CAGR:

15%Min. Investment:

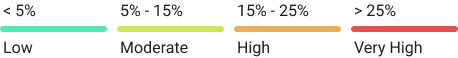

₹20,000Risk:

High

High

This aggressive growth portfolio, managed by mutual fund analysts, aims for long-term capital appreciation with 85% equity exposure in small-cap, mid-cap, and trending sectors, and 15% in hybrid funds for stability. It is actively rebalanced depending on the market conditions and is especially designed to beat the market over time.

Allocation

One Time

See a detailed allocation of One Time in your portfolio.

Trailing Returns Comparison

Our Portfolio Returns vs Benchmark Returns

| Name | 1W | 1M | 3M | 6M | 1Y | 2Y | 3Y | 5Y | ALL |

|---|

Backtested Results

We show you transparent backtested results on your portfolio's performance.

Highlights

Get ready to learn useful insights into your portfolio's risk, performance & flexibility.

Standard Deviation

14.75%

Sharpe Ratio

1.15

Max Draw Down

Days to Recovery

0 DaysKey Details

Points to be noted from your end.

₹20,000

No Lock-In

₹0 (only exit load)

About the Portfolio

Here you will find everything you need to about this portfolio.

High Risk Appetite

Long Term (5-7 Years)

High Returns (15% p.a.)

Investing in high growth compounding business with buy & hold approach or targeting high growth industries at an inflection point. This style requires a higher risk appetite to tolerate short to medium term volatility and patience for at least 5-7 yrs. The clear focus is to make higher range of returns in the market.

Aim is to achieve higher range of returns in the stock market i.e. 15-18% CAGR for 5 yrs. investing duration. It means we can make 3x of your investing amount.

The portfolio is carefully designed using the following factors:

- Model portfolio designed for long-term investment goals.

- Max equity, minimal hybrid — lump sum risk managed.

- Focusing on small & mid-cap funds, trending themes & ideas.

- Using MPT and Monte Carlo for risk-return balance.

- Choosing funds managed by specialist fund managers.

- Backtested through all market cycles and bull phases.

- Outperforming market returns with higher profit margins.

- Screen funds based on performance, risk-adjusted returns, and fund manager expertise.

- Shortlisted Specialist AMC for Specific Style or themes

- Use the 5 P framework (Product, Process, Portfolio, Performance, Price Valuations).

- Select best scheme in the category according to the portfolio objective and investing style.

- Regular monitor and churn according to market condition or changes in fund management.

Start Your Portfolio Journey Today!

- 10+ Years In Business

- 1,50,000+ People Invested

- 5 billion+ Assets Under Management

- 4.3 Star Users Rating