Good Time to Invest in IT and Pharma: Know the Best Recommended Mutual Funds

The tech funds have indeed been the flavor of the season with clocking over 39 percent of returns in the past one year. This prodigious performance has led the sector to outsail all the other equity fund categories by a considerable margin.

Thus, it will be wise to say that the IT funds are enjoying a stellar run in the stock markets. Several investors also bet that although the momentum rests with the information and technology sector, the underperforming pharma funds can also be a good pick for investors who can undergo contrarian sail with a long-term perspective. Let’s find out the real story!

What Has Caused the Shift in the Headwinds for IT?

The devaluation of INR and the strict new rules of the US administration concerning to the H-B1 visa which is widely used by the Indian IT employees are two of the firm reasons supporting the upsurge in the Indian IT mutual funds. To the result of these, the sector experienced revival by bringing positive changes on global macro environments, increasing IT budgets, and adopting new technologies. The share prices soared with the attractive trading of most stocks in the segment.

Expert’s Take : The experts believe that the emerging technologies now are offering an entire new gamut of opportunities. Here’re some points that support our analysis:

- Being the topmost offshoring destination for IT companies globally, Indian IT segment has proven its capabilities.

- With the huge demand for technology and innovation, the sector is poised for a brighter earnings performance.

- Improving industry fundamentals and new updates on the technological grounds including VR, drones, headphones, and artificial intelligence are acting as prime catalysts in the growth of the segment.

Thus, investors who participate in this secular theme of digital transformation by taking exposure to tech funds are destined to gain from it.

Rough Patch for Pharma Funds, Yet Good Investment Opportunity for the Savvy Investors

The bad run in the pharma sector too continued, and the biggest concern right now is the steady erosion of big Indian pharma giants in the US generics market. The increase in competition has lead to the drop in the shares of Indian drug makers. Even the government’s price control measures have added friction in the growth of this sector. Thus, with no surprise, the pharma sector has been the biggest laggard in the race.

Road Ahead : Analysts have strong hopes with this segment in the future; thus it is recommended that investors who are seeking aggressive sector play can hop on to this segment taking contrarian sail. Reason being that the division has bottomed out, and it’s providing a strong upside potential now. Thus, even a small up-tick will result in a substantial rise in the valuation of its stocks.

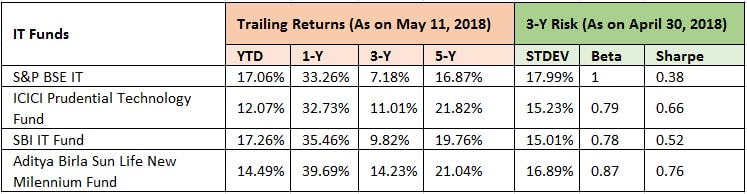

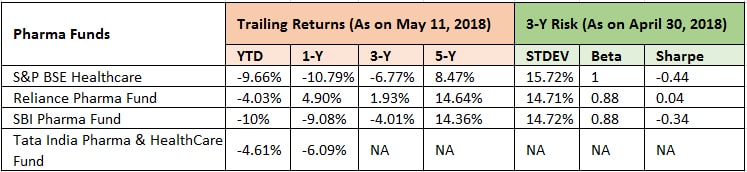

Here Are Some of the Best Recommendations for Pharma and IT Segment:

Who Can Invest?

Investors who have moderate to high-risk appetite can plan to invest in these funds for a long-term. Such funds provide a direct play in the market which is something challenging to experience in diversified funds. A sharp uptick in the performance of such dedicated sector funds can be highly rewarding for the investors. However, due to the absence of other sectors to cushion the fall in diverse times, it can be a risky bet for new or risk-averse investors.

Going for SIP investment can be a wise decision for someone who doesn’t understand the sector well. To bring more clarity in your conviction, we, at MySIPonline, recommend you to connect with our financial analysts and talk to them concerning all your doubts or queries.