DSP Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 56

- Average annual returns 12.36%

About DSP Mutual Fund

DSP Mutual Fund is a private institution mutual fund company and a market leader in asset management in India. It offers a wide range of plans that prioritize the needs of its clients, making it a top Asset Management Company (AMC) with over 20 years of excellence. Led by Mr Hemendra Kothari, it receives support from DSP ADIKO Holdings Pvt. Ltd. and DSP HMK Holdings Pvt. Ltd. The group has a long-standing history of collaboration with Merrill Lynch and Dresdner Bank A.G. DSP MF offers 50 mutual fund schemes, including 35 equity funds, 6 hybrid funds, 19 debt funds, and 3 commodities. DSP Healthcare Fund, the flagship scheme, has exhibited an impressive average annualized return of 25.18% since its inception.

More-

Launched in

16-Dec-1996

-

AMC Age

29 Years

-

Website

https://www.dspim.com -

Email Address

service@dspim.com

Top Performing DSP Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1756.31 | 18 years | -15.97% | 5.4% | 39.97% | 75.78% | 8.24% | 134.74% | 94.27% | 49.2% | 26.12% | 19.74% | Invest | |

| 153.76 | 16 years | -10.9% | 9.4% | 38.91% | 65.73% | 13.6% | 89.13% | 44.37% | 19.46% | 19.59% | 20.65% | Invest | |

| 331.34 | 2 years | -14.44% | 11.89% | 26.56% | 50.58% | 14.25% | 75.85% | 53.11% | - | - | - | Invest | |

| 93.28 | 16 years | -1.52% | 6.29% | 13.18% | 29.08% | 8.91% | 48.27% | 23.76% | 13.58% | 12.33% | 9.35% | Invest | |

| 1572.72 | 17 years | -1.97% | 4.64% | 10.35% | 21.05% | 6.32% | 28.62% | 15.38% | 22.78% | 22.51% | 19.92% | Invest | |

| 1068.04 | 13 years | -4.61% | -0.44% | 4.1% | 15.31% | 0.35% | 25.76% | 23.56% | 21.1% | 16.67% | 16.93% | Invest | |

| 6440.17 | 2 years | -3.08% | 1.98% | 7.92% | 17.34% | 3.32% | 25.37% | 20.92% | - | - | - | Invest | |

| 1623.85 | 2 years | 0.01% | -1.3% | 2.92% | 9.82% | 0.08% | 20.74% | 19.26% | - | - | - | Invest | |

| 58.22 | 1 years | 0.16% | -0.05% | 3.62% | 8.25% | 0.5% | 19.22% | - | - | - | - | Invest | |

| 205.76 | 22 years | -1.21% | -1.14% | -0.53% | 0.54% | -1.2% | 18.73% | 13.13% | 13.98% | 10.8% | 7.65% | Invest | |

| 1184.26 | 3 years | -7.73% | -1.59% | -2.09% | 9.23% | -1.59% | 17.96% | 20.32% | 24.21% | - | - | Invest | |

| 14.30 | 1 years | -0.48% | -2.04% | 0.88% | 5.46% | -0.91% | 13.39% | - | - | - | - | Invest | |

| 2415.27 | 8 years | 1.3% | -1.41% | 1.5% | 7.07% | -0.58% | 12.38% | 10.27% | 18.31% | 16.21% | - | Invest | |

| 65.95 | 1 years | -1.48% | 0.12% | 2.37% | 5.06% | 0.03% | 10.01% | - | - | - | - | Invest | |

| 17576.35 | 25 years | 0.63% | -1.92% | 1.07% | 5.14% | -1.49% | 9.93% | 12.87% | 20.62% | 16.95% | 16.58% | Invest | |

| 17609.03 | 19 years | 0.76% | -1.97% | 1.12% | 4.79% | -1.48% | 9.83% | 13.21% | 20.15% | 17.4% | 16.95% | Invest | |

