Mutual Funds Are Growing Your Money by Investing in These Top Performing Stocks

The effects of volatility in the markets have directed the vision of fund managers towards investments which can provide risk-adjusted returns. During the recent corrections, they have tried to pick up the stocks which are anticipated to have an increase in their earning prospects and visibility in the future.

The management teams of the fund houses have significantly adopted the investment strategies which can support their dual motive of selecting value funds with growth opportunities.

The surge of investment in the mutual funds and the inclination of the government towards the overall economic growth of the country have been the pivotal factors in influencing the stock market. These factors have insisted the fund managers to reconsider some of the ignored sectors and redefine their investments in the explored ones as well. Let us see which are those sectors and their respective top-performing stocks that caught the attention of the mutual funds.

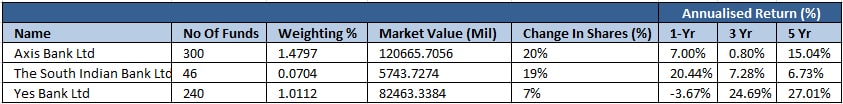

Being the base of the economic structure, Banking and Financial Services, Automotive, and Engineering & Capital Goods attracted fund managers the most. These sectors saw the maximum increase in investment by 27.2%, 8.7%, and 7.9%, respectively from the last 3 quarters. From the financial sector, mutual funds targeted Axis Bank Ltd., The South Indian Bank Ltd., and Yes Bank Ltd. and on an average invested 15% more in them. These stocks are now among the top ten holdings which cumulatively have 2.56% of weightage in mutual funds’ market capitalization. Though this data depicts the situation till October 2017, it would be interesting to note how these stocks have performed after the PNB fraud case. Let us have a look.

The brand names of the banking sectors have suffered a lot in the past three months after the revelations related to PNB scam which has ultimately affected their overall performance in the past year. On the other hand, the data for Auto and Auto Ancillary sector tells a different story altogether.

Two of the top performing funds of the auto sector (as mentioned in the table above) compelled the fund managers to include them in their portfolios because of the performance they have shown in the past 1, 3, and 5 years consistently. The high P/E ratio of about 30.28 of Jamna Auto Industries Ltd. stocks show higher expectations of its growth by the investors. Same is the case with Apollo Tyres which has seen around 96% of growth in its net income in 3 years.

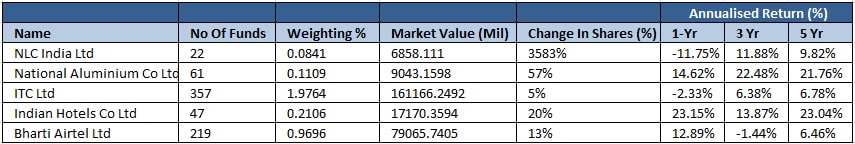

Along with the above-discussed stocks, mutual funds have also shown an increase in their interest towards the stocks of Basic Material, Consumer Cyclical, Energy, and Telecommunication sectors. Govt.’s aim of developing the nation completely in both the structural and digital directions, by the end of 2020, has given rise to opportunities of investment in the basic utilities and consumables as well as nonconsumable goods-producing industries.

It is the result of rapid digitalization that the stocks of Bharti Airtel Ltd. saw an increase in their sale. Even the increasing popularity of “Incredible India” has boosted the tourism sector. As a result of which, the stocks of Indian Hotels Co Ltd. are in the limelight since last 5 years with a consistent performance. Core companies like NLC India Ltd. and National Aluminium Co Ltd. are evergreen and need no introduction even in the declining markets. Due to some reasons, the former was unable to perform in the past year, but the latter has given consistent performance till now.

The companies which we have highlighted are growing in terms of earnings as well as valuation. The fund managers have acknowledged that investing in these stocks has contributed in the performance of their mutual fund schemes.

Selection of the stocks is undoubtedly an important factor that influences the performance of a mutual fund scheme. The funds mentioned in this blog are not guaranteed to deliver excellent returns always. This is stock market which gets fluctuated at times and so are the returns of the comprising stocks. However, a wise selection of stocks and their regular monitoring by a fund manager can definitely yield some magic numbers. Both investing in highly cyclical and very conservative sectoral stocks can hamper the growth of your investment. Hence, we would suggest you to stay moderate with your expectations as well as risk tolerance. To know about such mutual funds in detail and for other related queries, connect with the experts associated with us.