Government’s Next Move! Merger of Banks in India

The government of India has bid to consolidate the public sector units in the banking sector through mergers to create three to four globalised banks and reduce the number of state-owned banks to twelve in the country. The public sectors bank will reduce to up to twelve in the medium term, and as per the three-tier structure, there would be at least three to four banks of the size of SBI (State Bank of India).

The official has confirmed that some of the region-centric banks like Punjab & Sind Bank, Andhra Bank will continue to remain independent entities while some of the mid-sized banks will also co-exist. The Union Finance Minister Arun Jaitley said that the government is working towards building a consolidated banking sector, but he declined to provide any detail about the same as the information is price -sensitive and may impact the valuations of the entities involved. The SBI merger has been successfully implemented, and now the government is planning to execute another such proposal by this fiscal if the bad debt conditions come under the control.

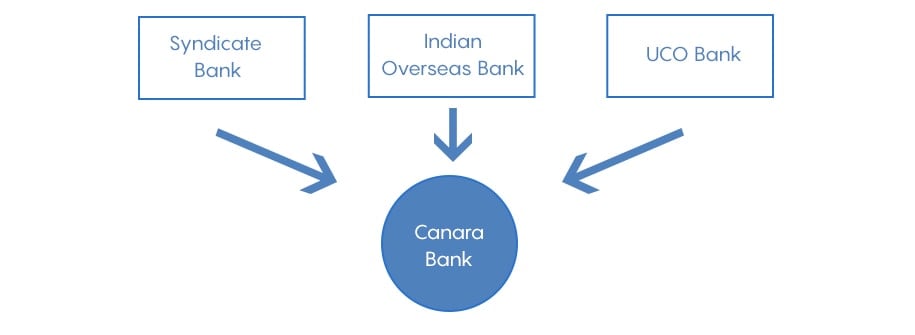

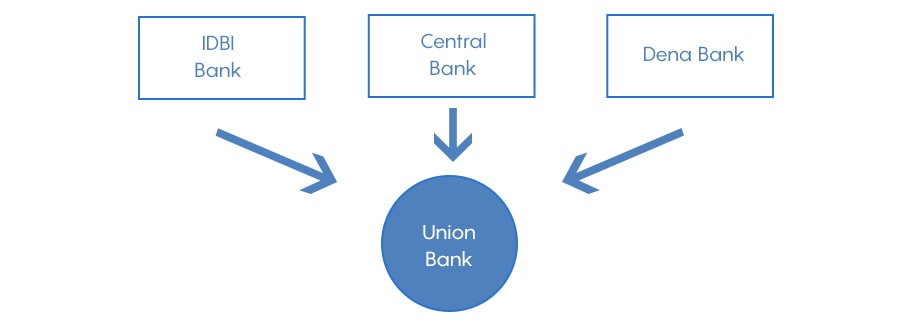

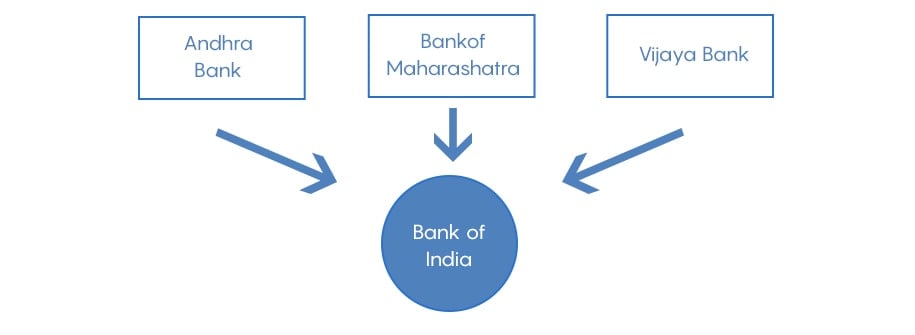

The experts have analysed that United Bank & P&S bank would merge into Bank of Baroda, while Indian Overseas Bank, Syndicate Bank, and UCO Bank will get merged into the Canara Bank. Furthermore, the IDBI Bank, Central Bank, and Dena Bank will all merge into the Union bank, while Andhra bank, Bank of Maharashtra, and Vijaya Bank will get merged with the Bank of India.

Reports state that as per the last consolidation held in the month of April 2017, five associate banks of SBI which include State Bank of Bikaner and Jaipur (SBBJ), State Bank of Hyderabad (SBH), State Bank of Mysore (SBM), State Bank of Patiala (SBP) and State Bank of Travancore (SBT), and the Bhartiya Mahila Bank (BMB) became part of the State Bank of India, catapulting the country’s largest lender among the top 50 banks in the world.

With this merger, the total client base of the SBI has reached to 37 crore, with the branch network of 24000 banks, and 59000 ATMs across the country. This has led to a great growth of country’s largest lender and is expected to make a considerable change in the Indian economy. Furthermore, with the upcoming consolidations, it has been estimated that the economic conditions would become favourable for all the sectors and majorly for the banking funds.

If you wish to be a part of this growth channel, then staying awake is of vital importance. Get associated with MySIPonline and subscribe to our newsletter to stay updated with all the latest advancements and expectations in the Indian growth story. We have every investment and financial solution for your goals.