Parameters to Select the Best Tax Saving Mutual Funds

March end is just round the corner, and the clock to put a halt to your tax planning for this financial year has started ticking away. On one side, companies have begun asking for investment declaration from their employees, whereas on the other, there are mutual fund campaigns which are boasting the benefits of investing in ELSS funds.

Well, considering the popularity mutual funds have gained in recent past, we assume you people are aware of the term ELSS funds. For all those who are still living under the rock, here’s the definition- “ELSS funds are diversified equity funds that come with the benefit of tax saving under Section 80C of the Income Tax Act of India, 1961.” When it comes to investing in an ELSS fund, it is always a challenge to pick a reliable scheme. Experts believe that the process requires due diligence and one has to be extra careful when selecting the best ELSS scheme as it comes with a lock-in period of at least three years.

In this write-up, we’ll make you acquainted with the basic points that should be kept in mind while choosing the same. So without any further delay, let the learning begin!

Factors to Look at When Picking an ELSS Scheme

AUM and Fund House

The experts at MySIPonline shared their views on investment in ELSS funds. They believe that when picking up an ELSS fund, it is important to opt for a scheme which owns a sizeable AUM (Asset Under Management), i.e., with at least 250 crore assets under its watch and also, the one which belongs to a leading fund house.

Returns

One must never miss analyzing the trailing returns of past one year, three years, and five years whenever planning to vest in this category. A fund might have performed exceptionally well than its peers in a one year time, but this cannot be the only statistics that should be considered in the hope of outperformance in the future. Historical performance is also a good measure to know the ability of the scheme’s performance in varying market situations. Besides, the investment strategy of the scheme in different market cycles can also be calculated using the historical returns of that particular fund.

As you can see through the table below, almost all of the recommended schemes have given exceptional returns in their long-term tenures of five and seven years. Thus, it should be noted that such funds provide capital appreciation in the long-term. There are a few exceptions here including ABSL Tax Relief 96 Fund, Mirae Asset Tax Saver Fund, and L&T India Tax Advantage Fund which have managed to deliver excellent returns of 21.08%, 18.41%, and 19.04%, respectively in a one-year horizon too.

Showing the Past Years Performance of the Recommended Schemes.

Risk-Adjusted Returns

We know several investors who look at the historical returns of the schemes to determine the nature of providing returns; however, they do not represent the actual picture. Past performance of the ELSS scheme should be adjusted for risks.

Risk-adjusted returns of any fund signify the excess return that the fund manager has generated by taking one unit of risk, and this is measured using the 'alpha’ of the fund. The excess return of a fund relative to the return of a benchmark index is referred to as the fund's alpha. The higher the alpha of any fund, the better is the fund.

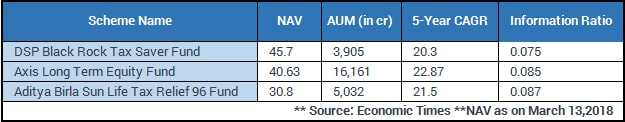

Among several parameters, you can also go with the Information Ratio to gauge the risk-adjusted returns. The tracking error which is measured as standard deviation of active returns is used to determine the Information Ratio. It is the real test of the fund manager’s skills as it is based on the deviation of the returns from the benchmark indices.

Showing the Information Ratio of the Recommended Schemes.

Risks

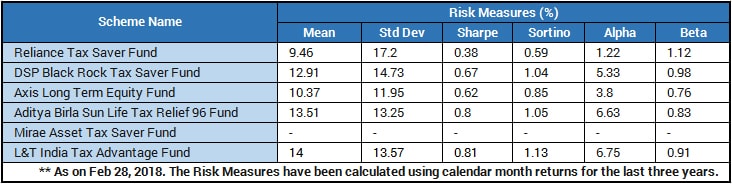

Performance is a good parameter to be considered. But analyzing the fund’s risk is the sign of a smart investor. The market is uncertain, and it can anytime show its volatile nature. Therefore, the values of variance, standard deviation, and the beta of the portfolio should be checked before taking an investment call. Also, it should be checked that these values are lower in the selected fund than that of the benchmark of the fund.

Let’s understand this through an instance.

Consider a fund manager who includes high-beta stocks ( the stocks which have higher volatility and higher return profile in comparison to their index). It is possible that the fund can outperform its benchmark in the bull run, but there’s also a possibility that it can adversely affect the performance in the bear market. Therefore, the conservative investor should opt for low beta funds.

Showing the Risk Measures (%) of the Recommended ELSS Schemes.

Variance in the Risk Profile

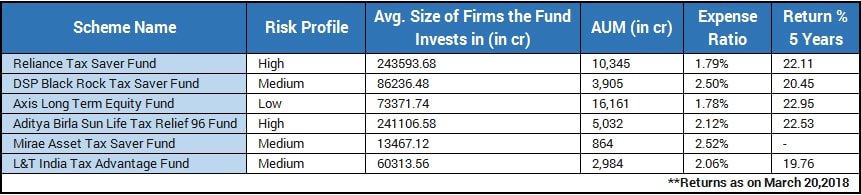

ELSS funds are way different from the funds which have a clearly defined investment universe. The allocation such as large-cap, small-cap, or even multi-cap is not specified in Equity Linked Savings Schemes; as they have the flexibility to invest anywhere. However, it can be noticed that almost all of them follows a defined template when it comes to asset allocation.

The differentiated approach to portfolio construction denotes that the risk profile of these funds varies substantially across each other. Fund selection, therefore, is quite critical.

Experts’ Take

The choice of an ELSS fund should ideally be based on one’s own risk profile, and not purely on a fund’s return profile. As an investor, you should identify the nature of underlying exposure of the ELSS funds to ensure that the scheme's objectives are in-line with your requirements.

Considering all the parameters mentioned above, our research team has filtered out top 6 Equity Linked Savings Schemes for our investors. We hope now you’ll be able to make the right choice in a tax saving instrument from the basket of our suggested mutual funds.

Showing the List of Recommended Schemes and their Details.

However, in case you are still facing any difficulty, connect with us to seek the best solution. We provide recommendations on the best performing funds of different categories time and again; to check the details of the top ELSS funds, click here.

Connect with us at MySIPonline for the most reliable online investment services!