Where Is Your Fund Manager Investing Your Money?

Mutual funds provide a diversified way to invest your money. And, the fact that your fund manager is well aware of it is the icing on the cake. The unique perspective that makes investment in mutual funds distinctive is that you do not have to worry about the tricky decisions of when to take entry in the market or when to exit.

For this purpose, the AMC has appointed a fund manager for you. All the mutual fund houses are backed up by the experienced and expert fund managers.

The behavior of the returns from the mutual funds depends on various factors. One of them is the strategy and the vision with which the fund manager allocates the assets. Another aspect that designates a fund to be ‘performing or non-performing’ is the selection of stocks by the fund manager in a particular sector or business in which they are investing. It might happen that some of the portfolios get over-weighted in some sectors, when a group of fund houses anticipate their future growth. We have retrospected the data that might justify that the prime fund managers think somewhat the same way. Let us see what were the calls of the fund managers, during the past year, and what was the asset allocation in the different sectors.

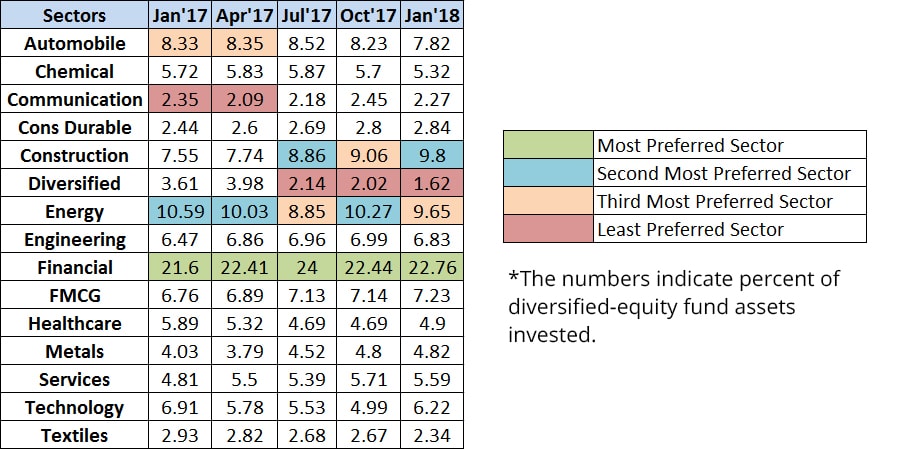

The table below includes the percentage of investment in equity sectors made by the fund managers during the past year. During the previous year, the fund managers preferred investing in the ‘Financial sector’ the most. Energy and Construction sectors acquired the second position in the favorites’ list of the fund managers, cumulatively. Pointing to the last position, the diversified sector failed to attract the attention of the fund managers and bagged the least number of investors. The subsequent table will make it clear.

Equity Funds: Sector Preferences

(Source: Value Research)

*The numbers indicate the percentage of diversified-equity fund assets invested As you can see, the Financial sector has managed to be in the eyes of the fund managers throughout the year. Banking & financial sector accrued 23.98% of the total investment in the April 17 – July 17 quarter by the mutual funds and continued to be the most preferred sector over the last 12 months. Energy and construction managed to toggle between the second and third-most preferred sectors for parking the money by the mutual funds. Even automobile sector earned a considerable reputation in the investment market for initial two quarters of the past year. But the communication and diversified sectors saw a notable downfall in the sentiments and consequently were of least interest to the mutual fund houses.

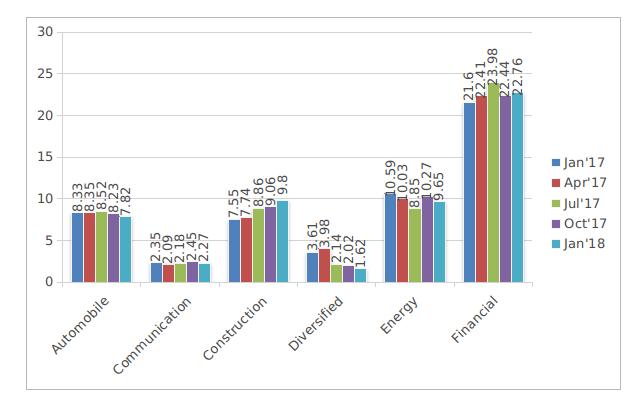

According to the data from the Morningstar Inc., five of the top 10 holdings of the mutual funds were financials that account for 58.9% of the aforementioned. The private lenders, ICICI Bank and HDFC Bank, ruled the list. The experts assert that the financial sector is expanding. It now covers insurance companies, mutual fund companies, brokerage firms, small finance banks, and many more. This implies that there are more options for asset managers in the financial space. The chart below depicts the trend in mutual funds that was followed by the fund managers.

The data shows that the fund managers have kept a vision of allocating their assets in the direction of the overall economic growth. Banking & finance sector plays a circulatory role in the development of the country. Focusing on the core sectors such as Energy, Construction, Automobile, and Finance suggest that the fund managers have plotted their strategies to accrue benefits in the long run. As the economic development is the ultimate goal in the emerging country like India, it is the smartest way to benefit and get benefitted from these opportunities.

This write-up is a result of the thought that ‘keeping an account of your investment is a good habit. It is not that you should not trust the fund managers, but knowing where the return is coming from, keeps you updated about the flourishing and anticipated investment opportunities.

MySIPonline always tries bringing up the most relevant and trusted information to the readers. We would be delighted to provide you with all the viable solutions to your investment queries.