How to Choose the Best Mid-Cap Mutual Funds to Invest in FY 2018-19?

Aggressive investors primarily look for eye-popping returns for which they are even ready to risk their investments. For instance, the recent correction in the stock market may have hit the mid-cap funds, but investors’ fascination for them has not diminished.

The investors prefer to invest in mid-caps because they believe them to be the future market leaders on the basis of their past performances. But we would like to inform you that with mid-caps, it is not going to be a smooth ride. However, if you are passionate about parking your money in mid-cap mutual funds despite their extremely volatile behavior, then you must follow a strategic approach to opt for an appropriate scheme to invest in.

Apparently, the above concern gives rise to the question - How to choose the best mid-cap funds to invest in?

We have analyzed that majority of investors select the mutual funds on the basis of their historical performances and that too over a shorter period. However, taking the investment decision based on a single or shorter time frame may not yield the best returns as a fund can be top performer for one time frame while underperformer for other. So, the investors are advised to invest in the funds which have consistently outperformed their benchmark and category average over various and longer periods of time.

For the same purpose, you can follow a methodology that considers the below mentioned parameters for choosing the best mid-cap funds in the same order.

- Past Performance Consistency: Trailing annualized returns for different time frames such as 1, 3, 5, and 10 years.

- Mean Rolling Returns: Rolled quarterly for the last 5 years.

- Risk Parameter: Defines the risk involved in investment with respect to the category.

- Outperformance: Risk-adjusted returns generated by a mutual fund scheme relative to the expected market return or benchmark and category average. These are the average returns generated by the MF Scheme.

Apart from the consistent performance, a few other qualitative and quantitative factors also play important role in scrutinizing an ideal fund. Therefore, including the data such as Mutual fund rating, AUM, fund age, expense ratio, fund manager’s investment style, etc. is equally essential. Moreover, investors are suggested to check at least last 3 years’ performance of a fund. To ensure that the fluctuation in the performance of the funds does not hamper your average amount of returns you must invest for a long-term.

Which are the Best Mid-cap Funds to Invest In?

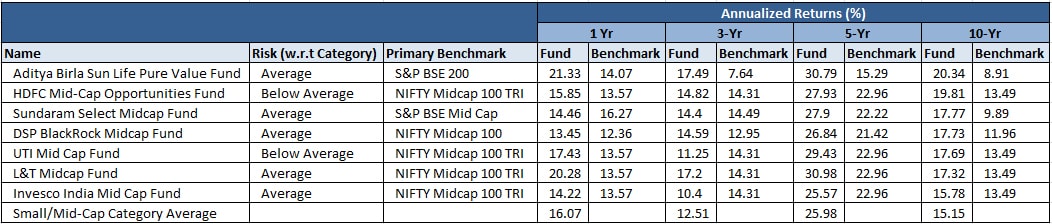

Below is the list of the funds that have been handpicked by our experts on the basis of their consistent performance over different time frames. The list also depicts the risk related to every fund as compared with the category.

*Returns calculated are annualized

The funds in the above table are arranged according to their performance over the period of past 10 years in decreasing order. As we can observe, the selected funds have consistently outperformed their benchmarks and category across not only one but all the time frames over 10-years as on April 10, 2018.

Conclusion

Mid-cap funds have undoubtedly rewarded their investors with impressive returns at times. But, it is advisable to keep the exposure of your portfolio within the optimum levels while investing in mid cap mutual funds. The reason being, mid-cap funds can be highly risky as they readily get influenced by the volatility of the market. We have already recommended the funds that have outperformed their primary benchmarks consistently, but to help you invest better MySIPonline would like to guide you throughout the investment process.