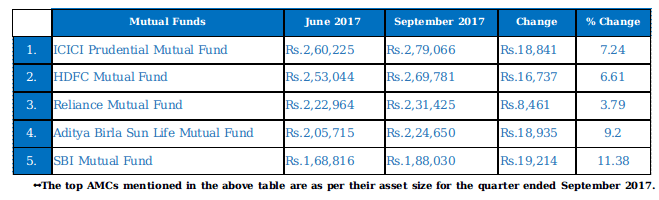

Top 5 AMCs in India for Mutual Fund Investments

Mutual fund industry in India has been imprinting a massive role in the economic development of the country since years. The scenario in the past five years has shown a great boom in the size of this industry.

It has witnessed a large number of investments flocking in recent years. Most of the investors think that investing in an AMC having a good brand name or healthy asset size will provide security against default or give guarantee of returns. This is not actually true when you are investing in mutual funds. Their performance entirely depends on the experience and expertise of their fund managers. The top five asset management companies in India are mentioned below:

List of Top Mutual Fund Houses in India:

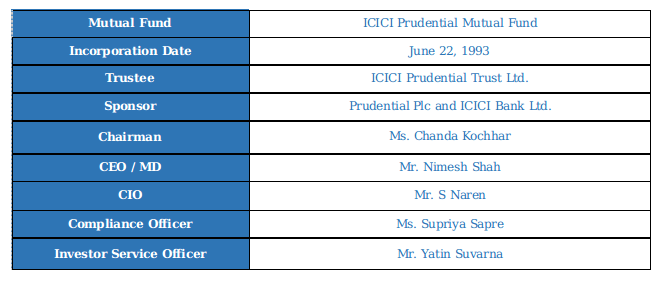

- ICICI Prudential Mutual Fund : It is the largest asset management company in India in terms of its assets under management. With an amazing attitude toward providing high capital appreciation to the investors, it kept growing since its launch. Being established in the year 1993, it has completed almost 25 years of its tremendous success in the Indian mutual fund industry. If you are looking for a fund house that can provide you with the best schemes to fulfil all your financial requirements, then you can wrap-up your search here at ICICI Mutual Fund.

Details About the Fund House:

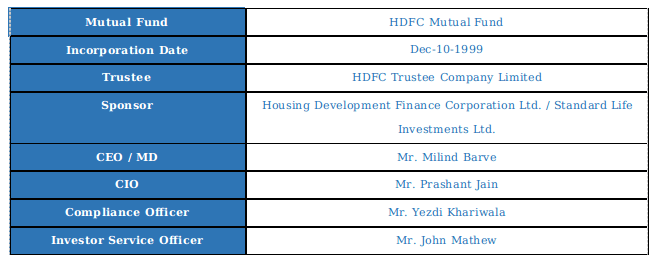

- HDFC Mutual Fund : One of the most trusted asset management companies, HDFC Mutual Fund was established in the year 1999. In 2003, it has acquired Zurich India Mutual Fund. With the passage of time, it has managed to win the trust of several other investors and became one among the best AMCs in India. It stands in the second position in terms of its assets size which is Rs. 2,69,780.89 crore as on September 30, 2017.

Details About the Fund House:

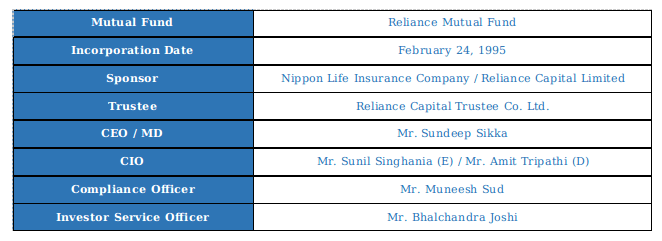

- Reliance Mutual Fund : One of the giant brand names of India, Reliance, also has its presence in the industry of mutual funds since 1995 with the name Reliance Mutual Fund (RMF). It is the third largest AMC in India in terms of its AUM which is Rs. 231425.09 crore as on September 30, 2017. It offers all types of mutual fund schemes to the investors such as equity, debt, hybrid, etc. Therefore, you can choose to invest in the schemes of this AMC and attain all your financial goals in required time.

Details About the Fund House:

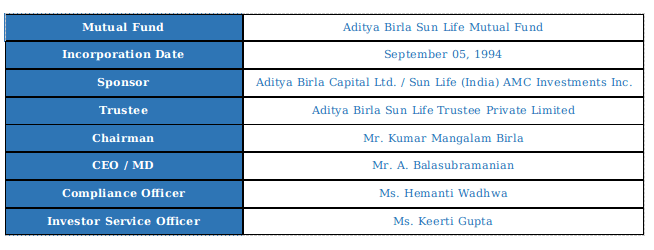

- Aditya Birla Sun Life Mutual Fund : A joint venture between Sun Life Financial (Canada) and Aditya Birla Group (India), ABSL Mutual Fund is one of the most promising asset management companies in India. By providing the ways to achieve financial success, it has managed to bring economical stability in the life of the investors. Sparkling on the fourth position in terms of AUM, the name of Aditya Birla Sun Life Mutual Fund is a brand in itself.

Details About the Fund House:

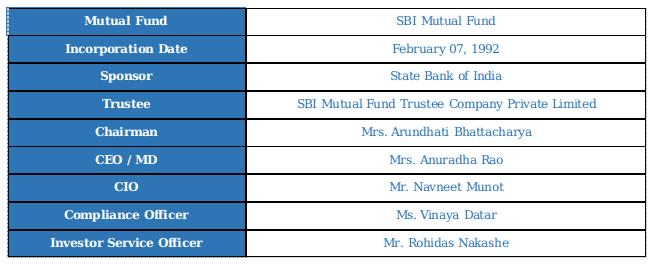

- SBI Mutual Fund : SBI Mutual Fund is one of the India’s most trusted mutual fund house with the assets under management amounting to Rs. 1,88,029.72 crore as on September 31, 2017. It is a joint venture between State Bank of India Limited and AMUNDI (France), one of the leading fund management companies in the world. You can find all types of MF schemes at this AMC to invest in. So, without wasting any time, start investing today in it.

Details About the Fund House:

The top five asset management companies as mentioned above are as per the volume of their total assets under management. You can select the schemes which suits to your investment objectives. We, at MySIPonline, have all the best schemes of the above-mentioned fund houses. You can easily start investing in any of them to reap higher benefits.

You can also ask our experts for investment related suggestion so that you can make more result-oriented decision. Investment in mutual funds is no more a critical job for you as we are supporting you at each step of your investment with our keen and objective-oriented team. Get associated with us today if you are still not in our circle, and get all the benefits that we offer to our discerning clients.