March End is Here: What Should be Your Move to Save Tax in the Last Few Days?

Have you been ignoring your tax planning so far? The current financial year is nearing its end, and there is no time to delay your tax saving strategy now. As you are already late, you probably won’t qualify to get the maximum benefits from the tax-saving instruments. But you can minimize the hefty sums that you might end up paying due to notional losses in investment.

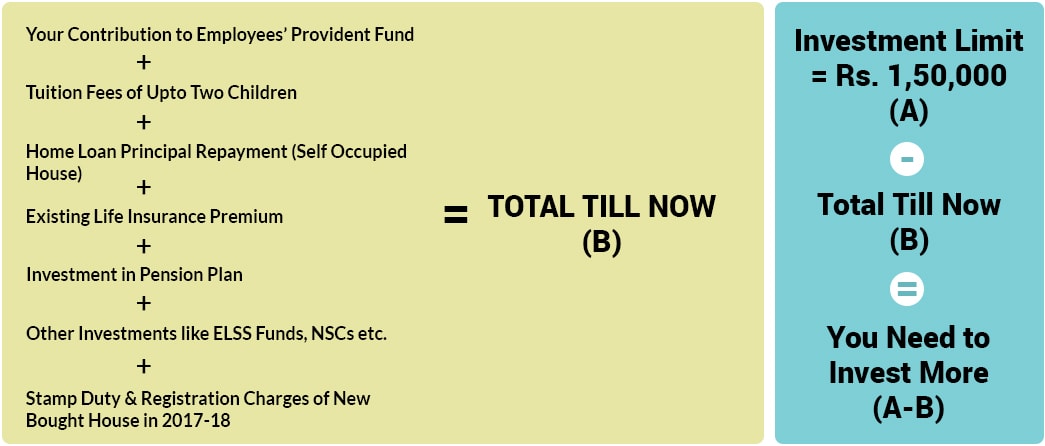

As per the tax policies for the FY 2017-18, Rs. 1.5 lakh is the maximum limit that can be claimed for the tax deduction under Section 80C of the Income Tax Act, 1961. As the first move towards the last minute tax planning, calculate how much more you need to invest to exhaust the tax deduction limit.

How Much You Need to Invest?

Plan Your Last Minute Tax Saving According to Your Profile

We do not want to panic you but if you have not planned your taxes in advance, make sure you consider some crucial factors before doing high time investments. Most importantly your tax-saving investment should depend on your financial requirements and goals. Your age, liabilities, and risk-return profile are among other major factors that should influence your investment decision.

Your investment amount should be spread among different asset classes to reap the dual benefit of lowering tax burden as well as building wealth. There are various tax-saving routes that can render you this edge.

Utilize the Tax Benefits Under Section 80C to the Fullest

Most of the investors fail to exhaust their tax benefit limit of Rs. 1.5 Lakh per annum, even by the end of the financial year. The financial space is filled with a wide range of investment instruments which provide tax deduction under Section 80C of the Income Tax Act, 1961. Stick to your financial plan and identify the appropriate investment options. This will not only save taxes but ensure your financial planning is not compromised. For example, if you have a low-risk profile, you can satisfy yourself by parking your money in Public Provident Fund (PPF), bank fixed deposits, NSC, etc. These are the safest options that would yield decent returns and tax benefits. On the other hand, if you prefer high returns in the long-term and are ready to tolerate moderate risk, you can invest in tax saving mutual funds (ELSS).

Opt for ELSS Funds

Investing in ELSS funds is undoubtedly one of the most prudent ways to claim tax deduction through year-long investments. The difference would be the approach that should be applied during the end of the tax saving season. It can be easily done online by visiting MySIPoline: The only essential requirement is the investor being KYC compliant.

We suggest you to invest in ELSS funds as they are low on charges, fairly transparent, and offer liquidity without the compulsion of subsequent investments. They possess the potential to generate wealth in the long run. The only constraint is the new LTCG taxation rule that come in effect from April 1st, 2018. The long-term capital gains of ELSS will be taxed at 10% on exceeding Rs. 1 lakh. However, to the relief of the taxpayers, the gains from the ELSS till January 31, 2018, will be grandfathered. The sole diligent task is choosing an apt ELSS fund; everything else including the systematic monitoring can be done on our website.

Look for Options Beyond Section 80C

There several other sections beyond Section 80C to avail tax benefits. Under Section 80E, you can claim a deduction for the interest paid towards an education loan for you, your spouse or children. The interest received on your Savings Bank account is allowed for a tax benefit of Rs. 10,000 under Section 80TTA. Similarly, you can explore Section 80G, 80GGA, and 80GGC, which help you get a tax deduction by making donations to NGOs or political parties. There are many less popular tax saving options which majority of taxpayers overlook.

Go for Expert Help

As everyone bears distinct financial responsibilities and risk tolerating abilities, there is a unique tax-saving plan for all. Opt for an investment that suits your requirement and do not blindly imitate what others suggest. It may be the mid of March, but you can still seek professional help to optimize your tax saving. Financial experts, like the ones at MySIPonline, can assist you in choosing the best financial instruments that ensure both tax optimization and value for investments.

Start Next Year’s Tax Planning Now

Starting early gives ample of time to understand the risk-return ratio related to the various investment options. When you start planning your finance with the beginning of the year, it benefits in the long-term wealth creation along with tax management.

Last minute haste develops the chances of errors and risk. You don't get time to devote a second thought to the committed actions. The next financial year is only a few days away, make sure you don't delay your tax planning exercise this time. Happy Tax-Planning!