Active Funds v/s Passive Funds: Which One Performs Better and When?

Observation is a passive science, experimentation an active science. - Claude Bernard-French Physicist. The above quote from “one of the greatest of all men of science" perfectly defines how the investments of Active and Passive Funds are strategized.

Yes, we are talking about two different investment styles that are fundamentally adopted by fund managers to construct the portfolios according to their vision. Active and passive investment styles have the primary difference that fund managers have no role to play in passive investing. Let us try to understand the contrast between the two investing styles in brief and find out which one of them serves the investors better and when?

Going by the Definition

- Passive Funds: Passively managed mutual funds work on buy and hold strategy by investing their money in all stocks of the benchmark index they are based on. As a result, they tend to mimic the returns of their particular index. Index funds and ETFs (Exchange Traded Funds) are two products that come under the shed of passive funds.

- Active Funds: On the other hand, actively managed funds look for the opportunities and buy the shares of the companies which have the potential of growth, and churn the portfolio when the stocks reach their saturation. Active funds include equity, debt, hybrid, income, and money market funds earnestly managed by various fund house managers.

Investment Strategies

Active fund managers look for the growth-oriented stocks and bonds which are expected to outpace the others in that same asset class. Some of them adhere to value investing and look for the undervalued companies while some may invest with the expectations of the relative performance of different economic sectors. Whereas, the passive fund managers actually have nothing to do, but follow the benchmark of the fund. They spend the assets of the fund in proportion to the allocation of their index. For instance, an index fund tracking Nifty 50 will invest in the Nifty 50 stocks, following the same allocation pattern as the index. Based on the investment patterns both the strategies have their own pros and cons. Have a look.

Pros and Cons

Actively managed funds provide you with a professional fund manager who manages the funds on your behalf and try to outperform the set benchmark. Passive funds again may not necessarily have a fund manager to decide the investments. They reflect a market index and the fund manager’s skills cannot influence their performance.

As a result, the active funds typically have a higher expense ratio than the passive ones. The active management involves regular monitoring and research, thereby increasing the expenses for the investors.

Which One is Better for You?

A short answer is - Depending on one’s circumstances both the types of funds can turn positive in a well-diversified portfolio. Appropriate diversification among active and passive styles can reduce overall expenses, add-on to the returns, and help mitigate risk in different market cycles. Moreover, passive funds keep their equity allocation exactly as the market index which depicts their suitability for the ones who have a low-risk appetite. They also provide the advantages like liquidity and low investment cost which place them at the top in the list of conservative investors. However, active fund investments have periodically given higher returns to the investors with the steady growth of emerging Indian market and professional fund management. Additionally, selecting one among these two types also depends on willingness of taking risk by the investor.

Performance Factor

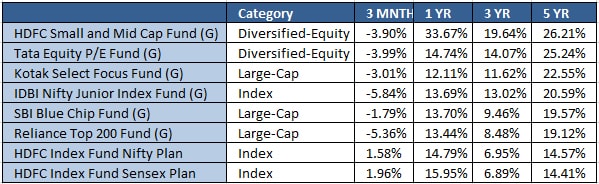

Performance of a fund in different market cycles plays an important role while making selection. But, chasing historical performance of either an active or an index fund is impractical as the below data shows that a passive fund can outperform an active one in some market cycles, and vice versa.

Passive schemes like index funds trace their benchmarks more closely than others and give steady but limited returns. However, this behavior of passive investing reduces the chances of mistake and deviation from the benchmark returns. On the contrary, active funds not only provide you with substantial returns, but also protect your investment from the downside risk if the benchmark falls.

The analysis over a period of 10 years has shown that actively-managed funds have generated an average of 22.58% return as compared to the average return of 17.94% of passive funds for the same period. This shows that actively managed funds perform better over long period of time.

Actively managed large cap funds have been able to deliver much higher returns than the index funds in the initial stages of the market recovery. However, the gap in outperformance reduces significantly when the stocks are over-valued and the bull-market gets mature.

Conclusion

Mutual fund portfolios can benefit from both the active and passive strategies as they perform differently on a relative basis during different market cycles. Experts have acknowledged that passive funds play a crucial role in an actively managed diversified portfolio. Passive management clips overall expenses and act as a hedge in the negative periods of active funds. And a skilled active management along with diversification can offer both “alpha” as well as safeguarding benefits to a portfolio. The only necessity for choosing an ideal fund is figuring out a strategy that would work for your risk profile and investment goal.