Investors are informed that investment in “Gold Investment Plan” is a way of systematic investment in the units of Nippon Gold Savings Fund (RGSF). This fund is an open-ended fund of funds that further invests in the units of Nippon ETF Gold BeES which is an open-ended exchange traded scheme with an underlying asset in the form of physical gold. It should be noted that this investment will lead to accumulation of units of RGSF (which will be equivalent to the price of physical gold subject to applicable NAV) and the physical gold.

The investment objective of this scheme is to help investors earn returns that closely correspond to the returns provided by Nippon ETF Gold BeES.

Following is the asset allocation of RGSF.

| Instruments |

Indicative asset allocation (% of total assets)

|

Risk Profile |

| Minimum |

Maximum |

| Units of Nippon ETF Gold BeES |

95 |

100 |

Medium to High |

| Reverse repo and /or CBLO and/or short-term fixed deposits and/or Schemes

which invest predominantly in the money market securities or Liquid Schemes* |

0 |

5 |

Low to Medium |

*The Fund Manager may invest in a Liquid Scheme of Nippon Mutual Fund or in any other mutual fund scheme registered with SEBI, which invests mainly in the money market securities.

Expenses to be Incurred by Investors:

- Investors should note that they will be liable to incur the expenses of RGSF along with Nippon ETF Gold BeES in which this scheme invests.

- There is no entry load which an investor needs to pay.

- If the units are redeemed by investors before completion of one year, then he/she will be liable to pay 2% as exit load. On redemption done after completion of one year, no exit load will be charged.

It should be noted that the past performance of the scheme may or may not be sustained in the future. Investment in the schemes of mutual fund carries high risk and therefore, the investment decision should be taken only after consulting a tax consultant or a financial advisor. Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

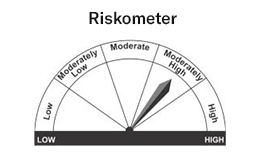

Product Label:

Nippon Gold Savings Fund:

This product is suitable for investors who are seeking*:

- 1. Long term capital growth

- 2. Returns that are commensurate with the performance of Nippon ETF Gold BeES through investment in

securities of Nippon ETF Gold BeES

*Investor should consult their financial advisers if in doubt about whether

the product is suitable for them.

|

|

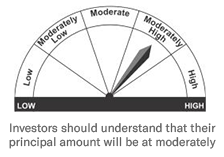

Nippon ETF Gold BeES

This product is suitable for investors who are seeking*:

- 1. Portfolio diversification through asset allocation.

- 2. Investment in physical gold.

*Investor should consult their financial advisers if

in doubt about whether the product is suitable for them.

|

|

|