May 03, 2018 4 min read

How to Pick the Best SIP Plans for 2018?

Here’s how you can select the best SIP plan for yourself. Also, get the best recommendations from experts.

Systematic Investment Plan(SIP) not only helps build wealth, but it also imparts financial discipline in the lives of the investors. To avail the true benefits of SIP, one needs to choose the right SIP plan first. This step ensures that the long-term commitment you’re making with yourself today will definitely assist you in fulfilling your goals tomorrow.

Keeping in mind the utmost importance of selecting the right SIP plan, we’ve enlisted some aspects to consider that will help you do the same. Let’s get started!

- Analyze the Category

Mutual funds are available in three major categories which include equity, debt, and hybrid funds. A prudent investor is the one who invests in funds which he/she understands well in terms of pros and cons. A person who has a good knowledge of the equity market and a high to moderate risk appetite can invest in a small-cap fund. Whereas, the one who is naive in the field can go for large caps or balanced funds. If you’re aware where to invest, the task of choosing a suitable SIP scheme becomes less tedious. - Examine the Best Funds of the Selected Category

Once the category is selected, and the time comes to pick the best fund, we can finalize the ones which showed consistency. The funds beating benchmark and category returns in every cycle of the market can be an ideal pick. For this, Rolling Returns is a critical factor to look at. When it comes to the performance of a long-term fund, there can be periods where returns were less than average and others where returns look intriguing. Now, if you look at annual returns of the fund, from say the first day of the calendar year to the last day in each year for the last ten years, you’ll find a lot of difference. This won’t help you understand how the fund is doing. Here, rolling returns for a period is a better indication of how well the scheme has performed. - Associated Risks

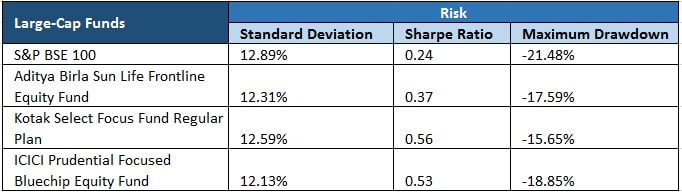

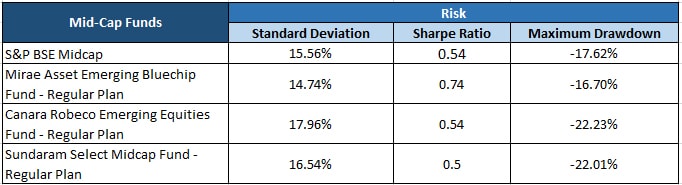

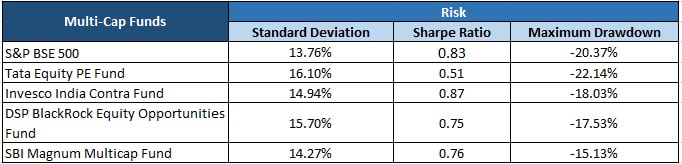

The risks linked to a scheme are checked to learn about the fund’s volatility when the market is down and the amount of losses one can experience. Three risk factors to look at include Standard Deviation, Sharpe Ratio, and Maximum Drawdown. Let’s consider the same in different products of the equity category.

Source: MySIPonline Research Desk

Considering the first table here, you can see that the standard deviation value of all large-cap funds is less than that of their benchmark. This indicates that the funds will fluctuate less as compared to their benchmark both in negative as well as positive cycle. Further, the Sharpe Ratio denotes the risk-adjusted returns where again the funds’ values are better than that of their benchmark. Here, the last factor which is maximum drawdown value shows how negative a fund has performed in the past. From the large-cap funds’ table, it is again clear that the schemes have less negative drawdown percentage in comparison to their benchmark. - Portfolio Management

Keeping track of portfolio when investing in mutual funds via SIP is as important as choosing the fund. A quick overview of the portfolio can go a long way in improving your investment returns. You learn about the portfolio's investment style and top holdings of the scheme. Besides, you can check if the portfolio is aggressive or conservative if it has a value or a growth tilt. You can also make out if you are over-exposed to certain sectors/stocks, and how it can affect your long-term SIP returns.

Some of the Best Recommendations for SIP Investments

_5aeaf36ac9eb1.jpg)

_5aeaf49dd2e5e.jpg)

_5aeaf5b8ee6d8.jpg)

Source: MySIPonline Research Desk

We hope these factors can help you make the best pick for your SIP investment from the table mentioned above. In case of any doubt, connect with us at MySIPonline.