| 19585.60 | 19 years | 2.43% | -1.68% | -0.77% | 2.01% | -0.72% | 9.16% | 11.81% | 20.27% | 14.84% | 15.82% | Invest | |

| 5323.37 | 21 years | 2.74% | -0.99% | -1.12% | 1.91% | 0.39% | 9.12% | 11.36% | 25.19% | 24.55% | 17.8% | Invest | |

| 1175.58 | 1 years | 1.41% | -1.09% | -0.01% | 4.15% | -0.16% | 8.72% | - | - | - | - | Invest | |

| 3708.72 | 12 years | 0.61% | -0.66% | 0.62% | 3.11% | -0.48% | 8.33% | 9.96% | 12.48% | 8.92% | 9.48% | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Feb-2026 | Jan-2026 | Dec-2025 | Nov-2025 | Oct-2025 | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 |

|---|

| Fund Name | 2026-Q1 | 2025-Q4 | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 |

|---|

| Fund Name | 2026 | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 1756.31 | Average |

16.55%

|

129.46%

|

98.16%

|

71.27%

|

43.01%

|

23.37%

|

12.82%

|

Invest | |

| 153.76 | Average |

15.84%

|

92.92%

|

50.93%

|

34.36%

|

21.7%

|

18.22%

|

11.75%

|

Invest | |

| 331.34 | High |

10.65%

|

58.12%

|

49.66%

|

-

|

-

|

-

|

47.31%

|

Invest | |

| 93.28 | Very High |

7.16%

|

52.54%

|

28.86%

|

20.21%

|

13.87%

|

9.98%

|

6.87%

|

Invest | |

| 1572.72 | Very High |

6.68%

|

29.01%

|

13.68%

|

18.46%

|

18.44%

|

18.06%

|

16.18%

|

Invest | |

| 1068.04 | Average |

5.54%

|

41.18%

|

29.26%

|

26.15%

|

20.21%

|

17.76%

|

16.39%

|

Invest | |

| 6440.17 | Very High |

5.82%

|

26.74%

|

20.36%

|

-

|

-

|

-

|

20.5%

|

Invest | |

| 1623.85 | Very High |

4.31%

|

18.97%

|

17.85%

|

-

|

-

|

-

|

17.93%

|

Invest | |

| 58.22 | Very High |

4.09%

|

16.4%

|

-

|

-

|

-

|

-

|

13.38%

|

Invest | |

| 205.76 | Moderately High |

0.83%

|

6.23%

|

13.89%

|

14.47%

|

13.12%

|

9.27%

|

7.97%

|

Invest | |

| 1184.26 | Average |

3.93%

|

32.44%

|

25.74%

|

26.46%

|

-

|

-

|

25.92%

|

Invest | |

| 14.30 | Very High |

2.78%

|

15.41%

|

-

|

-

|

-

|

-

|

15.41%

|

Invest | |

| 2415.27 | Very High |

2.54%

|

15.01%

|

9.22%

|

13.89%

|

15.09%

|

-

|

16.25%

|

Invest | |

| 65.95 | Average |

1.69%

|

11.09%

|

-

|

-

|

-

|

-

|

10.35%

|

Invest | |

| 17576.35 | Average |

3.17%

|

13.76%

|

8.96%

|

15.88%

|

16.9%

|

16.59%

|

18.36%

|

Invest | |

| 17609.03 | Very High |

3.16%

|

13.11%

|

9.16%

|

15.86%

|

16.74%

|

17.1%

|

16.11%

|

Invest | |

| 19585.60 | Very High |

0.57%

|

11.74%

|

7.22%

|

13.93%

|

14.64%

|

15.11%

|

16.31%

|

Invest | |

| 5323.37 | Very High |

0.01%

|

8.1%

|

2.21%

|

13.83%

|

20.28%

|

19.28%

|

15.08%

|

Invest | |

| 1175.58 | High |

1.37%

|

10.58%

|

-

|

-

|

-

|

-

|

9.33%

|

Invest | |

| 3708.72 | Moderate |

1.63%

|

