Top Three Mutual Fund Schemes: The Good and the Bad Sides

During your school days, you must have learn one thing that ‘where there is a merit, there will be a demerit too.’ This is true in every aspects of our life. As every coin has two faces; mutual fund schemes also have some good sides and the bad ones. However, it completely depends on the investors that how they see the different schemes. But, not all schemes fit to the requirements of different investors.

Without wasting much of your time, let’s directly do the performance analysis of some of the top equity schemes to know their various aspects regarding investments.

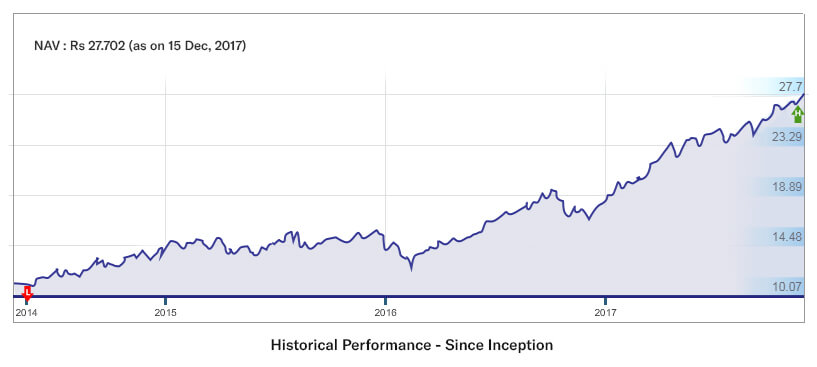

L&T Emerging Businesses Fund

At first, we’ll talk about L&T Emerging Businesses Fund growth plan. The scheme was launched in the year 2014 and has managed to provide 32.74% since then. Being a small-cap category scheme, it moves quite aggressively to attain high capital appreciation. The performance of the scheme in the last one year was excellent as it tends to generate massive returns for the investors. So, let’s know the various aspects of this scheme:

- The Good : The appreciable part of this scheme is its performance due to which it is also holding the 1st rank by CRISIL for the quarter ended September 2017. Moreover, as it is a small-cap scheme of aggressive nature, it can be a primary choice of the investors who want to gain large profits in the significant period of time.

- The Bad : One cannot point out any issues with the star performers, but still, due to the different nature of people, their likes and dislikes also vary. When it comes to investing, they differ in many points and of which the major one is the risk appetite. This scheme does not suit to the investors who do not have heart to face volatility.

Moving forward to the performance analysis of the scheme:

It has performed amazingly well in all the years since its inception. The trailing returns of this scheme as shown below depicts a great picture of its potential to generating extreme growth in the long-term period. However, it does not have any long-term performance track record, all the three year of its starts are appreciable, in terms of growth, till now.

_5a41f44f9b2e6.png)

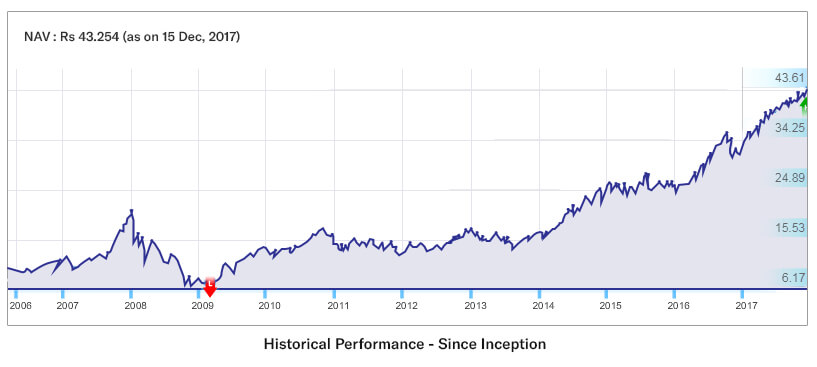

Sundaram Rural India Fund

In the queue, the next name is of Sundaram Rural India Fund (G). It is one of the star performers in the category of diversified equities. CRISIL has given 1st rank to this scheme for the quarter ended September 2017 for its excellent performance record. Being a diversified equity scheme, it tends to provide many benefits to the investors which help them in gaining stabilised returns.

