Find Out the Best Mutual Funds Online for a Sound Investment Portfolio

Are you searching for the best mutual fund investment plans that can provide you with extravagant returns and help you attain all your investment objectives?

If yes, then it’s time to bring your search to an end because here in this write-up we are going to reveal the names and details of the best mutual fund schemes which are capable of providing excellent returns in the long-term.

Top Mutual Fund Schemes to Invest in India:

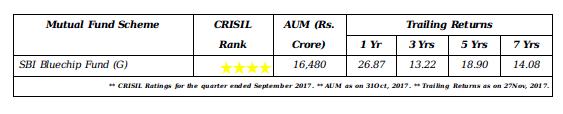

1. SBI Bluechip Fund (G):

- Scheme Objective : It is a large-cap equity scheme which majorly targets a stabilised long-term growth in the capital investment of the investors. It primarily invests in the stocks of the companies whose market capitalisation is at least equal to or more than the least market capitalised stock of BSE 100 index.

- Funds’ Performance : It was launched in the year 2006 and has managed to provide healthy returns in the long run to the investors. The performance chart of the last five years attracts the attention of the investors as it has been showcasing excellent performance for the five years. It has also managed to beat both its benchmark, i.e., S&P BSE 100, and peers in each of the last five years.

Why Should You Invest in this Fund?

Being a large-cap equity fund, it provides higher stability in returns than that of the small and mid-cap peers. It also tend to generate healthy returns if you stay invested for a longer tenure. Moreover, for an investor who want to create wealth from equities while moving safely from frequent market fluctuations, SBI Bluechip Fund Growth scheme can be a better choice.

2. Aditya Birla Sun Life Pure Value Fund (G):

- Scheme Objective: It is a mid-cap equity scheme which majorly targets high growth in the capital invested by the investors. It primarily invests in the stocks of the companies which are neither the newly entered competitors in the industry nor they are well established giants. It means that it focuses on the mid-sized companies which are highly capable of providing excellent capital appreciation in the long-term period.

- Funds’ Performance: It was launched in the year 2008 and has managed to provide significant returns to the investors in the long-term period. The aggressive nature of the scheme from the beginning of the year 2014, showcases an excellent record of fantastic growth in the past years.

Why Should You Invest in this Fund?

Being a mid-cap equity fund, it tends to offer higher possibility of providing excellent returns than that of the large-cap peers. It can help you create wealth if you stay invested for a longer tenure. The best part of investing in this scheme is that, it offers benefits from both the ends to the investors, i.e., of large-cap and small-cap. You get higher return stability than that of the small-cap categories, and you also travel aggressively to reap high returns unlike large-cap peers.

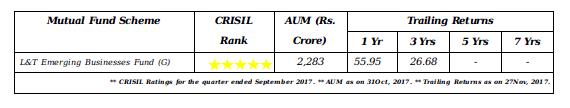

3. L&T Emerging Businesses Fund (G):

- Scheme Objective: It is a small-cap equity scheme and targets extreme growth in the long-term period. It primarily invests in the stocks of the small and mid-cap companies which are highly capable of providing amazing growth in the long-term duration.

- Funds’ Performance: It was launched in the year 2014 and has managed to provide significant returns to the investors. Currently, it is holding 1st rank under the category of small and mid-cap by CRISIL for the quarter ended September 2017. It has beaten both its benchmark, i.e., S&P BSE Small Cap, and peers with healthy margins in terms of generating returns.

Why Should You Invest in this Fund?

You must consider this fund if you are an investor who wants to gain extravagant profits on the investments over a long period of time. This fund has the capability to make the dreams of wealth creation come true. It invests only in the stocks of selected companies which can deliver exceptional returns on investments and showcase high growth. As it invests more than 98% of its total assets in the small and mid-cap stocks, it tends to provide higher profits during the up market scenario.

The three equity mutual fund schemes as mentioned above are among the best performers and have provided significant results to the investors in adequate time. So, you must not miss investing in any of them. Start reaping the benefits of investing in the best mutual fund schemes of the top AMCs of India at MySIPonline. We provide you with an easy and simplified investment platform and featured services.