Is it Right to Continue with SIP Investments When the Market Experiences Volatility?

There’s this famous saying by Legendary Investor Warren Buffet, “You don't need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ”. Considering the investment’s success, superior EQ plays an important role than high intelligence quotient. You might be wondering, what’s the use of this moral lesson? Well, here is the explanation!

According to studies, people with high emotional quotient or EQ are less likely to get swayed by the feeling of greed or fear. Thus, in relation to investments in SIPs, these people are those who follow a much-balanced approach to investment. They usually make fewer changes in their investments, thus end up getting high returns in the long-term tenure.

Coming back to the main topic, several investors have a common question that is it a correct strategy to continue with SIP investments when the market hits the rough patch, or it’s time to throw in the towel. While the latter can be the best escape for many SIP investors out there, the wise ones will always choose to continue.

Let’s understand the process of SIP investments in the volatile market with the help of an example.

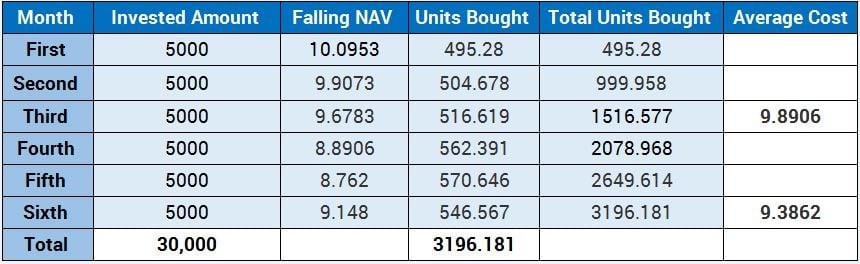

Suppose you invest Rs 5000 per month in SIP. Now, assume that it is a falling phase for the market. Thus, as in SIP investments, it’s the time when you’re able to purchase more number of units as there is a drop in NAV. As per the table, you can see that you will be able to get benefit from a lower average cost. In case you decide to stop your SIP investment after the 3rd month, the average price would have been Rs 9.8906 which is much more than Rs 9.3861 if you continue to invest till the end of 6th month.

Let’s see what happens when you withdraw all your investments midway!

Assuming that you redeemed your investments after the 6th installment, your investments would get affected in two ways. In the first case, the value you redeemed from your investment may be lower than the amount you had invested (as in this case, Rs 9.1480* 3196.181 units gives Rs 29,238.66, whereas Rs 5000* 6 installments equal to Rs 30,000). The second drawback of doing it is that the most recent investments may not be free from the exit load period. This states the amount thus redeemed would be even reduced by the exit load charged.

Having discussed that withdrawing a current SIP in a volatile market may not be the most favorable action, we will further talk about the various aspects which provoke investors to withdraw early.

What Factors Are Leading to This Early Withdrawal in Investors?

Several recent changes such as the return of long-term capital gains tax on equity mutual funds and sudden volatility in the market have led some investors to think about stopping their Systematic Investment Plans (SIPs). There is a lot of chaos in the market as still there are investors who do not know about the grandfathering clause or exemption on returns on gains made till January 31st, 2018 and on calculating the tax liability.

The re-introduction of LTCG tax along with the recent turmoil in the markets have deeply hit the sentiments of investors on D-street. The significant segment of these quitters include the DIY investors who have themselves concluded that there is no point of continuing the SIPs in the current market scenario.

What Can be Done to Avoid Early Withdrawal of SIPs?

- Manage Your Investments Less, and Your Emotions More

The first rule to investments is to avoid panicking when the market experiences change. When we panic we do not think clearly, thus end up taking wrong decisions. Controlling emotions at the time of investments is easier said than done. It is because people often get worried when their investments lose value, and during that time panic is a natural human reaction. To overcome it, you need to make an effort to stay calm and focused.

In all such times remember that your initial investment in SIP started with an aim. Thus, the bull market, bear market, volatile markets, range bound market, etc., are all part of the journey towards your destination. If you are focused, what comes in the journey towards the goal will not be a distraction. Focus and discipline are two important aspects of emotional intelligence in investing. - Treat Volatility As Your Friend in Long-Term Investment Journey

Quoting early withdrawals in SIPs, Deepali Sen, Founder of Srujan Financial Advisors said, “Stopping your investments in mutual funds before you meet your goal is never a wise decision. Moreover, if you are investing via SIPS, volatility is your friend.” Thus as the prudent investors do, you should use the volatility in your favor. SIP provides the benefit of Rupee Cost Averaging. Thus, with the fixed amount of investments on a regular basis in mutual funds, you can average out the cost of purchase.

The idea here is simple! You buy more units when the price is less, and less units when the value is more. Rupee cost averaging works for you by reducing your average cost of acquisition, thereby enabling you to earn rewarding returns in the long-term period.

We hope after going through this write-up, you’ll be able to manage your SIP investments in mutual funds even in the volatile market. Smart investment decisions taken in unstable market conditions can help you significantly enhance the returns on your online SIP mutual fund investments. More importantly, discipline and commitment towards the investment plan are essential when investing.

For more such informative blogs, stay in touch with us. We, at MySIPonline, provide the best online investment services. Further, you can also get the recommendations on various types of mutual fund schemes that you can prefer to invest in.