8.36%

|

8.06%

|

10.55%

|

10.17%

|

9.55%

|

9.3%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Average |

28.78%

|

-

|

-

|

-

|

Invest | |

| Average |

26.17%

|

-

|

-

|

-

|

Invest | |

| High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

21.65%

|

-

|

-

|

-

|

Invest | |

| Very High |

17.22%

|

4.36%

|

0.92%

|

0.94%

|

Invest | |

| Average |

13.78%

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Moderately High |

5.83%

|

-

|

-

|

-

|

Invest | |

| Average |

28.18%

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

13.13%

|

-

|

-

|

-

|

Invest | |

| Average |

-

|

-

|

-

|

-

|

Invest | |

| Average |

12.87%

|

1.73%

|

0.95%

|

1.06%

|

Invest | |

| Very High |

12.57%

|

3.12%

|

0.96%

|

1.05%

|

Invest | |

| Very High |

14.37%

|

-

|

0.97%

|

0.86%

|

Invest | |

| Very High |

14.5%

|

2.63%

|

0.92%

|

1%

|

Invest | |

| High |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

6.3%

|

2.41%

|

0.77%

|

1.14%

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹100

|

₹100

|

2.36%

|

Jay Kothari

|

14-Sep 2007

|

Invest | |

|

₹100

|

₹100

|

2.16%

|

Jay Kothari

|

29-Dec 2009

|

Invest | |

|

₹100

|

₹100

|

1%

|

Anil Ghelani

|

17-Nov 2023

|

Invest | |

|

₹100

|

₹100

|

2.11%

|

Jay Kothari

|

14-Aug 2009

|

Invest | |

|

₹100

|

₹100

|

2.11%

|

Rohit Singhania

|

25-Apr 2008

|

Invest | |

|

₹100

|

₹100

|

2.34%

|

Kedar Karnik

|

03-Aug 2012

|

Invest | |

|

₹100

|

₹100

|

1.64%

|

Jay Kothari

|

27-Sep 2023

|

Invest | |

|

₹100

|

₹100

|

2.19%

|

Jay Kothari

|

08-Dec 2023

|

Invest | |

|

₹100

|

₹100

|

0.85%

|

Anil Ghelani

|

31-May 2024

|

Invest | |

|

₹100

|

₹100

|

1.18%

|

Vivekanand Ramakrishnan

|

13-May 2003

|

Invest | |

|

₹100

|

₹100

|

2.04%

|

Kedar Karnik

|

14-Feb 2022

|

Invest | |

|

₹100

|

₹100

|

-

|

Anil Ghelani

|

24-Jan 2025

|

Invest | |

|

₹100

|

₹100

|

0.91%

|

Anil Ghelani

|

23-Oct 2017

|

Invest | |

|

₹100

|

₹100

|

0.26%

|

Jay Kothari

|

18-Mar 2024

|

Invest | |

|

₹100

|

₹100

|

1.7%

|

Rohit Singhania

|

16-May 2000

|

Invest | |

|

₹500

|

₹500

|

1.64%

|

Rohit Singhania

|

18-Jan 2007

|

Invest | |

|

₹100

|

₹100

|

1.68%

|

Vinit Sambre

|

14-Nov 2006

|

Invest | |

|

₹100

|

₹100

|

1.86%

|

Rohit Singhania

|

11-Jun 2004

|

Invest | |

|

₹100

|

₹100

|

2.21%

|

Charanjit Singh

|

17-Dec 2024

|

Invest | |

|

₹100

|

₹100

|

1.93%

|

Laukik Bagwe

|

06-Feb 2014

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

57.6652

(05-02-2026)

|

60.6771

(04-02-2026)

|

-4.96%

|

69.1145

|

23.2573

|

Invest | |

|

30.4972

(05-02-2026)

