Is it the Right Time to Invest in IT Sector?

With the revival of the US economy, Indian IT sector is enjoying good seasons. The other reasons which are in favour of the same include the devaluation of INR as well as the focus of Indian Government on Digital India.

Talking about numbers, the Information Technology sector funds have successfully been able to deliver returns as high as 30.5% in the last one year. Experts believe that if the economy in the States continues to rise with the same momentum, then these funds will experience growth even in the coming time period. Considering the increasing interest rates in the US, the growth is good, unemployment is less, President Trump is planning to cut down the corporate tax, and the economy is doing well; thus all these factors can bring ample of opportunities for the Indian IT market.

So, will it be right if we say that the rough patch for the Information Technology sector has finally been over and they seem to be back on track? Let’s find out here!

Reasons for the Declination Phase

Indian IT professionals and the sector as a whole was experiencing a major fall in the last few years. The crackdown by the US President, Donald Trump, on H1-B visas(the work visas which are used widely by tech-companies) came as a double whammy. Besides, the industrial revolution, technologies like Artificial Intelligence and shift to computerization displaced workers that eventually added fuel to the fire of decline.

Some other reasons included Brexit, weaker discretionary spending, and growing pricing pressure in the traditional business that became the factors due to which Indian IT segment experienced a downfall.

Turning Around its Fortunes: What Has Led to the Spike in IT Sector & Mutual Fund Investments?

After facing rigorous headwinds for about 2-3 years, the sector is witnessing a rise in spending by almost 15 percent on the various upcoming projects. Taking stats into account, the numbers from the big IT companies were exceptional in the last quarter, leading to a spike in Information Technology sector.

Let’s check out the points responsible for the same!

- Surprisingly, the sudden rise in the digital usage coupled with a new set of technology advancements and evolution which include Blockchain and AI has offered the IT sector with a new perspective.

- There is an allocation of about Rs 3,073 crore for Digital India Program and Rs 10,000 crores the creation of telecom infrastructure which in turn has a big hand in creating new opportunities for the sector.

- Further, the strengthening of the US dollar against rupee and other currencies provide a cushion to leverages on its new set of business model.

- The upsurge in the oil prices also played a significant role causing an uptick in the performance of technology sector funds, that too when the entire pack of market caps was down due to the same factor.

- Another reason being is that the Indian IT segment is an export-based sector, hence any declination in rupee against the dollar is a win for them.

- This rise can also be due to the expensive valuation in other sectors of the market. As the market touches fresh all-time highs, the valuations of the market capitalization too stretched, and thus fund managers who preferred buying less expensive stocks turned to IT segment.

What Should the Investors do?

Our experts believe that the investors who have moderate to high-risk profile can aim to invest in this sector funds. However, the investment made should be long-term. Indulge yourself in good value buys, and enjoy growth as the IT prospects are looking good for at least next one financial year. One must not forget to consider the fact that the IT funds are not for everyone. Thus, you must assess your risk profile and take a good knowledge of the sector before vesting your money.

List of Best Performing Technology Funds

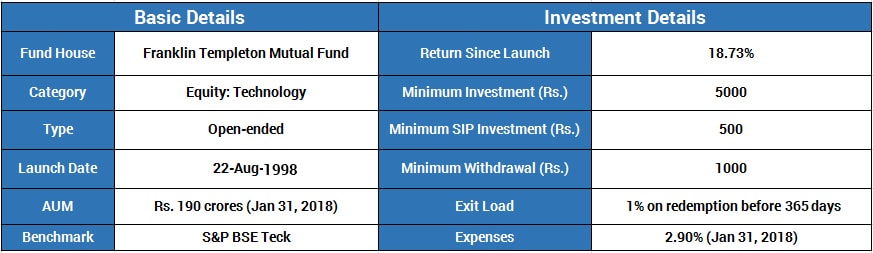

- Franklin India Technology Fund(G): The scheme invests primarily in stocks that are a part of the technology. The purpose is to invest in companies with good quality management that carry the potential for faster growth. The recommended investment horizon in this scheme is five years or more.

Details of the Scheme:

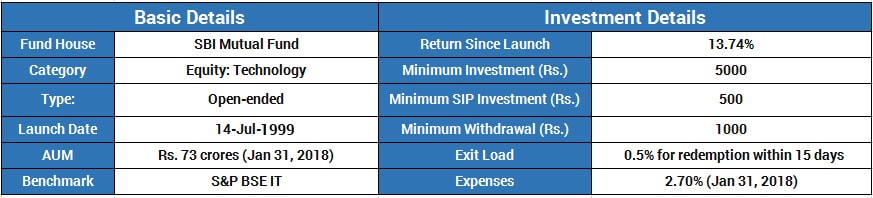

- SBI IT-G: The main objective of this technology fund of SBI is to provide the investors with maximum growth opportunity through equity investments in stocks of growth-oriented sectors including one of the major concentrations in the IT sector.

Details of the Scheme:

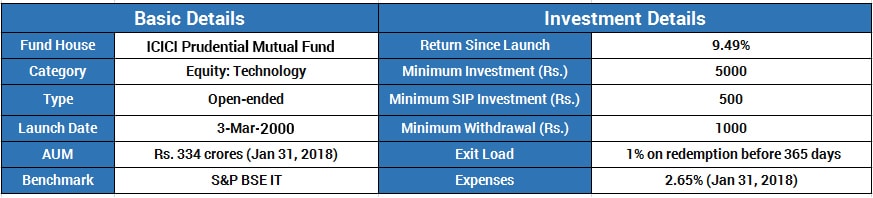

- ICICI Pru Technology-G: This technology fund offered by ICICI Prudential concentrates its investments in the IT sector as well as the related sectors of India. It allows the investors to start with as little an amount as Rs. 5,000.

Details of the Scheme:

Lastly, as an investor, you are bombarded with strategies to buildup your investment folio. There are plenty of investment options available, and considering the sector funds, there should always be a room in your portfolio if this particular sector is expected to provide good returns. This will help you to diversify your investment and take benefit of the opportunity to make profits from what’s trending.

For a more personalized recommendation, don’t forget to consult an expert. You can connect us for the same via phone or email. We, at MySIPonline, are known to provide the best online SIP investment services.