Mirae Asset Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 49

- Average annual returns 8.93%

About Mirae Asset Mutual Fund

Mirae Asset Mutual Fund is a part of the Mirae Asset Foundation which was established on 30th November 2007. Mirae Asset Management Company (AMC) was founded by Hyeon-Joo Park. He is renowned for his expertise in the financial market. This AMC offers 54 fund schemes across various categories – 32 equity, 15 Debt, and 5 hybrids. It has become the best-performing company in the financial markets of India. This fund house is committed to providing investors with high returns.

Currently, the AMC holds the 9th position among top Asset Management Companies. Mirae Asset Healthcare Fund, the flagship scheme, has exhibited an impressive average annualized return of 21.89% since its inception.

More-

Launched in

30-Dec-2007

-

AMC Age

18 Years

-

Website

https://www.miraeassetmf.co.in -

Email Address

customercare@miraeasset.com

Top Performing Mirae Asset Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 283.84 | 1 years | -6.01% | 6.82% | 19.57% | 45.28% | 8.05% | 71.96% | - | - | - | - | Invest | |

| 58.77 | 3 years | -3.71% | 6.81% | 9.22% | 46.39% | 8.8% | 48.14% | 28.07% | 11.05% | - | - | Invest | |

| 349.18 | 3 years | -0.23% | 3.52% | 1.88% | 26.21% | 4.91% | 36.55% | 33.95% | 33.83% | - | - | Invest | |

| 90.45 | 4 years | -4.9% | 0.78% | -7.32% | 12.25% | 1.2% | 29.59% | 42.12% | 15.08% | - | - | Invest | |

| 2282.44 | 4 years | 2% | -0.96% | -7.16% | 5.86% | -1.94% | 22.64% | 45.65% | 53.6% | - | - | Invest | |

| 2215.61 | 5 years | 0.27% | -2.87% | 1.42% | 5.95% | -2.03% | 21.25% | 14.74% | 18.48% | 14.19% | - | Invest | |

| 2016 years | -0.06% | 3.33% | 9.68% | 18.26% | - | 19.27% | 13.78% | 7.12% | 10.38% | - | Invest | ||

| 2815.11 | 2 years | -0.72% | -1.27% | 3.29% | 9.42% | -0.6% | 17.75% | 14.55% | - | - | - | Invest | |

| 18409.26 | 6 years | 0.92% | -5.94% | -4.45% | 2.17% | -5.38% | 11.7% | 9.36% | 20.01% | 18.83% | - | Invest | |

| 114.94 | 4 years | 0.88% | -4.36% | -2.29% | 6.22% | -3.58% | 11.69% | 14.08% | 21.38% | - | - | Invest | |

| 43766.03 | 15 years | 1.11% | -4.94% | -3.32% | 2.96% | -4.39% | 10.24% | 8.75% | 17.04% | 14.89% | 17.8% | Invest | |

| 27195.94 | 10 years | 1.04% | -4.58% | -3.28% | 2.1% | -4.03% | 10.03% | 10.29% | 17.05% | 14.86% | 17.91% | Invest | |

| 4593.75 | 2 years | 1.41% | -4.84% | -4.1% | 1.09% | -4.18% | 10.01% | 8.69% | - | - | - | Invest | |

| 9537.61 | 10 years | 0.6% | -3.29% | -1.16% | 2.6% | -2.65% | 9.41% | 9.58% | 13.85% | 11.92% | 13.18% | Invest | |

| 3541.83 | 2 years | 0.35% | -4.57% | -2.3% | 2.56% | -3.91% | 8.93% | 9.83% | - | - | - | Invest | |

| 1865.39 | 7 years | 0.4% | -1.54% | -0.11% | 2.56% | -1.21% | 8.27% | 8.74% | 11.22% | 9.83% | - | Invest | |

| 94.86 | 5 years | 0.06% | -4.93% | -2.34% | 1.58% | -4.07% | 8.08% | 8.02% | 13.08% | 10.86% | - | Invest | |