|

31.9337

(04-02-2026)

|

-4.5%

|

34.2284

|

14.0976

|

Invest | |

|

23.8288

(05-02-2026)

|

24.5673

(04-02-2026)

|

-3.01%

|

27.8514

|

13.4994

|

Invest | |

|

25.8605

(05-02-2026)

|

26.3922

(04-02-2026)

|

-2.01%

|

26.3922

|

14.345

|

Invest | |

|

106.734

(05-02-2026)

|

107.260

(04-02-2026)

|

-0.49%

|

108.882

|

76.963

|

Invest | |

|

77.1070

(05-02-2026)

|

78.2643

(04-02-2026)

|

-1.48%

|

80.8342

|

47.6019

|

Invest | |

|

16.0313

(05-02-2026)

|

16.2522

(04-02-2026)

|

-1.36%

|

16.5413

|

12.3027

|

Invest | |

|

14.265

(05-02-2026)

|

14.371

(04-02-2026)

|

-0.74%

|

14.51

|

11.336

|

Invest | |

|

12.1984

(05-02-2026)

|

12.2341

(04-02-2026)

|

-0.29%

|

12.2341

|

9.7184

|

Invest | |

|

50.219

(05-02-2026)

|

50.6464

(04-02-2026)

|

-0.84%

|

50.8852

|

42.2853

|

Invest | |

|

18.2841

(04-02-2026)

|

18.6911

(03-02-2026)

|

-2.18%

|

19.8153

|

12.5301

|

Invest | |

|

11.6046

(05-02-2026)

|

11.6737

(04-02-2026)

|

-0.59%

|

11.9245

|

9.3393

|

Invest | |

|

26.5676

(05-02-2026)

|

26.6366

(04-02-2026)

|

-0.26%

|

26.969

|

22.0193

|

Invest | |

|

11.9603

(05-02-2026)

|

11.9242

(04-02-2026)

|

0.3%

|

12.1397

|

10.6681

|

Invest | |

|

636.63

(05-02-2026)

|

639.428

(04-02-2026)

|

-0.44%

|

650.624

|

535.701

|

Invest | |

|

143.51

(05-02-2026)

|

144.229

(04-02-2026)

|

-0.5%

|

146.693

|

121.44

|

Invest | |

|

148.536

(05-02-2026)

|

149.353

(04-02-2026)

|

-0.55%

|

151.787

|

120.64

|

Invest | |

|

315.872

(05-02-2026)

|

318.763

(04-02-2026)

|

-0.91%

|

321.346

|

258.529

|

Invest | |

|

10.283

(05-02-2026)

|

10.356

(04-02-2026)

|

-0.7%

|

10.465

|

8.582

|

Invest | |

|

28.385

(05-02-2026)

|

28.442

(04-02-2026)

|

-0.2%

|

28.597

|

25.5

|

Invest |

DSP Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top DSP Mutual Fund

DSP Credit Risk Fund - Regular Plan -Growth

3Y Returns 13.98%

VS

DSP Credit Risk Fund - Regular Plan -Growth

3Y Returns 13.98%

VS

UTI Credit Risk Fund - Regular Plan - Growth Option

3Y Returns 7.19%

UTI Credit Risk Fund - Regular Plan - Growth Option

3Y Returns 7.19%

DSP Global Innovation Overseas Equity Omni FOF - Regular - Growth

3Y Returns 24.21%

VS

DSP Global Innovation Overseas Equity Omni FOF - Regular - Growth

3Y Returns 24.21%

VS

Kotak US Specific Equity Passive FOF - Regular Plan - Growth

3Y Returns 28.02%

Kotak US Specific Equity Passive FOF - Regular Plan - Growth

3Y Returns 28.02%

DSP Arbitrage Fund - Regular - Growth

3Y Returns 6.86%

VS

DSP Arbitrage Fund - Regular - Growth

3Y Returns 6.86%

VS

SBI Arbitrage Opportunities Fund - Regular Plan - Gr

3Y Returns 7.1%

SBI Arbitrage Opportunities Fund - Regular Plan - Gr

3Y Returns 7.1%

DSP Multi Asset Allocation Fund - Regular (G)

