Planning to Invest for 5-7 Years? Here Are the Best Recommended Mutual Funds

With the rise of the mutual fund industry, people are starting to realize that this market is for those who are in it for a long run as most of the schemes had shown some really good returns on long-term investment.

Today, we are going to discuss a portfolio of 4 schemes for investors who are ready to invest for a period of 5-7 years and have a moderate to high risk appetite. So, without any further ado, let’s get started!

Best Mutual Funds For 5-7 Years

- L&T Emerging Businesses Fund

- SBI Blue Chip Fund

- Mirae Asset Emerging Blue Chip Fund

- HDFC Mid Cap Opportunities Fund

L&T Emerging Businesses Fund

A small cap fund that invests in emerging businesses. The reason that this fund is on top of the list is due its performance since inception. L&T Emerging Businesses Fund has a current NAV of Rs 26.97 (as on Jun 14, 2018) and with major investment in sectors like Engineering, Construction, Manufacturing, Chemical, and Finance. The returns it has given in a short period of 3 years are just astonishing. Let’s have a look at the returns to understand that how good this fund really is.

.jpg)

(As on Jun 14, 2018)

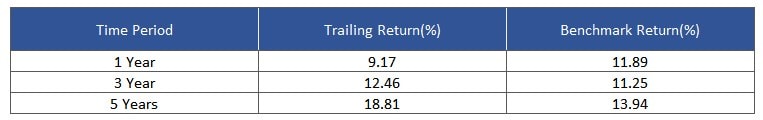

SBI Blue Chip Fund (G)

SBI MF, being a big name in the mutual fund industry, has always provided investors with good outstanding schemes and SBI Blue Chip Fund is one of them. The fund has shown consistent progress and has been leading the benchmark for quite some time now. The fund falls in the large cap category and invests majorly in growth sectors like banking, automobile, finance, consumer, and construction. This scheme is recommended to new investors too as the risk appetite is comparatively low.

(As on Jun 14, 2018 )

(As on Jun 14, 2018 )

Mirae Asset Emerging Blue Chip Fund

This fund is among the top-performing mutual funds from a very long time. This scheme falls in the mid-cap category and invests majorly in banking, consumer non-durables, pharmaceuticals, auto ancillaries, and textile. Mirae Asset Emerging Blue Chip Fund gave an outstanding return of 30% in 5 years time period as on June 14, 2018, which is really great as compared to its peers.

.jpg) (As on Jun 14, 2018 )

(As on Jun 14, 2018 )

HDFC Mid Cap Opportunities Fund (G)

This fund is among the top most funds provided by HDFC. With an objective to provide long-term growth, this fund has shown some strong growth. HDFC Mid Cap Opportunities Fund falls in the mid-cap category and has investments in sectors like finance, engineering, technology, chemicals, and automobile. It has an asset size of Rs 20,616 crores (as on May 31, 2018).

.jpg?t=1529141034852) (As on Jun 14, 2018 )

(As on Jun 14, 2018 )

So, these were the funds that can prove to be a gamechanger for your portfolio. But it is strongly recommended to do a self-research on any fund that you are going to invest in. To seek expert opinion in this regards, you can connect with us at MySIPonline. We will be happy to serve you with all our might.