| 41802.47 | 17 years | 0.36% | -4.93% | -2.76% | 1.38% | -4.35% | 7.93% | 8.98% | 12.93% | 11.61% | 14.18% | Invest | |

| 989.68 | 5 years | 0.39% | -4.98% | -2.99% | 1.87% | -4.13% | 7.38% | 8.44% | 15.9% | 14.03% | - | Invest | |

| 71.35 | 2 years | 0.21% | 0.08% | 1.11% | 2.04% | 0.16% | 7.33% | 7.68% | - | - | - | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Feb-2026 | Jan-2026 | Dec-2025 | Nov-2025 | Oct-2025 | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 |

|---|

| Fund Name | 2026-Q1 | 2025-Q4 | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 |

|---|

| Fund Name | 2026 | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 283.84 | Very High |

10.76%

|

57.74%

|

-

|

-

|

-

|

-

|

57.34%

|

Invest | |

| 58.77 | Average |

5.74%

|

56.46%

|

32.88%

|

21.61%

|

-

|

-

|

19.16%

|

Invest | |

| 349.18 | Very High |

4.48%

|

44.66%

|

36.08%

|

34.64%

|

-

|

-

|

35.22%

|

Invest | |

| 90.45 | Very High |

-4.52%

|

7.7%

|

33.67%

|

29.15%

|

-

|

-

|

22.12%

|

Invest | |

| 2282.44 | Very High |

-1.12%

|

27.56%

|

38.75%

|

46.8%

|

-

|

-

|

41.02%

|

Invest | |

| 2215.61 | Very High |

4.13%

|

18.89%

|

15.17%

|

16.63%

|

16.17%

|

-

|

16.14%

|

Invest | |

| Average |

-

|

-

|

-

|

-

|

-

|

2.19%

|

2.96%

|

Invest | ||

| 2815.11 | Very High |

4.22%

|

19.33%

|

15.1%

|

-

|

-

|

-

|

15.1%

|

Invest | |

| 18409.26 | Very High |

2.25%

|

19.92%

|

11.01%

|

16.4%

|

17.49%

|

-

|

21.46%

|

Invest | |

| 114.94 | Very High |

2.42%

|

18.14%

|

9.78%

|

17.35%

|

-

|

-

|

18.78%

|

Invest | |

| 43766.03 | Very High |

2.55%

|

16.42%

|

9.34%

|

13.95%

|

14.34%

|

16.94%

|

19.56%

|

Invest | |

| 27195.94 | Very High |

2.18%

|

14.52%

|

9.64%

|

14.23%

|

14.57%

|

16.87%

|

16.92%

|

Invest | |

| 4593.75 | Very High |

1.43%

|

14.05%

|

9.15%

|

-

|

-

|

-

|

11.47%

|

Invest | |

| 9537.61 | Very High |

2.39%

|

12.4%

|

8.86%

|

11.95%

|

12.08%

|

12.91%

|

12.89%

|

Invest | |

| 3541.83 | Very High |

2.57%

|

15.63%

|

9.96%

|

-

|

-

|

-

|

13.87%

|

Invest | |

| 1865.39 | Moderately High |

1.6%

|

8.84%

|

8.03%

|

9.89%

|

9.92%

|

-

|

10.85%

|

Invest | |

| 94.86 | Very High |

2.42%

|

12.25%

|

8.25%

|

12.08%

|

11.67%

|

-

|

11.78%

|

Invest | |

| 41802.47 | Very High |

2.23%

|

12.85%

|

9.01%

|

12.01%

|

11.97%

|

13.43%

|

15.19%

|

Invest | |

| 989.68 | Average |

2.31%

|

12.92%

|

7.77%

|

12.75%

|

13.84%

|

-

|

14.52%

|

Invest | |

| 71.35 | Low to Moderate |

1.16%

|

5.14%

|

6.92%

|

-

|

-

|

-

|

7.31%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Average |

7.28%

|

-

|

-

|

-

|

Invest | |

| Very High |

