PNB Fraud Highlights: Affect on Equity Market, PSU Banks, & Others

There’s no denying the fact that gems and jewelry play a very important role in the Indian Economy. Maybe that’s the reason why India is deemed to be the hub of the global jewelry market. However, due to the recent PNB fraud, diamonds, a gem for which Indians are obsessed with, have somewhere lost its lustre. All thanks to Nirav Modi!

The multi-crore scam associated with Punjab National Bank has significantly dented the brand value of diamonds, and thus trickled other PSU banks as well. Tremors of the case have led management of top public sector banks to conduct a review session discussing steps to centralize all processes including SWIFT to link them to core banking solutions (CBS).

As we have already discussed much about the PNB fraud case earlier (All You Need to Know About the PNB Fraud and Its Impact on Mutual Fund Industry), here we will highlight the impacts of the same on PNB, other PSU banks, and what changes does it bring in the world of equities.

So without further ado, let’s get started!

The case brought in some significant changes, the highlights of which include:

- Constant Tumbling in the Shares of PNB

The market valuation of Punjab National Bank has slumped down drastically by about Rs 10,939 crores in just five days after the Fraud case went public like wildfire. The stock has lost nearly 28 percent in just five days period.

While reeling under a major financial fraud, PNB seeks support from PwC. The auditing company will gather evidence that can be used against Modi and his associates in court. In the ‘scope of work’ that PNB issued the auditing firm on February 17, 2018, and finalized on February 21, 2018, the instruction was made by the bank to PwC demanding to identify how Nirav Modi misused the Letter of Undertaking (LoU) mechanism. Besides, they ask them to track the money and check on the end use of the funds that were raised. They will also quantify PNB’s losses due to the alleged scam. - Sharing the Spotlight: PSUs or State-Owned Banks

While high-profile arrests in connection with Rs 11,400 crores PNB fraud, many experts shared a feeling that it might claim more victims in the PSU banking sector. This has affected the most prominent PSU banks in India, including SBI and BoB.

Soon as the Nirav Modi case broke, Bank of Baroda rusk knocking CBI on Rotomac Case. In October 2015, BoB had classified a loan of Rs 435 crores to Vikram Kothari who run Rotomac Global- a non-performing asset. After the Modi’s swindle has come to light, the bank is fearing that Kothari too might be planning to leave the country. To top it all, the PSU banks were already under pressure because of the cleaning of their account books and rising NPA problem. - Losing Value on its Investments in Banks and Companies Hit By Fraud: LIC

The huge Rs 11,400 crores fraud allegedly perpetrated by the companies of diamonaire Nirav Modi and Mehul Choksi has hit Punjab National Bank along with other PSUs. But, a few of us know that it had a great impact on another state-owned equity, i.e., Life Insurance Corporation(LIC). It happened because LIC is the single largest institutional investor in all the three fraud affected banks, Punjab National Bank, Allahabad Bank, as well as Union Bank of India, and in addition, Mehul Choksi-promoted brand Gitanjali Gems. The four entities fell sharply over the last few days which led LIC to lost nearly Rs 1,400 crores in the trading.

It is in records that LIC owns about 13.93 percent in PNB, 13.24 percent in the Union Bank of India, and 13.17 percent in Allahabad Bank. Furthermore, it also holds 2.88 percent of Gitanjali Gems from as on December 31, 2017. Incidentally, Life Insurance Corporation's holding in all these four organizations is the single largest institutional holding. Thus, making it the biggest loser as an investor in these entities following the crash in share prices after the fraud came to light.

Mutual Funds and PNB Fraud

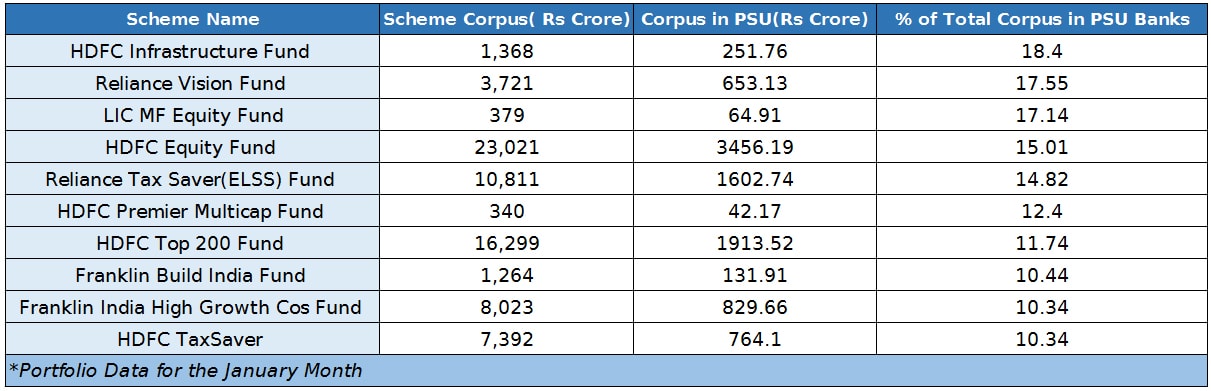

A few mutual fund schemes that have more than 10 percent of their corpus in the shares of public sector banks are listed in the table below:

What Should Be Done if Your Mutual Fund Scheme Has Huge Exposure in PSU Banks?

The experts have analyzed the situation and stated that the investors who are new to the banking sector or the ones who are planning to enter the segment need to be cautious as this sectoral fund tend to be risky. Those who have not invested in schemes which are well-diversified should consider diversifying by vesting in diversified funds.

Further, as per the stats, PNB alone crashed by 28 percent, leaving all other banks red as well, thus there is a slight possibility that the time is going to hurt this sector schemes to an extent.

However, there are a few experts who are analyzing the other side of the coin and advising investors with broad exposure to PSUs to avoid being a part of any knee-jerk reaction. They can take benefit of the period, and use this time as an opportunity to buy good quality PSU stocks on dips.

The experts at MySIPonline believe that it’s the time which will narrate the actual story. Henceforth, it would be better to be a part of the crowd and avoid panicking in any way.

In case you are seeking advice on the same, connect with us directly via phone call. We will help you understand a clear picture and ensure that your queries are sorted out in the best possible method. You can visit MySIPonline for the best online SIP investment services!