3Y Returns 0%

VS

DSP Multi Asset Allocation Fund - Regular (G)

3Y Returns 0%

VS

Quant Multi Asset Allocation Fund-Growth

3Y Returns 23.86%

Quant Multi Asset Allocation Fund-Growth

3Y Returns 23.86%

Investment Strategy

This Mutual Fund house targets undervalued stocks to build long-term wealth. It focuses on patient investing, aiming for capital appreciation as the market recognizes the true value of these stocks over time.

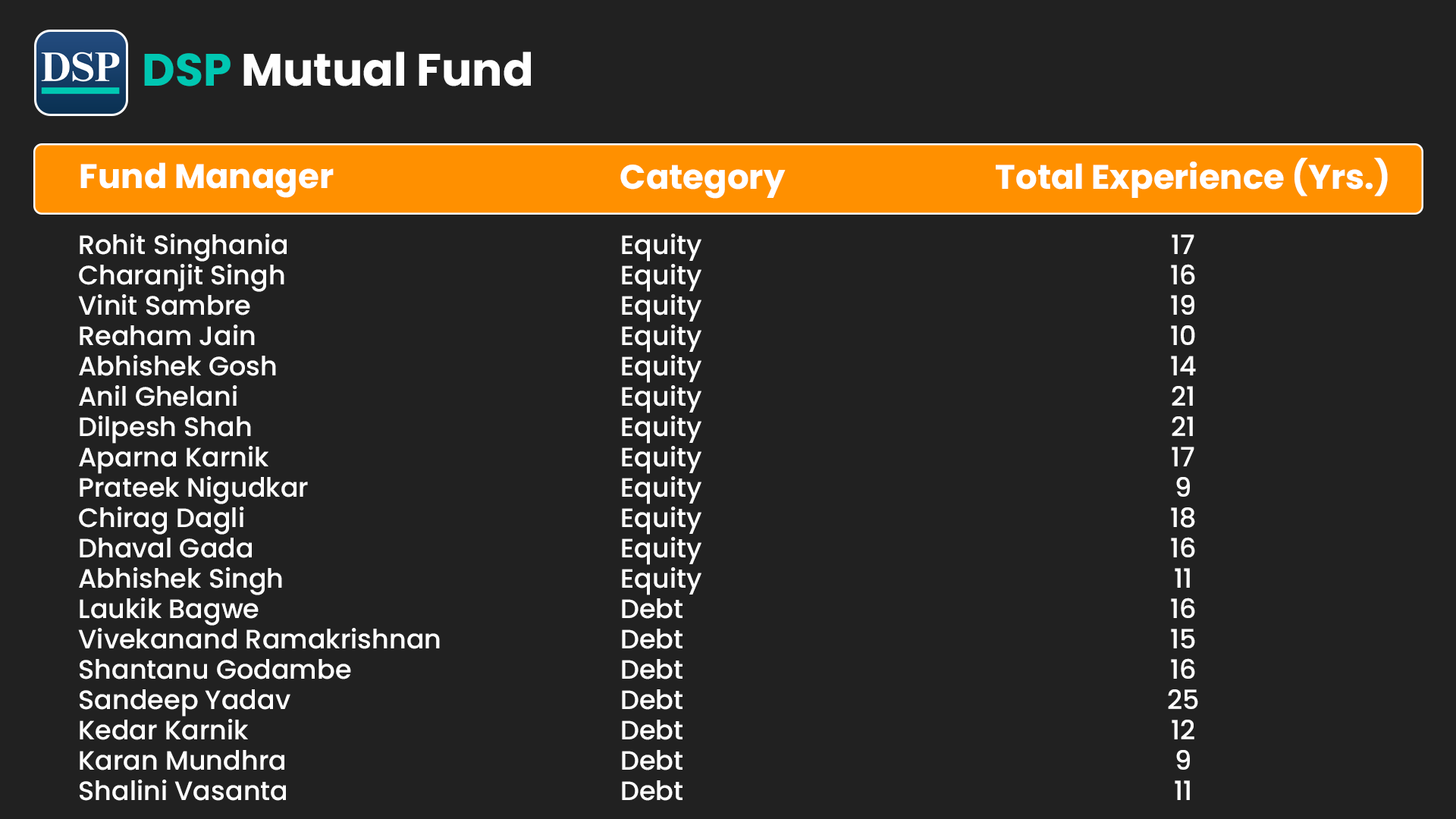

Fund Management Team

MR Vinit Sambre (Head of Equity)

Vinit Sambre has been managing the DSP Micro Cap Fund since June 2010 and is also the Fund Manager for the DSP Small and Mid-Cap Funds. With more than 16 years of experience in small and mid-cap investments, he joined DSP Investment Managers in July 2007. Vinit, a Chartered Accountant, has previously worked with DSP Merrill Lynch and IL&FS Investsmart Limited.