19.58%

|

-

|

-

|

-

|

Invest | |

| Very High |

44.16%

|

-

|

-

|

-

|

Invest | |

| Very High |

27.06%

|

-

|

-

|

-

|

Invest | |

| Very High |

14.7%

|

2.38%

|

0.99%

|

0.86%

|

Invest | |

| Average |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

13.73%

|

-

|

0.98%

|

0.91%

|

Invest | |

| Very High |

16.2%

|

-

|

-

|

-

|

Invest | |

| Very High |

12.08%

|

-

|

0.98%

|

0.87%

|

Invest | |

| Very High |

11.83%

|

1.21%

|

0.95%

|

0.93%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

8.94%

|

0.87%

|

1.16%

|

0.84%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Moderately High |

5.04%

|

0.41%

|

1.19%

|

0.97%

|

Invest | |

| Very High |

12.41%

|

-

|

-

|

-

|

Invest | |

| Very High |

11.18%

|

-

|

0.89%

|

0.71%

|

Invest | |

| Average |

12.57%

|

-

|

-

|

-

|

Invest | |

| Low to Moderate |

-

|

-

|

-

|

-

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹99

|

₹5000

|

0.69%

|

Ritesh Patel

|

28-Oct 2024

|

Invest | |

|

₹99

|

₹5000

|

0.54%

|

Siddharth Srivastava

|

07-Sep 2022

|

Invest | |

|

₹99

|

₹5000

|

0.4%

|

Siddharth Srivastava

|

07-Sep 2022

|

Invest | |

|

₹99

|

₹5000

|

0.53%

|

Ekta Gala

|

08-Dec 2021

|

Invest | |

|

₹99

|

₹5000

|

0.45%

|

Ekta Gala

|

10-May 2021

|

Invest | |

|

₹99

|

₹5000

|

2.06%

|

Gaurav Kochar

|

11-Dec 2020

|

Invest | |

|

₹1000

|

₹5000

|

%

|

Bharti Sawant (3.1)

|

20-Sep 0009

|

Invest | |

|

₹99

|

₹5000

|

2.01%

|

Ritesh Patel

|

31-Jan 2024

|

Invest | |

|

₹99

|

₹5000

|

1.67%

|

Ankit Jain

|

29-Jul 2019

|

Invest | |

|

₹99

|

₹5000

|

0.46%

|

Ekta Gala

|

27-Jan 2022

|

Invest | |

|

₹99

|

₹5000

|

1.54%

|

Neelesh Surana

|

09-Jul 2010

|

Invest | |

|

₹500

|

₹500

|

1.56%

|

Neelesh Surana

|

28-Dec 2015

|

Invest | |

|

₹99

|

₹5000

|

1.89%

|

Ankit Jain

|

21-Aug 2023

|

Invest | |

|

₹99

|

₹5000

|

1.73%

|

Mahendra Kumar Jajoo

|

29-Jul 2015

|

Invest | |

|

₹99

|

₹5000

|

1.96%

|

Varun Goel

|

27-Feb 2023

|

Invest | |

|

₹99

|

₹5000

|

1.32%

|

Mahendra Kumar Jajoo

|

17-Dec 2018

|

Invest | |

|

₹99

|

₹5000

|

0.42%

|

Ekta Gala

|

18-Nov 2020

|

Invest | |

|

₹99

|

₹5000

|

1.53%

|

Gaurav Misra

|

04-Apr 2008

|

Invest | |

|

₹99

|

₹5000

|

0.12%

|

Bharti Sawant

|

21-Sep 2020

|

Invest | |

|

₹1000

|

₹5000

|

0.48%

|

Mahendra Kumar Jajoo

|

29-Mar 2023

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

18.898

(03-02-2026)

|

18.102

(02-02-2026)

|

4.4%

|

22.118

|

10.873

|

Invest | |

|

14.740

(03-02-2026)

|

14.848

(02-02-2026)

|

-0.73%

|

15.465

|

7.858

|

Invest | |

|

26.993

(03-02-2026)

|

28.067

(02-02-2026)

