SIP Investment

PlatformFind the best systematic investment plan for wealth creation, offering the Best SIP Funds by mutual fund analyst.

Start Your Wealth Journey with Just ₹1000/Months

Discover the Best Investment Secrets- Top 5 Fund for 18% p.a. for 2030. See Funds Now

-

Deep Research by Experts

-

Tailored to Your Needs

-

Quality Fund Manager & strong portfolios

-

Carefully Shortlisted

What is SIP?

A SIP or Systematic Investment Plan is a systematic way to invest a fixed amount regularly in mutual funds. SIPs allow you to invest monthly, quarterly, or yearly, starting as low as ₹100. SIP helps you stay disciplined in your investments, making it easier to reach your financial goals over time by investing smaller amounts instead of one large sum. It’s a simple and convenient way to grow your money steadily.

SIP Return Calculator

A SIP calculator is a simple tool that allows individuals to get an idea of the

returns on their mutual fund investments made through

SIP.

SIP investments in mutual funds have become one of the most popular investment options for

millennials lately.

*Your expected future value could lie between the outcome range being minimum or maximum value.

Best SIP Plans in 2026

Here are some of the best SIP Plans of 2026 curated & customized just for your needs.-

Up to 15% Returns p.a.

-

Tenure of 5 Years

-

Medium

-

Up to 16% Returns p.a.

-

Tenure of 5 Years

-

Medium

-

Up to 16% Returns p.a.

-

Tenure of 5 Years

-

Medium

-

Up to 16% Returns p.a.

-

Tenure of 5 Years

-

Medium

What are Benefits of SIP Investment ?

Best Compounding of Savings

Invest for a long period to get better-compounded returns over time, i.e., the returns earned get reinvested, thus helping in earning better.

Rupee - Cost Averaging

Under this type of investment, more units are purchased when the price is low and less when it is high. Thus, the overall cost is managed well, which is comparatively low.

No Market Timing Required

It doesn’t matter how the market conditions are; you don’t have to wait for the right time. Investment in an SIP will yield returns that are shielded against volatility.

Disciplined Investment

SIP investment helps an individual develop a savings habit and facilitates disciplined investing, i.e., on a regular, timely basis, which is favorable to wealth creation.

How to Start Online SIP with MySIPOnline?

-

Step 1 Enter PAN and Check KYC

-

Step 2 Activate Auto-SIP Setup

-

Step 3 Select Best Funds

-

Step 4 Add Funds in Cart

-

Step 5 1st Manual Payment (UPI)

-

Step 6 Track Auto SIP Deduction

Benefits of SIP or Systematic Investment Plan

A systematic investment plan gives you multiple benefits over other modes of investment such as:

-

Power of Compounding

Compounding makes your money grow faster over time. The returns you earn on your investment start generating their returns, creating a snowball effect. For example, if you invest ₹1,000 every month at an average return of 10% in 20 years, your total amount grows to ₹7,18,259. It’s the key to turning small, consistent investments into a large corpus.

-

Rupee Cost Averaging

The amount invested gives your mutual fund units at their current market price or NAV (Net Asset Value). So when you invest via SIPs, it buys units each time during market is high or low. Due to this overall investment is averaged avoiding any loss on investment. This strategy benefits you to make high returns in the long term.

-

Irrelevant to Market Timing

By investing via a SIP route, you do not have to worry about market volatility. SIPs are managed by experienced fund managers who actively monitor the market and adjust portfolios toward maximum profits.

-

Makes you a Disciplined Investor

discipline in investing is the key principle and SIPs keep you disciplined and develop a habit of saving regularly. You can also opt automatic payment option for a hassle-free investment experience.

-

Opportunity for Everyone

Any investor can invest in mutual funds and build steady wealth with SIP starting at just Rs.100, making it affordable and easy on your wallet. It is among the most affordable investments compared to any other option.

Types of SIPs

The different types of SIPs or systematic investment plans are as follows:

-

Regular SIP

This is the most basic type of SIP where you invest a fixed amount regularly for a specific period. You can choose to invest monthly, quarterly, or even half-yearly. It’s simple just stay disciplined, and over time, small amounts can grow into a significant sum.

-

Top-up SIP

These are also called step-up SIPs, which let you increase your SIP amount periodically, like every year. For example, you start a SIP of Rs.5,000 per month and increase it by 10% annually, the next year you’ll invest Rs.5,500. It’s perfect for matching your investments with your income growth.

