How taxation on mutual funds will play after budget 2018-19?

It’s a matter of surprise for all the investors in the market, as the budget of 2018-19 has been recently announced. Everyone around is getting curious to know, what actually the comeback of LTCG Tax in scene has bought for them. Earlier in 2004-05, the government had decided to exempt the long-term capital gain from levy of tax.

But, it was observed that the returns of equity mutual funds were too lucrative even without tax exemption, so to make a pick on tax evaders, our Finance Minister, Mr. Arun Jaitley has made it a point to bring LTCG in the tax net. Also, to the amazement of investors, tax is levied on income distributed to them in the form of dividends in mutual funds. To get in detail of what has happened, let us first understand new imposition of Tax on long term capital gain earned after 31st January 2018.

As we all know, the gains on mutual fund investments are classified into short term and long term. Further, the rate of tax is applicable according to the types of mutual funds such as equity and debt funds. Where as of now:

In equity mutual funds money invested for less than 1 year is covered in short term capital gain and tax is levied at the rate of 15%. And if investment tenure exceeds 12 months, the gains on such investment is known as Long Term Capital Gain and the same was tax exempted income.

In debt mutual fund the duration of short term is 3 years or 36 months and redemption of investment before it is taxable according to the slab rates.The long-term capital gain is taxed at 20% with inflation indexation benefit, if redeemed after the tenure.

As per the introduction of budget, there is no changes in the taxonomy of the mutual fund investment except reintroduction of LTCG Tax. Additionally, tax will be levied on the distributed income from equity mutual funds in the form of dividends. The first provision is expressed by our finance minister Mr. Jaitley when he said that there will be imposition of tax on long term capital gains exceeding 1 lakh at the rate of 10% without allowing the benefit of any indexation. However, all gains up to 31st January, 2018 will be grandfathered.”

The second change is addition of tax on dividend income in equity mutual funds. Now, dividends would be taxed at same rate as of long term capital gain in equity i.e. 10%. This is done so that people do not avoid tax on long term capital gain by switching the route to the dividend option.

A big question which comes in mind while interpreting an important line, in the new provision, is “All gains until 31st January 2018 have been grandfathered.

Well this explains that the new cost of holdings to your equity mutual funds is the closing price or NAV on January 31st, 2018. However, the cost of purchase will remain same. Let’s check the calculations of LTCG tax by taking different scenarios to cover the above provision.

Scenario 1

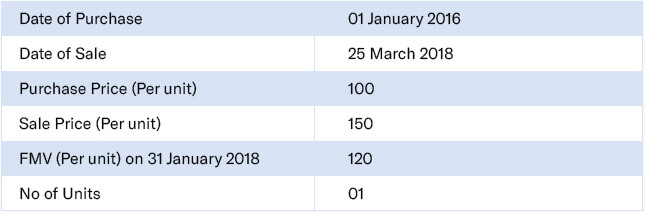

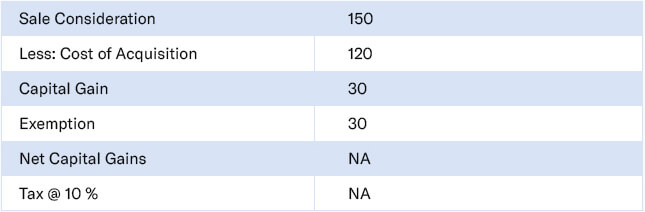

How much LTCG Tax will you pay if redeemed before 31st March 2018

Computation of taxes on LTCG

Scenario 2

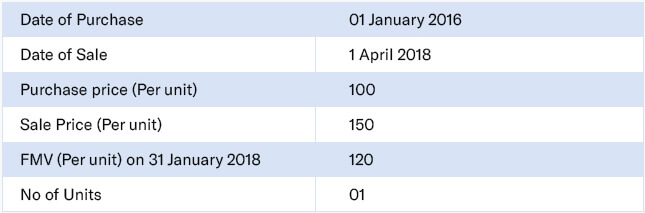

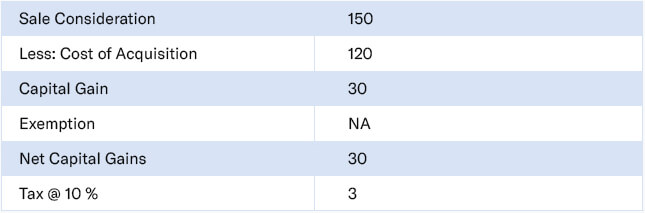

How much LTCG Tax will you pay if redeemed after 31st mar 2018

Computation of taxes on LTCG

Scenario 3

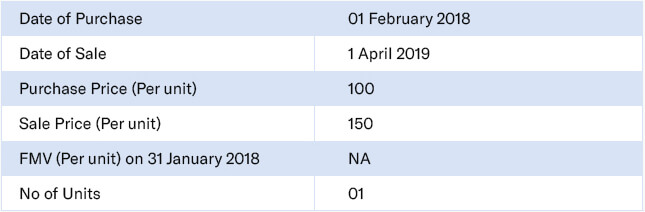

How much LTCG tax will you pay if purchased and sold after 31 January 2018.

Computation of taxes on LTCG

*No LTCG Tax on gains up to INR 1 Lac in one FY from 2018-19.

*FMV: Fair Market Value

Now what can be the escaping window from these scenarios?

- If you sell the units of mutual funds before 31 January 2018, you can still claim tax exemptions on LTCG. According to the new tax regime, LTCG is effective for the transactions done from April 1,2018

- LTCG on these instruments realized after 31 April 2018 by an individual will remain tax exempted up to Rs 1Lakh Per annum.

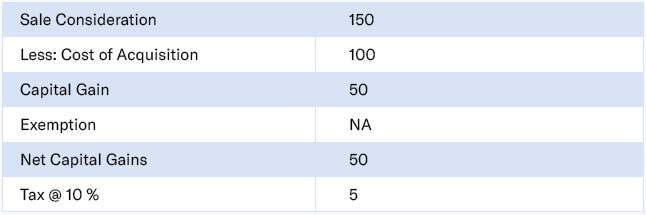

New Tax rate on the mutual fund for individuals:

*Gains up to 1lac are free of tax and tax applied on gains above 1 lac. Earlier the rate was 0%.

# Dividend tax of 25% + surcharge if applicable)+ cess

$ Dividend tax of 10% + surcharge (if applicable)+ cess

CESS

Health and education cess increased 4% from 3 %.

Surcharge :

- 10% of the Income Tax, where taxable income is more than Rs. 50 lacs and upto Rs. 1 crore.

- 15% of the Income Tax, where taxable income is more than Rs. 1 crore.