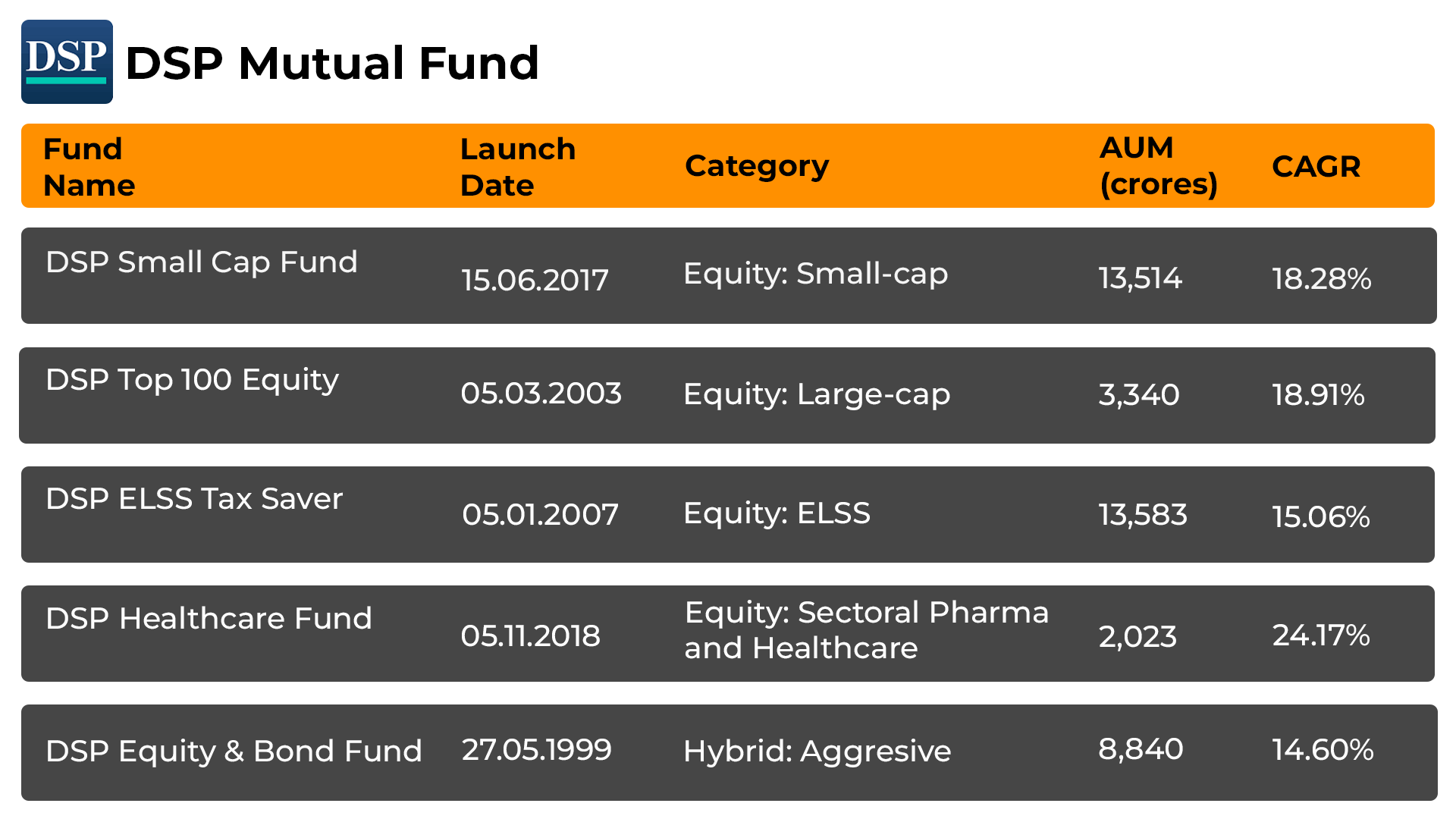

Top 5 DSP Mutual Fund

History of DSP Mutual Fund

The DSP Group started as a stockbroking firm in the 1860s and has been around for 152 years. It's like an old, reliable company. They follow the Indian Trust Act and are registered with SEBI, which is like a quality stamp for their services. The DSP Group is a respected Indian banking firm with almost 160 years of history. They have a strong support system in place to help investors. For over 25 years, DSP Investment Managers have been helping people make smart investment choices.

- For more than 25 years, DSP Asset Managers have been at the forefront of assisting investors in making educated and thoughtful investment decisions.

- We have evolved to become one of India's largest asset management companies.

- Trusted by a diverse investor base that includes hardworking individuals, high-net-worth clients, NRIs, small to large businesses, corporations, trusts, and foreign institutions.

How to Select DSP Mutual Fund?

There are various aspects to be considered while carefully selecting a DSP MF. Below is a list of such aspects to help you make the right choice:

- Set realistic and achievable investment goals; plan accordingly.

- Determine your risk tolerance and establish clear boundaries.

- Diversify investments across different areas for increased stability.

- Study the past performance of a fund before investing.

- Regularly monitor investments and make necessary adjustments.

- Seek professional advice to navigate market changes for secure assets.