|

-3.83%

|

28.741

|

15.867

|

Invest | |

|

12.953

(03-02-2026)

|

13.122

(02-02-2026)

|

-1.29%

|

17.391

|

9.558

|

Invest | |

|

34.647

(03-02-2026)

|

34.647

(02-02-2026)

|

0%

|

37.321

|

21.895

|

Invest | |

|

22.096

(03-02-2026)

|

21.579

(02-02-2026)

|

2.4%

|

22.217

|

17.124

|

Invest | |

|

17.296

(2017-09-14)

|

17.296

(2017-09-14)

|

0%

|

-

|

-

|

Invest | |

|

13.463

(03-02-2026)

|

13.164

(02-02-2026)

|

2.27%

|

13.707

|

10.794

|

Invest | |

|

37.046

(03-02-2026)

|

36.208

(02-02-2026)

|

2.31%

|

38.494

|

29.046

|

Invest | |

|

19.272

(03-02-2026)

|

18.691

(02-02-2026)

|

3.11%

|

19.646

|

15.225

|

Invest | |

|

154.670

(03-02-2026)

|

151.130

(02-02-2026)

|

2.34%

|

158.985

|

125.82

|

Invest | |

|

50.208

(03-02-2026)

|

49.064

(02-02-2026)

|

2.33%

|

51.417

|

41.512

|

Invest | |

|

14.503

(03-02-2026)

|

14.160

(02-02-2026)

|

2.42%

|

14.892

|

11.816

|

Invest | |

|

33.340

(03-02-2026)

|

32.686

(02-02-2026)

|

2%

|

33.799

|

28.196

|

Invest | |

|

16.275

(03-02-2026)

|

15.865

(02-02-2026)

|

2.58%

|

16.624

|

13.352

|

Invest | |

|

20.933

(03-02-2026)

|

20.691

(02-02-2026)

|

1.17%

|

21.015

|

18.516

|

Invest | |

|

19.084

(03-02-2026)

|

18.585

(02-02-2026)

|

2.68%

|

19.548

|

16.207

|

Invest | |

|

115.452

(03-02-2026)

|

112.714

(02-02-2026)

|

2.43%

|

118.556

|

98.144

|

Invest | |

|

25.554

(03-02-2026)

|

24.886

(02-02-2026)

|

2.68%

|

26.189

|

21.492

|

Invest | |

|

12.3242

(03-02-2026)

|

12.3197

(02-02-2026)

|

0.04%

|

12.3242

|

11.4875

|

Invest |

Mirae Asset Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top Mirae Asset Mutual Fund

Mirae Asset Focused Fund Regular Plan Growth

3Y Returns 10.04%

VS

Mirae Asset Focused Fund Regular Plan Growth

3Y Returns 10.04%

VS

HDFC Focused Fund - GROWTH PLAN

3Y Returns 21.17%

HDFC Focused Fund - GROWTH PLAN

3Y Returns 21.17%

Mirae Asset Arbitrage Fund Regular Growth

3Y Returns 6.9%

VS

Mirae Asset Arbitrage Fund Regular Growth

3Y Returns 6.9%

VS

SBI Arbitrage Opportunities Fund - Regular Plan - Gr

3Y Returns 7.14%

SBI Arbitrage Opportunities Fund - Regular Plan - Gr

3Y Returns 7.14%

Mirae Asset Equity Savings Fund- Regular Plan- Growth

3Y Returns 11.22%

VS

Mirae Asset Equity Savings Fund- Regular Plan- Growth

3Y Returns 11.22%

VS

Sundaram Equity Savings Fund (Formerly Known as Principal Equity Savings Fund) - Direct Plan - Growth Option

3Y Returns %

Sundaram Equity Savings Fund (Formerly Known as Principal Equity Savings Fund) - Direct Plan - Growth Option

3Y Returns %

Mirae Asset Diversified Equity Allocator Passive FOF - Regular Growth

3Y Returns 15.9%

VS

Mirae Asset Diversified Equity Allocator Passive FOF - Regular Growth

3Y Returns 15.9%

VS

HSBC Aggressive Hybrid Active FOF - Growth

3Y Returns 14.04%

HSBC Aggressive Hybrid Active FOF - Growth

3Y Returns 14.04%

Investment Strategy

The AMC investing strategy revolves around assisting clients in achieving their long-term objectives. This involves a commitment to meticulous research, strategic asset allocation, and a focus on delivering consistent, competitive returns. Mirae Asset Global Investments to navigate global financial markets effectively, leveraging its expertise to create value for investors and contribute to their financial success over the long term.

