Must Know: 7 Important Questions About ELSS Funds

The ‘Tax Festival’ is soon gonna be here! What! Yes, as the financial year 2017-18 wraps up with end of this month, not you but the Government must be enjoying the tax festivity.

According to the new taxation policies, the public is now liable to pay more in terms of taxes whereas the government has got an opportunity to widen its scope of investment in the upcoming policies and projects. Although, the taxes are collected to benefit the public indirectly, the tax rates are growing as if they would eat up the whole income of an individual.

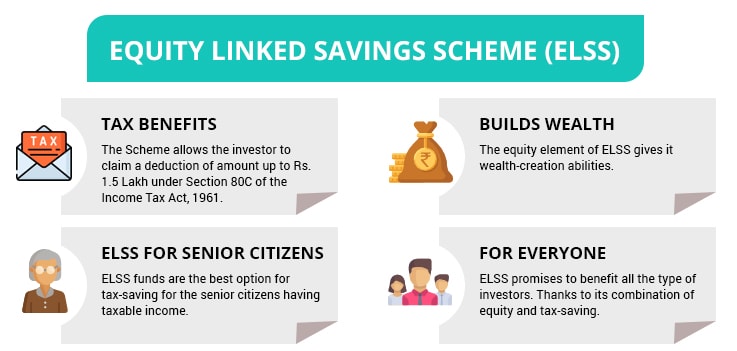

The above reason makes tax saving a compulsory part of one’s financial planning. And if you are looking for some tax saving options mutual funds has a gift for you - Equity Linked Savings Scheme (ELSS). ELSS can be a good choice as its sole purpose is not concentrated to just tax saving but they help you to use your saved tax wisely. Haven’t heard about it? Have a doubt about investing in ELSS funds? Not a problem.

This write up has brought in the answers to the 7 most basic but important questions about the ELSS funds. Here they are:-

- What are ELSS Funds?

ELSS funds are the equity-linked mutual fund schemes for which investors are eligible to claim the investment amount for the tax benefits. They not only help you save taxes but also focus on generating wealth over the long term. - How much can I Invest in ELSS Funds?

As such, there is no maximum limit to your investment in ELSS. However, tax exemption is allowed only to an amount of up to Rs. 1.5 Lakh. - How can I Invest in ELSS Funds?

There can be two ways to invest your money in ELSS. You can either choose a lump-sum or a Systematic Investment Plan (SIP) to park your money in it. Investing through SIP is the most popularly suggested approach as it gives an opportunity to invest in a planned and disciplined manner. Besides that there are two advantages. One, breaking up your tax-saving investment over 12 months does not restrict your liquidity. Two, investors opting for SIP enjoy the benefits of rupee-cost averaging. On the contrary, investing with a lump-sum approach in ELSS Mutual funds will make you skip the opportunity to buy at the best possible price. - How do ELSS Mutual Fund Investments Give me Tax Benefits?

When you make an investment in ELSS, you can claim a deduction of the equivalent amount from your gross income under Section 80C of the Income Tax Act, 1961. But conditions apply. As stated above, in any financial year only the amount of up to Rs.1.5 lakh is eligible for tax break. Until the introduction of LTCG tax in the recent budget, ELSS schemes used to enjoy the EEE benefits of being Exempted, Exempted, and Exempted. This implies that as you invested in an ELSS you got tax exemption; the dividends received were tax-free; and there was no tax on the capital gains at the time of redemption. But as the new LTCG taxation rules that come in effect from April 1st, 2018, the capital gains arising from the redemption of ELSS held for more than a year will be taxed at 10%. This tax will be applicable on the gain exceeding Rs. 1 lakh. However, to the relief of the tax payers, the gains from the ELSS till January 31, 2018 will be grandfathered. - For How Long Do I Get Locked in with an ELSS Fund?

The ELSS funds have lowest lock-in period among all the tax-saving instruments such as PPF, fixed deposit etc. It is only three years. This period, restricts the redemption of your units. However, you are able to receive the dividend payments. - Do I Get Guaranteed Returns on My ELSS Investments?

Not guaranteed but ELSS does offer market-linked returns. ELSS funds invest actively in the equity market, with a potential to generate comparatively high returns from its traditional tax-saving peers like PPF. This tax-saving investment with a lock-in of 3 years can make you realize the effect of compounding in the long-term. Apart from the tax saving, remaining invested in the ELSS funds even during the temporary market corrections will help you create wealth. - How Exactly does My ELSS Investment Work?

Your ELSS investment in mutual funds can help you put your hard-earned money to good use in a way that you save on taxes and also create long-term wealth. Here is an example of how it works.

Let us assume, you have Rs. 1.5 Lakh to invest under Section 80C and you fall in thmust-know-7-important-questions-about-elss-fundse highest taxpayer bracket. Considering that the NAV of the ELSS Mutual Fund you wish to buy is Rs. 50, you can buy 3,000 units. As you are in the highest tax bracket, you are eligible for an exemption of 30% on this investment. For the sake of simplification, we are ignoring the surcharge and cess. This accounts to a tax rebate of Rs. 45,000 on an investment of Rs. 1.5 lakh. The amount of Rs. 45,000 has become an additional perk for you. And apparently, your notional investment comes down to Rs. 1,05,000.

Over the past 3 years, ELSS funds have generated a compounded return of around 15.8%. Assuming the return to be 15%, the NAV of the fund has appreciated to Rs. 72 at the end of 3 years. As a result, the value of your investment is doubled to Rs 2,17,000 in three years. This figure is nearly the double of your notional investment. Hence it shows that by investment in ELSS relishes the power of compounding combined with tax savings.

The above-mentioned questions and their answers illustrate that ELSS is not just a vehicle to save your taxes but it is a path that leads you to the goal of wealth creation. The table below will give you some more reasons to invest in ELSS mutual funds. So invest smart, save tax and create wealth! And for the same, visit MySIPonline which caters the investors with an all in one platform to invest in such and other type of funds.