In the end, mindful consideration and systematic planning through Online SIP leads to a balanced portfolio. If you are new to investing take guidance from a professional expert of finance.

How to Invest in DSP Mutual Funds via MySIPonline?

Using mysiponline to invest in this fund house is quite simple:

- Visit mysiponline.com & choose the funds for matching investment goals.

- Sign up for a free account, fill in your details, and add the selected fund.

- Complete the KYC process, necessary documents like PAN, Aadhar card, signature, and bank evidence.

- Quickly and paperlessly invest in your chosen mutual funds.

- Add selected mutual funds to the cart and proceed with payment.

- Wait and confirm your payment status via MySIPonline.

In conclusion, using our platform will help complete your investment process in simple steps. Also, use the SIP Calculator via MySIPonline to get an idea about the profits you can make.

What is the Taxation on DSP Mutual Funds?

The taxation of DSP AMC depends on which category they fall under equity or debt.

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding RS. 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Can I invest for a very short-term duration in DSP Mutual Fund?

What are the different DSP mutual funds available?

What is the advantage of investing in amc Funds?

Are all SIPs in DSP Funds online tax-free?

How to analyse the performance of DSP Mutual Fund?

Why do I need a financial adviser?

Explore Other AMC’s

Top Blogs of DSP Mutual Fund

Blogs

You can select three funds for compare.

You can select three funds for compare.