Head of Equity & Debt Team (CIO)

Mr. Neelesh Surana (CIO of equity)

Mr Surana is the Chief Investment Officer (CIO) at Mirae Asset Investment Managers (India) Private Limited, he plays a pivotal role in driving the firm's investment strategies and managing the overall portfolio. Since joining Mirae Asset in 2008, his extensive experience and expertise have contributed significantly to the company's success.

Mr Mahendra Kumar Jajoo (CIO of debt)

Mr Jajoo has 30 years of experience and has given 15 years to managing Fixed Income funds. His extensive background positions him as a seasoned professional adept at navigating financial markets and optimizing fixed-income portfolios.

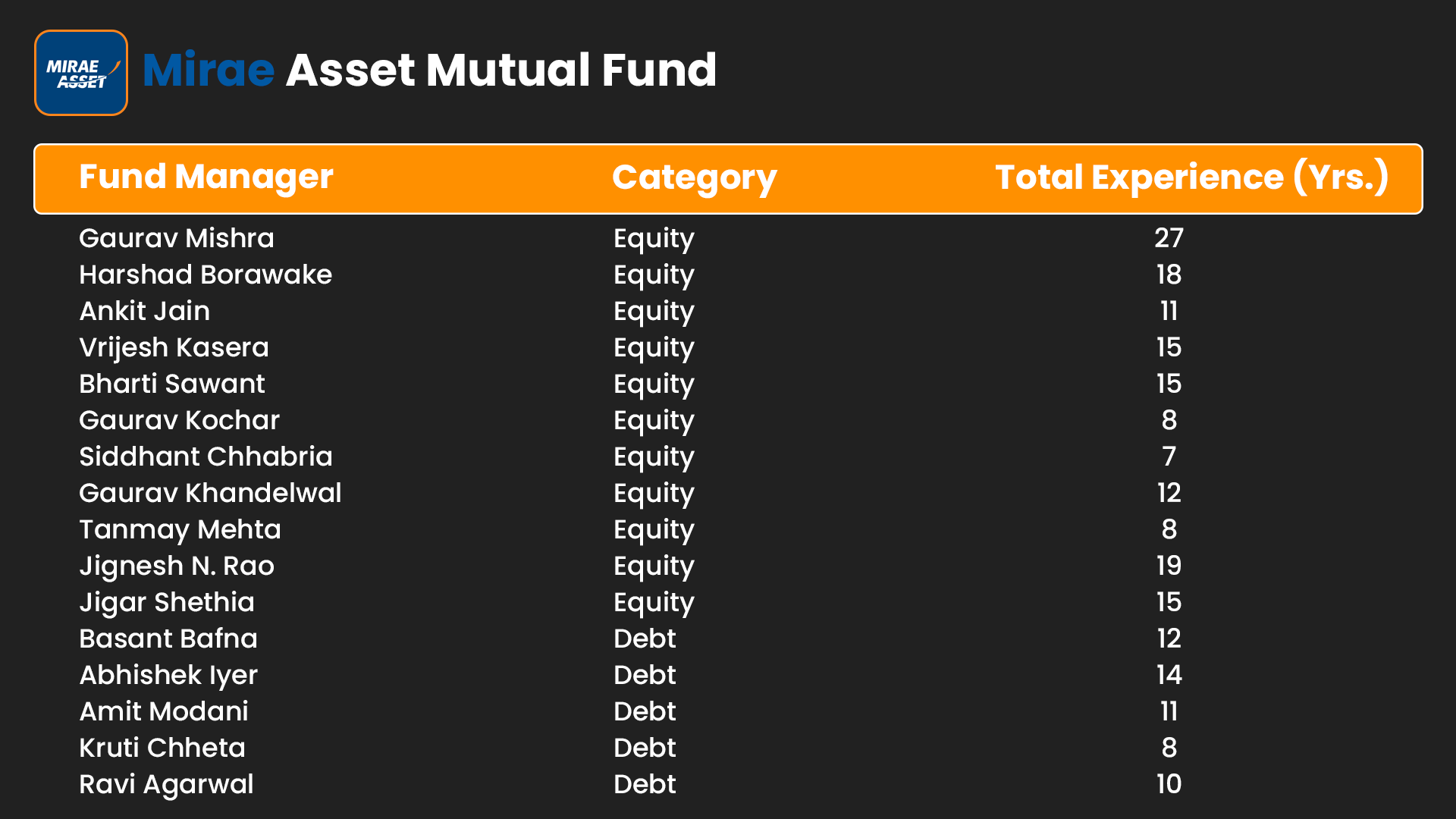

Key Fund Management Team

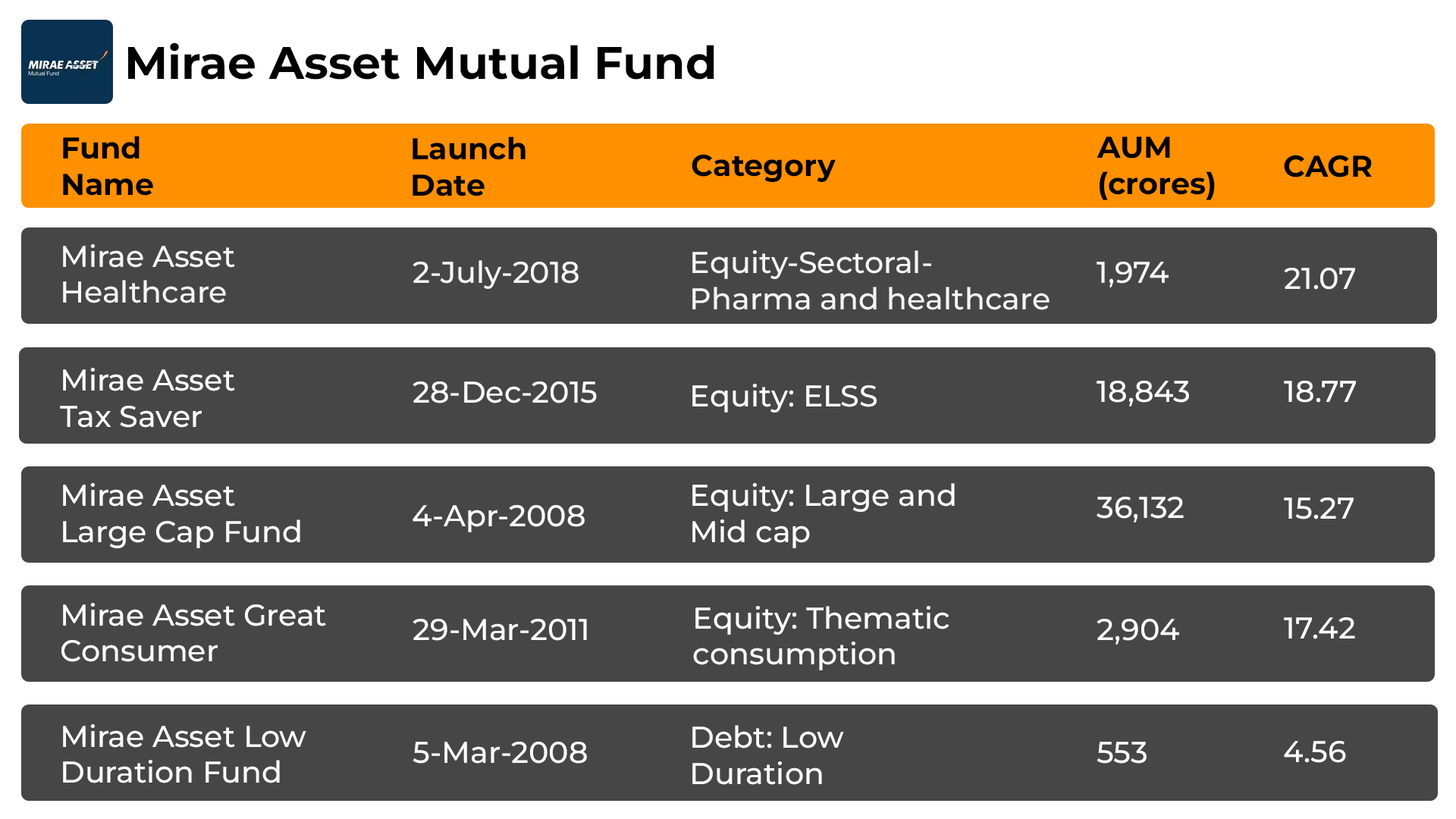

Top 5 Mirae Asset Mutual Funds

History of Mirae Asset Mutual Fund

Mirae Asset Global Investments Co., Ltd. a well-known in 1998 for launching the first Mutual Fund in Korea. Despite being established in 1997 during the challenges of the Asian financial crisis, their commitment and leading approach to consistent and steady returns, positioned Mirae Asset company as a leader in Korea's indirect investment market.

- It adopts a unique investing approach which sets it apart.

- This AMC has a wide range of varieties of fund schemes.

- Mirae Asset Mutual Fund believes in following strong work ethics.

