Know Which Sector Equity Funds are Providing the Best Returns

Investing in mutual funds is trending these days because of the growing awareness of savings and earning double-digit returns. But many of the investors make the mistake of choosing the wrong fund in their portfolio. It is well known that returns on investment depend on the various market trends which are uncertain.

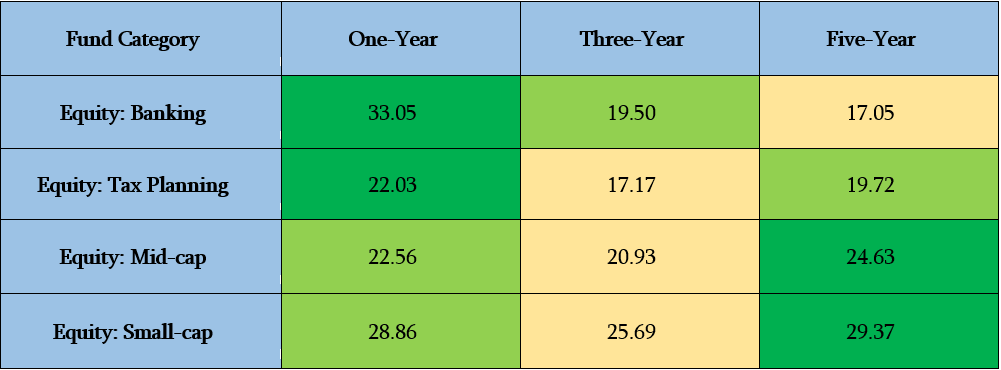

But, the good part is that the fund's future survival can be assumed on the basis of its past performance; and accordingly investment can be made. If you are also willing to earn exponential returns by investing in equity funds, here is the list of some of the categories which provided excellent profits in the past years. The figures below show the one-, three-, and five-year trailing returns from various categories of equity mutual funds:

Chart Showing Trailing Returns:

Trailing one, three, and five-years returns from various sectors as on August 01, 2017.

- Banking Sector Equity Funds : Investments in the banking sector have provided positive returns to the investors. If we see the income from investments in the banking sector, the whole chart shows green numbers which indicate no negative results. The investors who invested in the equities of this industry have made excellent profits from the one-year trailing returns. So, on the basis of the great records of last five years of the banking sector, we can estimate its potential to generate high profits for the investor.

- Equity Tax Saving : If you want to avail deductions on taxable income which is provided u/s 80C of the Income Tax Act, there are various schemes which help to achieve this objective along with fantastic returns. The investors who invested in the various equity tax saving schemes have earned excellent profits on their investments. Equity Linked Savings Scheme (ELSS) offers tax benefits of up to Rs. 1.5 lakh under section 80C.

- Equity Mid Cap : Those funds which majorly invest in the stocks of mid-cap companies have managed to provide exceptional returns to the investors. In the past five years, there have been great changes in the categories of mid-cap companies which resulted in positive growth. Thus, the investors of such schemes are happy as they received tremendous profits from their investment. Accordingly, the mid-cap companies have the potential to grow exponentially well in the future too. So, if you still have no investment in any mid-cap scheme, don’t miss the opportunity to grab the growth-oriented investments.

- Equity Small Cap : The trailing one-, three, and five-year returns of this category of investment ranges from 25% to 30%. It shows how amazingly the small-cap funds have been performing in the past five years. There are no doubts that the stock of big companies provides more safety from market volatility. But, the small entities are making their own track records of providing multiple returns which are attracting the interest of more investors. If you too wish to grab excellent returns on your investment, you must add the most suitable small-cap mutual fund scheme to your portfolio.

These four categories of equity investments have performed extremely well in the past years and provided great returns to the investors. The trailing returns of these categories show their potential to grow capital value in the various market trends over a long period of time. One can make investments in these fund classes for achieving their financial goals, but must consider these points before investing in any scheme:

- Objective of Investment : You must know the purpose of the scheme you are intending to invest in, and should match it with that of yours. If you are planning to purchase own house in a short duration, then your investment in small cap funds or tax planning may not help you achieve the objective efficiently.

- Long-Term Investment : Mostly the investments in equities are of long-term nature, and they may not provide excellent returns in short period of one year. If you want a short-term investment scheme, then parking your money in equities won’t work perfectly for you as per your requirements.

- Volatility : Equity investments travel through a great ride of volatility, and it shows various phases of the market to the investors. However, in the long run, they tend to provide good returns.

Therefore, if you too want to grab the amazing profits from equities, turn on the investment in the categories as mentioned above. If you want to start investing online through MySIPonline, you must get associated with us right away.