How Can Spike in the Crude Prices Affect Your Mutual Fund Investment?

It wouldn’t be wrong to say that over the last few months, crude oil prices have witnessed an unprecedented spike. According to reports, it has already hit its highest level since November 2014, thus making its valuation $80 a barrel.

Today, in this write-up, we will focus on what changes it can bring in the mutual fund industry and Indian stocks and what are the major funds that will have to grin and bear it.

What Impact will it Generate for the Indian Investors?

It’s a critical time when India might be in for a ‘crude shock.’ The rising price of the commodity is mainly on the back of geopolitical fears over potential supply disruption after the States withdrew from the Iran nuclear deal as well as supply shocks in Venezuela, Mexico, and Libya.

India, being the net importer of crude oil, imports approximately 80% to fulfill its crude oil’s requirement. This is the reason why a noticeable change in the prices will strain country’s fiscal deficit and trigger inflation concerns for the RBI. It might even dent hopes of the credit rating upgrades.

Not All Doom and Gloom

When it comes to an upsurge in oil prices, not all bear the brunt, as there are a few sectors who find value amid all the chaos. There is one side where companies in the natural gas and oil service sectors will face the headwinds from rising prices, and then there is another, where several segments will be well-positioned.

A spurt in Brent prices will increase the raw material cost, operating cost, and working capital requirements for user-oriented industries such as lubricants, chemicals (including consumer staples), and paints.

The same will prove to be beneficial in the case of export-oriented sectors such as IT and pharma as the rise in crude prices will put pressure on the currency as well.

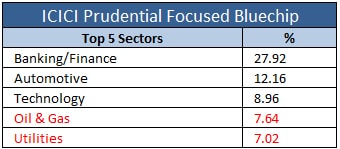

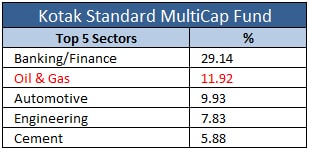

Mutual Fund Schemes That will Face the Consequences

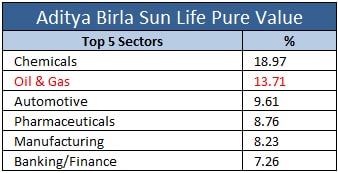

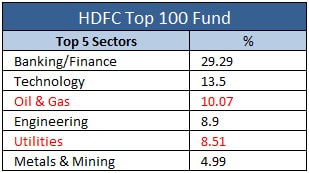

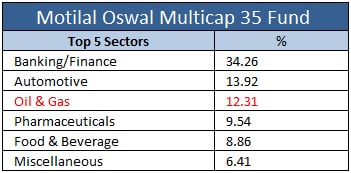

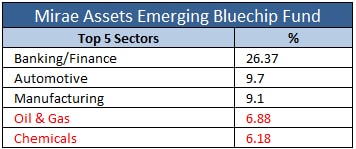

Due to greater exposure in the sectors effecting from the rise in crude oil prices, the listed mutual funds can get affected:

![]()

What Investors Should Be Mindful About?

In India, the increase in the oil prices will bring added pressure to the downstream oil and chemical sector. It will also lead to higher inflows from the middle east. Considering, the macroeconomic front, the rising crude rates mean a spike in inflation rates, disturbance in fiscal math, rise in petrol and diesel prices, and an increase in the probability of an interest rate hike. Going with the trends, it could mean inflow of funds and a rally in the equity market.

In India, the increase in the oil prices will bring added pressure to the downstream oil and chemical sector. It will also lead to higher inflows from the middle east. Considering, the macroeconomic front, the rising crude rates mean a spike in inflation rates, disturbance in fiscal math, rise in petrol and diesel prices, and an increase in the probability of an interest rate hike. Going with the trends, it could mean inflow of funds and a rally in the equity market.

For much such informative blogs, stay in touch with the experts working at MySIPonline. If you are worried about your mutual fund investments and wish to seek guidance on the same, then too you can reach out to us via call or email.