- Mirae Asset’s funds are top-performing in their respective categories.

How to Select the Best Mirae Asset Mutual Fund?

The selection of the Best Mirae Asset Mutual Fund is of utmost importance. To make sure you choose the correct fit for investment here is a guide:

- Ensure your investment has a specific and achievable purpose. Identify your goals and plan accordingly.

- Understand that higher risk can lead to better results, it's crucial to determine risk tolerance.

- Divide your assets across various sectors to minimize risk and maximize potential returns.

- Before investing in a specific fund, thoroughly learn and study. Understand its patterns and working style.

- Keep a close eye on investments. Regularly monitor their performance and make adjustments as needed.

- Consider getting assistance from a professional, since mutual funds are influenced by market changes.

- Expert guidance can be valuable in navigating these market changes and adapting accordingly.

To set realistic goals in mutual funds, you can use the SIP Calculator to see annual returns and get guidance to make better financial decisions.

How to Invest in Mirae Asset Fund Schemes via MySIPonline?

Mysiponline makes it easy to invest in Best Mirae Asset Mutual Fund. Here's a short, detailed how-to:

- Visit mysiponline.com and select funds that match investing objectives.

- Register for a free account, add the fund of choice and complete profile.

- Complete the profile after registering and fill in the KYC details.

- It only takes a few minutes to complete the online KYC procedures.

- PAN, Aadhar card, signature, and bank proof are required documents.

- Look through and put the mutual funds you want to buy in your cart.

- Make payment to complete the investment and wait for confirmation.

- Easily monitor your investments with your mysiponline.com account.

Investing in mutual funds through Online SIP is easy. Managing and keeping track of your Mirae Asset MF investments is made simple with mysiponline, which simplifies the process of investing.

What is the Taxation on Mirae Asset Mutual Fund?

The taxation of Mirae Asset Mutual Funds depends on which category they fall under equity or debt.

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding RS1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Can I invest for a very short-term duration in Mirae Asset Mutual Fund?

What are the different Mirae Asset mutual funds available?

What is the advantage of investing in amc Funds?

Are all SIPs in Mirae Asset Funds online tax-free?

How to analyse the performance of Mirae Asset Mutual Fund?

Why do I need a financial adviser?

Explore Other AMC’s

Top Videos and Blogs of Mirae Asset Mutual Fund

Videos

Blogs

You can select three funds for compare.

You can select three funds for compare.