-

Flexible SIP

A flexible SIP lets you adjust your investment amount or frequency. You can increase or decrease the amount depending on the market or your financial situation. For example, you increase your investment during a market fall and decrease your investment when the market rises.

-

Trigger SIP

This SIP occurs during specific market events. For example, when the NAV (Net Asset Value) declines or rises. To take advantage, you must have a reasonable market understanding. This type of SIP is best suited for experienced investors.

-

Perpetual SIP

A perpetual SIP works like a regular SIP but without an end date. You keep investing until you decide to stop. It’s great for long-term wealth creation because you benefit from compounding over an extended period.

-

Multi SIP

This allows you to invest in multiple mutual fund schemes through a single SIP. For example, if you invest ₹5,000 in a multi-SIP, it can be split among different funds, like ₹1,250 in four schemes. It’s convenient and diversifies your investments.

-

SIP with Insurance

This combines mutual fund investments with life insurance. Along with growing your money, you get an insurance cover. If something happens to you during the investment period, your nominee will receive a lump sum payout.

How SIP or Systematic Investment Plan Works?

SIPs are a powerful tool and a continuous process to earn stable returns in the long term, but you should know how your invested amount would make beneficial returns for you. Let's learn how it works:

-

You start by paying a fixed SIP amount every month on the day that you choose.

-

Every instalment earns you units of the mutual fund scheme, which are worth your investment.

-

These units are given based on NAV (Net Asset Value), which is the per-unit price of your mutual fund scheme.

-

The number of units received by every investor is directly dependent on the NAV.

-

If NAV is high, the investor gets fewer units similarly; when net asset value is low, it will buy you more units.

-

Thus, a systematic investment plan gives you the dual benefits of a bullish and bearish market while balancing the risk of your portfolio.

You can try a simple tool called SIP Calculator to get estimated returns.

Frequently Asked Questions

| Fund Name | Launch Date | AUM (Cr) | Date |

|---|---|---|---|

| ICICI Prudential Large & Mid Cap Fund | 09.07.1998 | 17,672 | 29-11-2024 |

| Nippon India Multi Cap Fund | 25.03.2005 | 35,270 | 29-11-2024 |

| Nippon India Large Cap Fund | 08.08.2007 | 39,001 | 30-11-2024 |

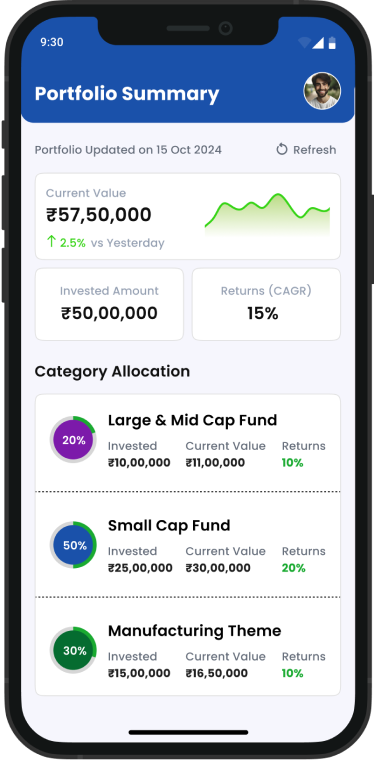

Why Choose Us?

ARN No.106881

SSL Protection

Secured Payment

Real Time Tracking

Real Time Tracking

Real Time Tracking

-

Check performance instantly.

-

Live updates at all times.

-

Easy access via app or website.

-

Track investments anytime, anywhere.

Zero Fee

Zero Fee

Zero Fee

- Free account opening & sign-up.

- Free expert recommendations on investments.

- No hidden charges on investments.

- Free-for-life transactions and maintenance.

Expert Guidance

Expert Guidance

Expert Guidance

- Recommendations by MF analyst.

- Quality selection of schemes

- 24/7 chat and call assistance available.

User Friendly

User Friendly

User Friendly

- India’s most convenient and user-oriented platform.

- Track your progress with an up-to-date dashboard.

- Streamlined investments via website and mobile app.

- Regular market & trigger updates.

-

SIP Calculator Calculate Now

-

Retirement Calculator Calculate Now

-

Child’s Future Calculator Calculate Now

-

Tax Calculator Calculate Now

Related Blogs & Videos

Blogs

Videos

Happy Customers are our true wealth

- 10+ Years In Business

- 1,50,000+ People Invested

- 5 Billion+ Assets Under Management

- 4.3 Star Users Rating

1 Lac Users Opted for this Service

36

36  2 Min. Read

2 Min. Read