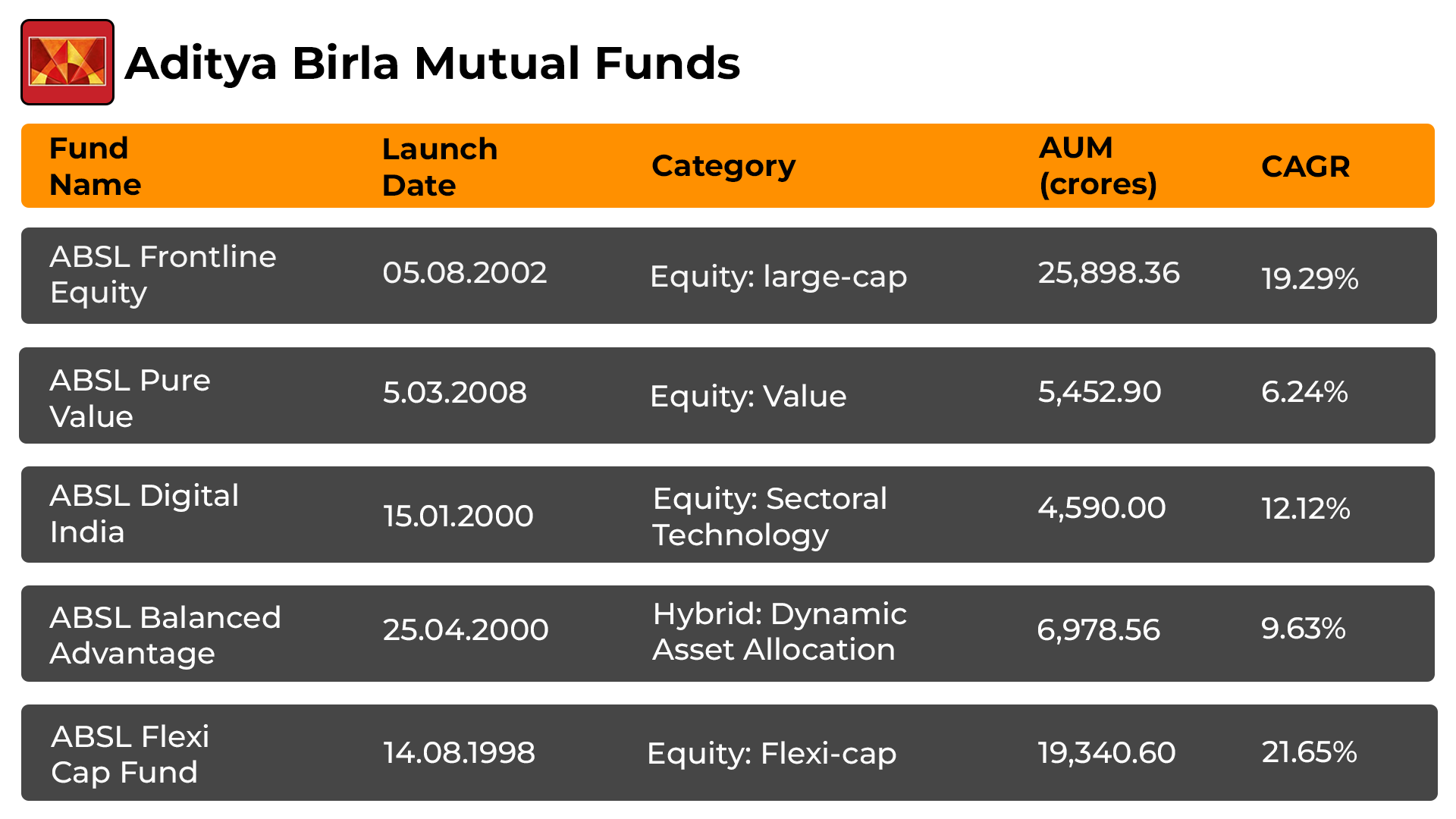

Top 5 Aditya Birla Mutual Fund Schemes

History of Aditya Birla Mutual Fund

The Aditya Birla Group is one of the biggest companies in India. The Aditya Birla Group and Sun Life Financial Services Inc. of Canada Birla is a partnership between Sun Life Asset Management Company Ltd. (BSLAMC) and Birla Sun Life Mutual Fund. Established in 1994, Birla Sun Life Mutual Fund has become a significant player in India's Mutual Funds sector, managing a wide range of assets for a distributed investor base. Aditya Birla adopts a different investing approach that sets it apart from other traditional investments.

- This AMC has a wide range of varieties of fund schemes.

- Aditya Birla Mutual Fund believes in following strong work ethics.

- Aditya Birla’s funds are top-performing in their respective categories.

How to Select Aditya Birla Mutual Fund?

This process requires careful analysis of various factors that determine the outcomes. It is important to be mindful of the following factors:

- Goal selection: Make sure your investment objective is attainable. Identify them and plan accordingly.

- Risk tolerance: The higher risk gives better the outcome, but determine how much risk you are willing to take.

- Diversification: It allows you to spread your investments across multiple sectors.

- Educate yourself: Learn and study thoroughly before investing in a specific fund.

- Monitor: Keep track of your investments regularly and make any necessary adjustments.

- Seek advice: It's best to seek the advice of a specialist because mutual funds are linked to market fluctuations.

To summarize, Online SIP allows you to easily invest in mutual fund schemes.

How to Invest in Aditya Birla Mutual Fund via MySIPonline?

Investing in the Best Aditya Birla Mutual Fund through mysiponline is simple. Here's a simple guide:

- Head to mysiponline.com and choose from Aditya Birla's top mutual funds that align with investment goals.

- Create a free account, fill in your profile details, and add your selected fund.

- Complete your profile, including the online and paperless Know Your Customer (KYC) process.

- Essential documents for your profile include PAN, Aadhar card, Signature, and Bank proof.

- Explore the available mutual funds and add the ones you want to your cart.

- Finalize your payment and patiently wait for the confirmation of your investment.

- Keep an eye on your investments conveniently through your mysiponline.com account.

To summarize, you can utilize the SIP Calculator to examine your annual returns and seek professional help for better results.

What Is the Taxation on Aditya Birla Mutual Fund?

The taxation of Aditya Birla mutual funds depends on which category they fall under equity or debt.

Equity-Oriented Mutual Funds

-

Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

-

Long-term Capital Gains (LTCG): Gains exceeding Rs. 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

-

Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

-

Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Can I invest for a very short-term duration in Aditya Birla Sunlife Mutual Fund?

What are the different Aditya Birla Sun Life mutual funds available?

What is the advantage of investing in amc Funds?

Are all SIPs in Aditya Birla Sun Life Funds online tax-free?

How to analyse the performance of Aditya Birla Sunlife Mutual Fund?

Why do I need a financial adviser?

Explore Other AMC’s

Top Blogs of Aditya Birla Sunlife Mutual Fund

Blogs

You can select three funds for compare.

You can select three funds for compare.