ICICI Prudential Balanced Advantage Fund: Get Stability Through Dynamic Asset Rebalancing

Considering the recent time, there’s a buzz around announcing the occurrence of volatility in the markets. The day of February 1, 2018, brought in noticeable changes in the lives of equity investors.

Indeed, the re-introduction of the LTCG tax was a dampener, which influenced the market to react negatively to some extent. However, even it could not overshadow the attractiveness offered by equity funds.

Nonetheless, several experts believe that equity remains the most favorable asset class from the medium to long-term perspective for the investors and systematic investment plans should help to rise through the near-term volatility.

Although it’s the situation where investors are once bitten, they prefer not to be shy from investments in equity. Let’s find out what’s our experts take on it!

What Can be a Suitable Pick?

Volatility is something that will be seen in the future market. Global Macro Developments, Commodity Prices, Foreign Institutional Investors Fund Flows, Government Policy, RBI Policy, Elections, Corporate Earnings are some of the factors that might be the reason in the near to medium term. That’s why investors are seeking options with moderate risk aversion.

This pushes up the demand for the balanced funds since the debt component of the balanced funds reduces downside risks and provides stability to the portfolio. On the other hand, the equity component helps investors to enjoy the capital appreciation due to the presence of at least 65% equity.

Best in Balanced Fund Category

With the growing demand for balanced funds in the market, there are several schemes present today which fulfil the quest of the investors. However, talking about the best one, there is no substitute for ICICI Prudential Balanced Advantage Fund. It has an even moderate risk profile as compared to others in the similar category. The reason is active equity allocation that ranges between 30-80% based on dynamic asset allocation strategy determined by equity valuations.

That’s why the fund stands ideal for investors with moderate risk-bearing capacity. Another advantage of this fund is that it can take the benefit of even the volatility in the markets. However, due to the comeback of the tax on long-term capital gains, the scheme doesn’t enjoy equity taxation any more. But still, it is a preferred choice when returns are taken into notice.

Escape Psychological Barriers with ICICI Prudential Balanced Advantage Fund

- What’s the Issue?

It’s often difficult for the investors as they start to panic as soon as the volatility hits the market. To this, experts’ advice to be calm and goal-oriented; but these seem like words to them. They encounter three major challenges:

- Facing curiosity to know when to enter and when to exit.

- Taking control over the feeling of fear and greed.

- Deciding dynamic/static asset allocation; considering exit load of the scheme, taxation on gains, frequency of re-balancing, and also operational issues like paperwork.

- What’s the Solution?

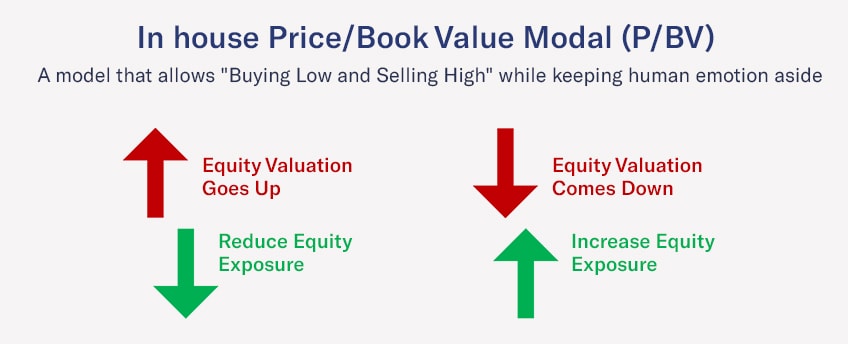

Well, ICICI Prudential Balanced Advantage Fund explains the solution by opting a simple model, i.e., P/BV.

- What Changes Does the Model Bring?

With P/BV model, ICICI Prudential Balanced Advantage Fund removes the barrier of greed and fear for its investors. Secondly, it allocates higher in equity when the market valuation of equity is low, and lower when the equity market valuation is high.

This happens because:

- The price to book value is less volatile as compared to price to earnings ratio

- The price to book value is better equipped in gauging intrinsic value of a company

- The book value is a balance sheet item; thereby it’s more reliable than Earning Ratio

Let’s see how this strategy has effected the scheme’s performance in various market conditions.

-min_5a8ea044e2ad4.jpg)

Considering the table above, you can see that the scheme has successfully outperformed its benchmark and Nifty 50 index. This makes it a suitable pick for investors who are willing to get a long-term wealth creation solution and aiming for growth by investing in equity and derivatives.

What’s New in ICICI Prudential Balanced Advantage Fund?

Investors have the facility to opt for AWP(Automatic Withdrawal Plan) under this scheme. With this additional feature, they can redeem a fixed sum of money periodically at the prevailing Net Asset Value (NAV) depending on the option chosen by the investor. Some of the other features included are discussed below:

- AWP allows one to withdraw a fixed sum of money periodically (in this case 0.75% of the invested amount) depending on the option selected by the investor.

- It generates a cash flow of 9% p.a. of the Capital Invested, for example, Rs 90,000 for an investment of Rs. 10 lakhs per annum.

Henceforth, if you find this scheme a suitable pick for your portfolio or the features provided by it enticed you somewhere, then connect with us to seek customized advice. The experts at MySIPonline will help you to make your online investment experience a successful one. Further, as mentioned earlier, we can even help you to overcome the operational issues by providing you with the facility of paperless transactions every time.