Bank Deposits Sink 53 Year Low, People Switching to Smarter Savings. Are You?

Bank deposits were on a roll after demonetization, but most of that money has gone out of banking system now. As a result, the bank deposit growth rate sunk into depths, it has never seen since more than last five decade. What exactly went wrong with the banking system suddenly after demonetization?

During November-December, 2016, Indian banks congested with bills of high denomination currency, which elevated the bank deposit growth to 15.8% as Rs 15.2 lakh crore was deposited as lockers, wardrobes, wallets, and pockets were emptied into the bank by the mass population. The aggregate deposit in the fiscal year ended March 2017 was Rs 108 lakh crore.

Surprisingly, the bank deposit growth rate of 15.8% has depreciated to a shocking 6.7% aggregating Rs 114 lakh crore in the fiscal year ended March 2018. This rate was lowest since FY1963.

The question is, why people are losing interest in the banking system? Where is the money going? The answer lies in the fact that total mutual fund assets under management have increased by 22% to Rs 21.36 lakh crore in March 2018 from Rs 17.55 lakh crore in March 2017. Yes, Mutual Fund is the reason behind the drop in bank deposits.

This clearly proves that people are changing their saving methods and moving on to smarter ways of saving, thanks to demonetization. And why not? If we can upgrade to smart-phones, better education, modern vehicles and many other up-to-date technologies, then why are we still stuck to a savings system which is more than 100-years old?

The rise in mutual funds industry can also be seen as a sign of development of the country because in developed countries like the United States of America people have shown a great interest in mutual funds. The AUM of mutual funds in America was US$ 1 trillion in 1990, US$ 7 trillion in 2000, and US$ 22.4 trillion, which is Rs 1,478 lakh crore in Jan 2018. According to the experts, this rise is showing no chances of slowing down. China is also catching up the USA in this race.

India, which is a developing country, has been performing well in the last few years, when it comes to mutual funds. “The base effect post demonetization has played a large part as money came back into circulation. Though, clearly, there is a move towards MF. This year, with interest rates moving up and equity markets likely to remain soft, we could see some uptick in deposits though not a sharp rise,” said Karthik Srinivasan, head-financial sector ratings, ICRA.

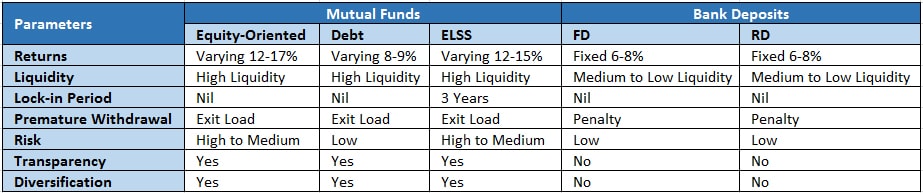

The impact of mutual funds has already started to show up its effect on banks as last week HDFC increased its fixed deposit interest rates under 1 crore by up to 1% to attract more customers to invest in banks. Many other banks are planning to increase their interest rates. But to compete with mutual funds, they actually need to give out what they don’t even possess. Let’s have a look at the comparison table of these investment options on various other parameters:

Conclusion

It should be noted that Mutual Funds and Bank Deposits(FD and RD) are different investment option altogether. One one side, where Bank Deposits give guaranteed returns, returns of mutual funds, on the other hand, are market linked. However, with mutual funds one can enjoy the benefit of transparency, customization, as well as liquidity. To sum it up, it would be right to say, an individual should first gauge his/her risk taking ability and then invest in different options available in the market. To get the best support considering mutual fund investments, connect with us at MySIPonline.