Fund Review: ICICI Prudential Value Discovery Fund

What can be better than endowing your money to the institution that has been handling the finances like a pro for decades? ICICI is one such name in the market having the most trusted mutual fund house because of the strong money management and lucrative return policy.

Among all the solutions that have been catered by this fund house, ICICI Prudential Value Discovery is the most prominent one in its own category. It is an open-ended large-cap equity oriented scheme that generates returns through a combination of dividend income and capital appreciation by investing in value stocks. You might now be thinking what are value stocks? Value stocks are the ones that trade at low-price in the market irrespective of the company’s performance. Why are we recommending this scheme from ICICI Prudential Mutual Fund? Because, unlike other funds, the scheme seeks to single out only those stocks whose prices are comparatively low with respect to their historical performance, earnings, book value, cash flow potential and dividend yield. Although, the potential of these stocks has not been revealed yet, they bear the probability of proffering extraordinary growth in future.

An Overview of its Performance

Despite being one from large-cap space, the fund has an exposure to mid and small-cap funds. This is done to achieve portfolio diversification by investing across the market capitalization. Hence, it can increase or decrease its share in any company irrespective of its size. Since its launch in 2004, it has accrued a large AUM of Rs.16,664 cr which is a tremendous contribution to the total AUM of mutual fund industry. This high AUM depicts the fund’s consistent performance and investor’s trust in fund’s management. Let us now measure its performance by looking at the calendar year and trailing returns of the fund and its category, and S&P BSE 500 taken as its benchmark since 2007.

- Year-on-Year Returns

The returns proffered by the fund in the table below depicts the fund is an apple of every ones eye. This fund is found to be present in every investor’s basket because of its value-oriented investment strategy and dynamic asset allocation. If we look at the calendar year returns of the fund, i.e., the returns taken from January 01 to December 31, it can be seen that there are two periods when the fund couldn’t beat its benchmark and the category average, i.e., 2007 and 2017. On contrary to the benchmark’s portfolio allocation, the fund investments were overweight in Pharma and IT which led to the under performance of the fund due to the downfall of these sectors.

*Category: Equity-Large cap

In the year 2008 and 2011, when the market underwent the bearish phase, the fund incurred huge losses to the investors leaving them wary and anxious. But there were periods when the fund performed outstandingly, like in the year 2009 and 2014 where it successfully catered whooping returns of 134.32% and 73.76% respectively. Likewise, 2012, 2013, 2015, and 2016 were the years of progress where it has beaten both its benchmark and category average returns by a sufficient margin. So, analyzing this, we can say that fund’s average performance was overall good which has helped it to score a four star rating and an analyst rating of Silver on Morningstar. - Trailing Returns

*Category: Equity-Large cap

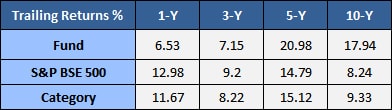

It is clear from the table above that the fund has consistently beaten its benchmark index and category over long-term period of 5 and 10 years, but has performed below both of them in 1 and 3 years.

Analysis

This fund is led by a virtuous fund manager, Mr. Mrinal Singh since February 2011, who has followed up valuation-conscious approach for stock selection. Because of Mr. Singh’s more concentration on valuation part, the fund bears a slight risk of underperforming in momentum driven and growth oriented markets. The evidence of which is its last year’s underperformance as compared with its benchmark and category. However, the current YTD returns of the fund indicate that it is back on its growth trajectory. Investors who can stomach moderately high risk and are willing to generate wealth by investing in equity can invest in ICICI Prudential Value Discovery Fund.