Kotak Select Focus Fund: Analysts’ Best Choice

Reliance Industries Ltd., ICICI Bank Ltd., Maruti Suzuki India Ltd., etc., are among the top 30 well-established and financially sound companies whose growth ultimately adds to the overall enhancement of the Indian economy.

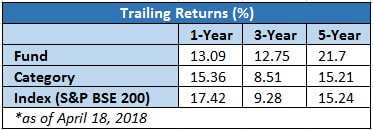

S&P BSE Sensex is the standard benchmark of Indian stock market which includes these all-time growing companies. To invest in them in one go, large-cap mutual funds can be a good option. One such capable large-cap scheme that has generated 21.7% annualized returns as compared to 12.43% returns of Sensex in the past 5 years is Kotak Select Focus Fund.

Introducing Kotak Select Focus fund – 5-Star Rated Fund from Morningstar

Kotak Select Focus Fund is a large-cap growth-oriented scheme which was launched in September 2009 with a motive of gaining capital appreciation in long-term with low-risk probabilities. As the name suggests, the fund’s portfolio has more than 70% of its assets spread across large-cap stocks, but it has considerably invested in mid-caps as well. As the scheme came into existence after the big market crash of 2008, its behavior is still to be tested in the market peaks. However, it was able to contain the downside in 2011; as a result of which Morning Star has awarded it with a 5-star rating.

Performance Analysis:

The table represents the calendar year returns of the fund in comparison with the Category & its Benchmarks.

Whether it is bearish or bullish, Kotak Select Focus Fund has outperformed not only Sensex but its benchmark and category as well, in both the tones of the market. Two cardinal rules of investment that has been adopted by the fund have created a bright history for it. Firstly, the management aims to invest for a long term period and secondly, it tries to maintain low portfolio turnover which is around 33% currently. Doing so enables the fund to register outperformance through both stock selection as well as sector allocation. The figures below depict the rest.

Despite its assets spread over the cyclical and sensitive sectors, the fund has been able to perform outstandingly by generating an average of 15% returns since its inception. Not only that, it has been consistently outperforming its peers and benchmark even during the market falls.

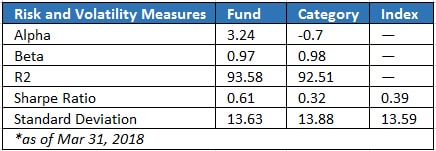

Risk Analysis

The fund has a lower Standard Deviation and Beta which show that it is comparatively less volatile than its benchmark and peers. The fund has sustained the thrashes of market falls by giving negative returns of -16.91% as compared to -20.21% of its benchmark. This relatively better drawdown percentage of the fund depicts lower possibilities of downside risk in the market troughs. Also, its higher Sharpe Ratio depicts its capability of generating more attractive risk-adjusted returns due to its well-diversified portfolio.

Portfolio Analysis:

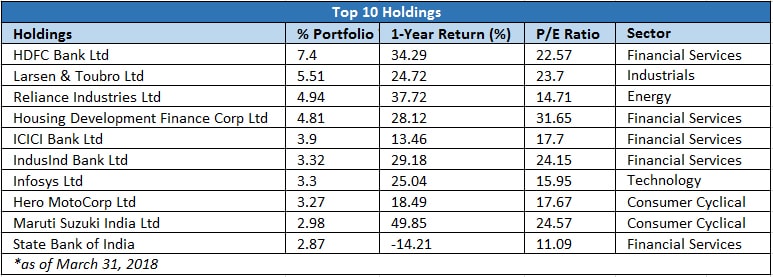

The investment portfolio of Kotak Select Focus Fund is a blend of strategies that select the sectors through top-down analysis and stocks through the bottom-up approach. According to the fund manager, Mr. Harsha Upadhyaya, his strategy generally revolves around the stocks having better earnings potential and lower valuations as compared to the others. On the lines of this strategy, the fund includes some of the renowned names such as Reliance Industries Ltd., ICICI Bank Ltd., Infosys Ltd., Hero MotoCorp Ltd. etc., in the top 10 holdings.

The above selection of stocks is based on their comparatively lower P/E ratios and high returns which ensures high earnings growth at reasonable valuations. The investment of the fund targets the sectors that are likely to outperform the broader market in various economic cycles. As a result, the fund manager has bet on the evergreen sectors such as Financial Services, Consumer Cyclical, and Energy.

Experts’ Take

Kotak Select Focus Fund is a good diversified equity scheme with strong risk-to-reward ratio suitable for investors with a long time horizon. It can be an ideal option for the ones who are looking for long-term capital appreciation with limited downside risks and higher alpha. You can consider investing in the scheme through the Systematic Investment Plan (SIP) or lump sum route.

To invest in this fund, consult the financial experts at MySIPonline.