Fund Review: Mirae Asset Tax Saver Fund

We all would approve that “older the wine, the better it is”. The mutual fund schemes hold an analogy with this statement. But there are outliers everywhere, and Mirae Asset Tax Saver Fund is that case here which, being a newcomer, has managed to highlight itself with its exceptional performance.

The AUM of over Rs. 800 crores, in just 2 years, is the evidence that the fund has succeeded in winning the trust of the investors. Under the matured guidance of Neelesh Surana, the growth of not only the lumpsum but SIP investment is visibly appreciable.

Matured Portfolio Aggregation

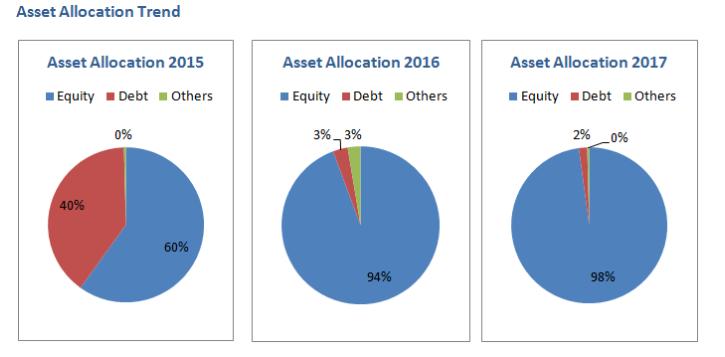

The fund invests majorly in equities and has witnessed an increase in the similar type of allocation since its inception. As we can see, the fund is size and sector agnostic, more than 60% of its assets are spread across the large-cap companies. The fund aims to invest in growth businesses having huge opportunities. The strategy is designed in such a way that it should target the options available at reasonable valuations. The fund is being majorly concentrated in the cyclic super sectors such as financial services, basic materials, and consumer cyclical which makes it highly sensitive to the ups and downs of the market cycles. Also, above-average assets of the fund are dispersed across sensitive sectors which correlate the fund’s performance to the business cycles moderately.

*Source: Economic Times

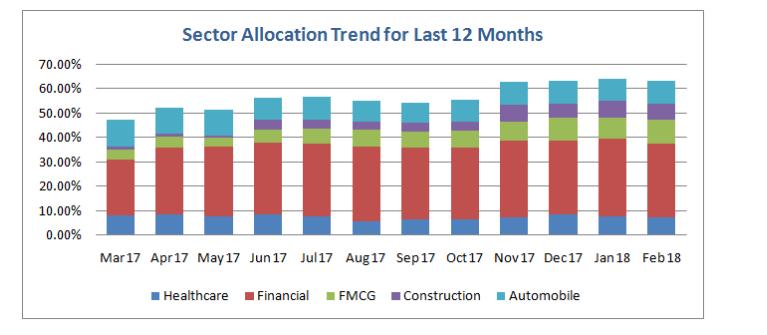

According to the current fund manager, the scheme’s disciplined approach, focus on quality, and diversification have backed it to yield satisfactory returns. Thanks to all the intellectual calls that were taken by the skilled team historically. Fund’s overweight stand in the private-sector banks including HDFC Bank, ICICI Bank, IndusInd Bank, and Kotak Bank, and exposure to consumer cyclical like automobiles contributed positively to its performance and always helped in accelerating the fund’s growth. Despite the transition of fund managers two times, the scheme is confident about the consumption sector of the economy. On the contrary, going against the benchmark with, exposure to the healthcare sector did not worked well for the scheme; hence, the allocation to this sector has been fluttering for the past 12 months.

*Source: Economic Times

Considering the past, the fund anticipates getting benefitted by the impact of the likelihood of a decent monsoon and its effect on the rural economy. The sectors on the bet this time are retail banking, consumer staples, consumer goods like auto durables and building materials. With over 19 years of experience in equity research and portfolio management, Mr. Surana gives credit to the Pay Commission, higher real wages, and fall in interest rates for contributing to the past returns.

Returns That Speak a Lot

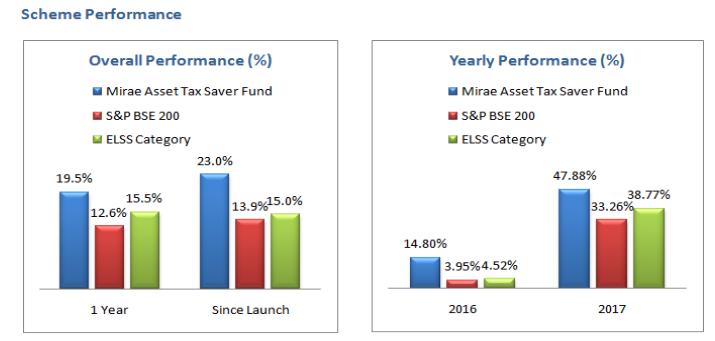

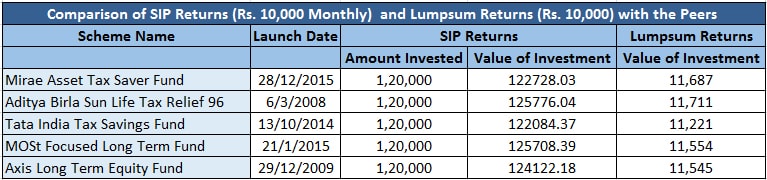

Mirae Asset Tax Saver Fund is a relatively new ELSS fund in the category. But this new kid on the block (only 2 years and 3 months old) has been ahead of the pack by a large margin, since its inception. The fund managed to deliver 23% returns since its launch in Dec 2015, while the category’s average performance stood at 15% during the same time span. Mr. Surana, Chief Investment Officer (Equities), was appointed as the sole fund manager of Mirae Asset Tax Saver Fund in April 2017. And since then, the fund has outperformed its benchmark and category average with jaw-dropping margins.

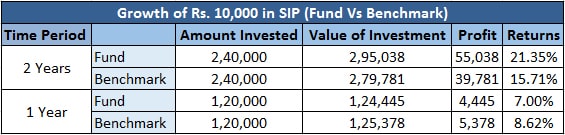

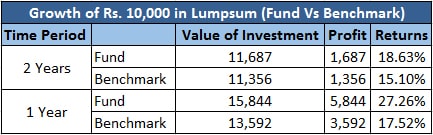

As a result of the growth-oriented investment vision, the fund’s performance in terms of SIP CAGR returns has hyped to 21% with respect to its benchmark which performed 15% in the past 2 years.

*Source: Value Research

The fund manager believes that the aforementioned factors along with several others have catalyzed the fund’s performance that generated 27% returns on the lumpsum investments merely in a year beating the benchmark as well as the category average.

*Source: Value Research

The skillful and experience-based bets of the fund manager have made the fund stand out among the category peers.

*Source: Value Research

Experts’ Take

The fund has built a superb turnover of about 114%. In fact, the P/E ratio of 25.39 proves the fund has been in the eyes of the investors due to its consistent performance. Assessing the extraordinary past performance of the scheme, the experts are also anticipating positive risk-reward ratio in the future. Although the risk parameter of the fund is moderately high, still the experts acknowledge that the fund can consistently generate high returns in the time ahead. You can bet on this fund if you don’t mind bearing risk for the generous returns you anticipate.

For more details of this fund, visit our Best Tax Saving SIP Funds’ page.