MySIPonline Recommends: The Best Mutual Fund Plans to Invest in India

Mutual funds are the best investment options these days, and recording new heights in terms of generating returns. If you see the growth graph of the past five years, it can clearly be understood that how aggressively the industry has moved upward.

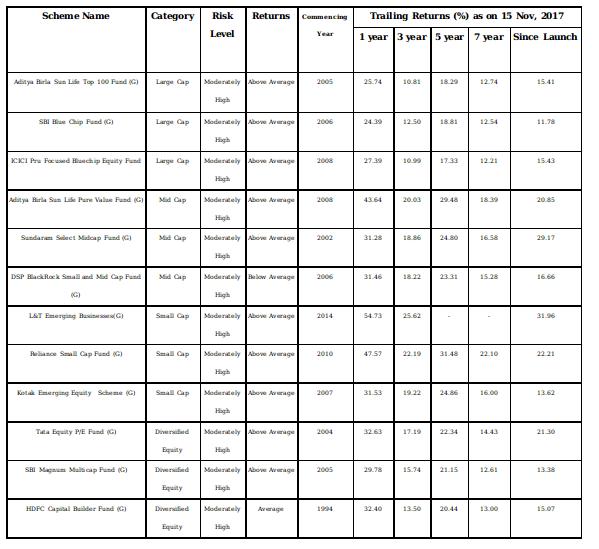

Equity remained in the limelight of the entire show as it has tracked an excellent number of investments in the past years. Let’s check some of the best equity mutual funds which are providing excellent returns to the investors:

So, what are you waiting for? If you have any interest in creating wealth in the long-term period, then the schemes which are mentioned in the above table are among the best solutions. All these schemes have proved their high potential in generating excellent returns in the long run. You can choose any one which suits the most to your investment objectives. The category wise distribution and the risk nature are also shown in the table so that you can easily determine which one of them is the best for you.

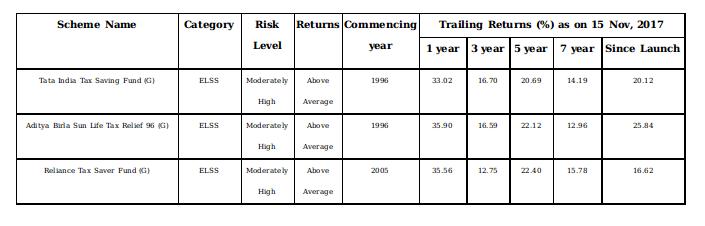

Furthermore, when we are talking about the equity world, it would be wrong to leave the ELSS category undefined. Therefore, we also present a table which will help you to determine the best tax saving mutual funds to invest in 2017. Here it is:

The above-mentioned schemes are recommended by the experts associated at MySIPonline. The past performance of these equity schemes has been properly analysed, and many other factors which influence the rewardability of the schemes are taken into consideration for drafting these tables. All the schemes have shown excellent returns to their investors in the long run. However, you need to consider certain things while investing in mutual funds so that the chosen scheme could provide you adequate benefits in the required time period, which include:

- Mark Your Investment Goal: It means that you need to make a clear vision of your financial objectives. Know what exactly you want to achieve and in what time! After that choose the most appropriate investment plan which has the potential to help you in reaching attaining your targets.

- Don’t Think it’s Late: Never make the age factor an issue. Yes, it is true that an early investment can reap you unrealistic benefits, but it is also never said that latecomers would achieve nothing. Therefore, forget about the age factor and start investing today. You may further lose the possible benefits, if you still waste your time in thinking!!!

- Don’t Stick to One Category: Try making diversification in your portfolio, unlike the one who invests only in a single category of fund. A well-diversified investment portfolio can help you maintaining stability in returns and reducing the risk.

- Stay Invested for the Long Term: You must have heard from the experts saying that equity funds can help you in earning millions when you stay invested for the long-term period. It is cent percent true, but the only thing you need to do is stick to your investment.

- Don’t Become Greedy for Short-Term Hikes: Sometimes, it has been seen that the investors become greedy for the sudden ups in any particular market without knowing the fact that it is not going to sustain for long. You need to take care of such things, and always prefer consistency if you want to earn healthy benefits.

On the final note, it is suggested to invest in equity fund investments and don’t be like a day dreamer! If you see the long-term returns provided by the schemes which are mentioned in the above tables, on an average they provided 10-16%. So, don’t make false expectation like earning 40% or 50%, and have a clear vision based on the real facts.