- The Good: Investment in this scheme can be a healthy bet for the investors who are seeking stabilised growth in an adequate period of time. Being a multi-cap fund, it invests in a mix of equities of all sized companies, which helps reducing the risk of loss in case uncertainty arises in any particular equity category.

- The Bad: Although this scheme provides a well diversified and stable approach toward capital appreciation in the long-term period, it does not fit all types of investors. The reason behind this is that none of the investors are walking on a parallel way. More precisely, for investors who want to achieve fast growth and do not have patience, this scheme is not an option.

Moving forward to the performance analysis of the scheme:

Sundaram Rural India Fund has performed quite excellently in comparison to its benchmark, i.e., S&P BSE 500. If you see the trailing returns as on December 15, 2017 given in the table below, then you will be able to know how well it has outperformed its benchmark. Moreover, the historical performance of this fund shows that how it has managed to make significant moves in the different times, and provide healthy growth in the long run.

_5a41f499284c1.png)

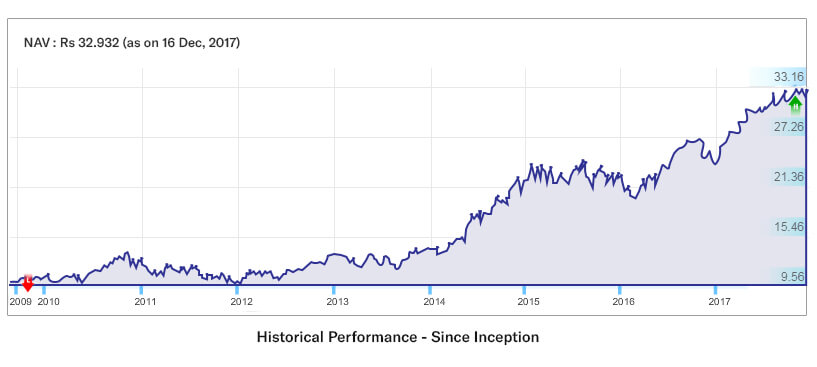

Kotak Select Focus Fund

Last but not least, Kotak Select Focus Fund is also one of the schemes which is in the limelight due to its appreciable performance in the past five years. It was launched in the year 2009, and since then has managed to provide a return of 15.51%. It is a scheme of large-cap category. Thus, it offers stability to the investors for their capital to grow in a long-term period.

- The Good : Being a Large Cap Fund, it can be a very good choice for the conservative equity investors. Those who wish to invest in the equities but do not have the heart to face the volatility can choose this scheme to invest in because it runs through a less risky way.

- The Bad : There is nothing bad about this scheme but again it may or may not suit all the investors. Moreover, in the initial stages, this scheme remained a consistent performer but if we compare its initial performance with that of in the recent four years, then it shows that the scheme was in the resting mode during its initial years.

Moving forward to the performance analysis of the scheme:

The trailing returns of the scheme as shown in the table below depict a clear picture of the potential of the scheme in generating excellent returns in the different time cycles. This scheme has beaten both its benchmark, i.e., Nifty 200, and category with a good margin. In the historical performance graph, you can clearly see that how excellently it has performed since the start of 2014.

_5a41f4d5068e0.png)

Henceforth, you must have understood whether you should invest in the scheme as mentioned above or not. If you find any of the schemes suitable to invest in, then sign in now to your account and grab the right opportunities at the right time.

If you are not a registered client at our website, then get it done today itself to reap the benefits of investing in mutual funds through our platform. We, at MySIPonline, are seeking to serve our clients at the best. We look forward to make the entire process an effortless one.