Top Mutual Funds to Invest in India to Attain Wealth Creation Objective

Invest in the top mutual funds in India and start your journey toward wealth creation. The top performers are selected on the basis of the past performance and many other parameters which aid to know the potentiality of the schemes in generating returns on investments.

If you are searching for the best schemes which can help you in attaining wealth in long-term period, then invest in the top schemes of diversified equity category so that you can effortlessly travel through a trend of stabilised growth in your capital investments.

Here are some of the top-ranked diversified mutual funds in India:

ABSL Advantage Fund (G): One of the excellent performers in the space of multi-cap equity, this scheme is sprinting on the 1st rank under the CRISIL ratings for the quarter ended September 2017. By showcasing fantastic performance since inception, it has attracted the attention of many investors. The primary objective of this scheme is to attain high growth in the capital investment in the long-term period by investing in the stocks of moderate levels of risk. Being from the multi-cap category, it invests in a well-diversified portfolio to maintain the stability of growth over the long term. The latest NAV of this scheme has been tracked at Rs. 437 as on December 08, 2017.

Trailing returns of the scheme as on December 08, 2017:

_5a30cdff08588.png)

Investment profile of the scheme:

_5a30ce214c2d3.png)

Top 10 holdings of the scheme as on December 08, 2017:

_5a30ce548509c.png)

Tata Equity P/E Fund (G): One more gem in the space of multi-cap mutual fund schemes, Tata Equity P/E Fund growth scheme has successfully imprinted its name among the top performers. This scheme has managed to provide excellent returns on investment in the long term. The performance of this scheme since early 2016 is applaudable. It has showcased excellent jump in its value. The NAV of this scheme is recorded at 136.70 as on December 08, 2017. It has also outperformed its benchmark and peers many a time with good margins. You can choose to invest in this scheme if you have the investment objective of creating long-term wealth and have a moderate risk appetite. It is also a 1st rank holder by CRISIL ratings under the category of diversified equity mutual funds for the quarter ended September 2017. Check the trailing returns and investment details of the scheme in the tables as shown below to know whether it suits your objectives or not:

Trailing returns of the scheme as on December 08, 2017:

_5a30cea805878.png)

Investment profile of the scheme:

_5a30cebc1efba.png)

Top 10 holdings of the scheme as on December 08, 2017:

_5a30cedd81fe5.png)

Sundaram Rural India Fund (G): After the fall of 2008, this scheme of Sundaram Mutual Fund has showcased high comeback potential. It has shown excellent growth in the very initial time after that, and further remained a consistent performer till late 2013. Again the scheme has managed to bring happiness to the investors by going bullish during 2014-16. But still, there was more to come. In January 2016, the management of the scheme was handed over to S Krishna Kumar, the fund manager and since then, the scheme has aggressively moved toward the sky. It also has records of providing superior returns on investments to its benchmarks and peers many a time.

Trailing returns of the scheme as on December 08, 2017:

_5a30cef66f111.png)

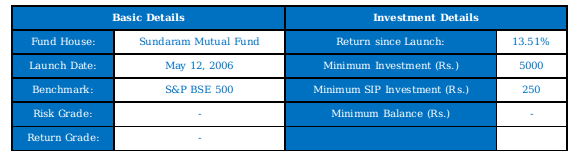

Investment profile of the scheme:

Top 10 holdings of the scheme as on December 08, 2017:

_5a30cf2bacdd0.png)

Henceforth, check out the details and invest in the top performing schemes of diversified equity categories as mentioned above. Multi-cap fund investment can be an aid to bring stability to the investment portfolio.

If your investment objective is not matching with any of the above-mentioned schemes, then visit us at MySIPonline. We will provide you with a plethora of the best mutual funds to invest in India.